,

June 30, 2020

Clients and friends have recently lamented gaining the “Quarantine 15.” Suppose you are one of these people and decide to join a newly reopened gym. Since you are familiar only with the bicep curl, you lift 10-pound weights four days a week. After many weeks, you successfully increase the size of your biceps, but without diversification in your workout routine, you have not improved your cardio health or core strength, and you have not lost any weight.

We can apply this analogy to investing. Investors feel comfortable buying the S&P 500 index because it is the most commonly used benchmark representing the largest 500 companies in the United States. Just like one muscle group is not representative of your overall physical health, we at GHP Investment Advisors, Inc. (GHPIA) do not believe owning a group of the largest U.S. companies is enough to maintain the strength of your investment portfolio.

Diversification is among the most fundamental, well-accepted concepts for investors and is at the core of GHPIA’s investment philosophy: investors can reduce portfolio risk by diversifying across different sizes, styles, and sectors of companies. Owning a greater number of companies is better than owning fewer, but if the companies owned are correlated, each company is likely to react similarly to changing economic conditions. This similarity includes companies with not only asset class or sector in common, but even similar corporate debt levels, cost structures, profit stability, and risk of obsolescence. History shows us that it is unlikely companies in any one classification will underperform or overperform the rest consistently over time. Owning companies across a variety of classifications mitigates risk and allows us to participate in growth in a wider variety of company types.

As noted in past newsletters, the S&P 500 index is less diversified than many investors believe. Limited to companies with market capitalization (total number of shares times the current market price of one share) of $5.3 billion or more, the S&P 500 index misses the mid and small-cap stocks that comprise most of the economy. Additionally, since the S&P 500 index is market-cap weighted, an investor in the S&P 500 index does not equally own 500 companies. Rather, the top 50 companies by size account for more than half of the index’s value. As a result, these 50 companies have a larger impact on the performance of the index. Sharp price movements in these companies and sectors have an undue influence on the overall index.

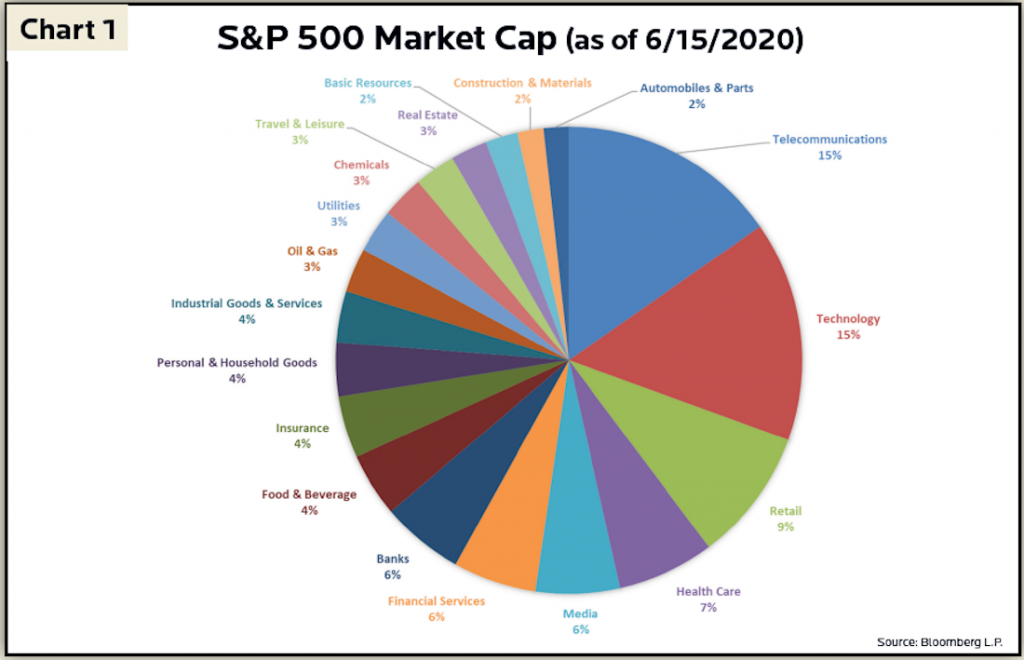

Every quarter, the committee overseeing the S&P 500 rebalances the index. Since the index is weighted by market value, this process accentuates those sectors currently in favor. While potentially beneficial in the short to medium-term, risks can mount as concentration increases. During the coronavirus pandemic, we are concerned that the S&P 500 index might be overexposed to risk in a handful of very large technology and telecommunications companies (Chart 1). Information technology and telecommunications companies comprise nearly 31% of the S&P 500 index, even though the U.S. Bureau of Economic Analysis estimates their contribution to Gross Domestic Product (GDP) to be closer to 7%. Since the S&P 500 index focuses on large companies, entire industries are either underrepresented or excluded from the index.

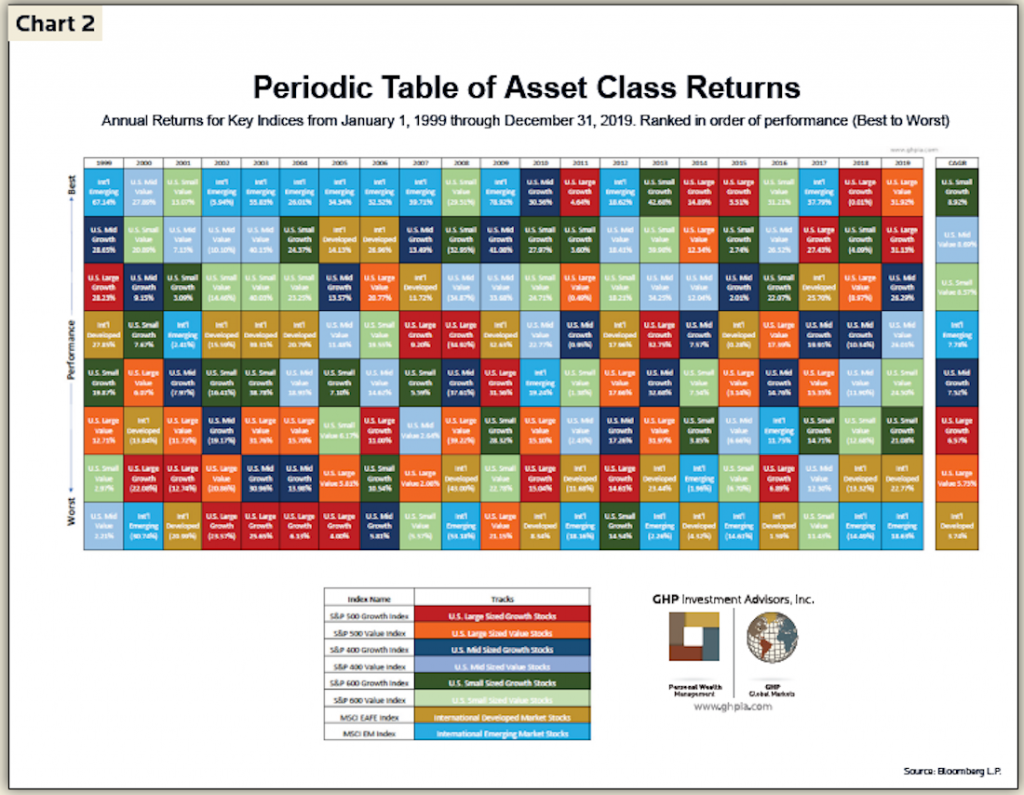

As we recently experienced, diversification does not always cushion short-term market swings, but it does reduce the risk of potentially catastrophic losses from more concentrated portfolios. Given the relative unpredictability of the stock market, diversification also helps smooth wild swings over longer periods of time (Chart 2).

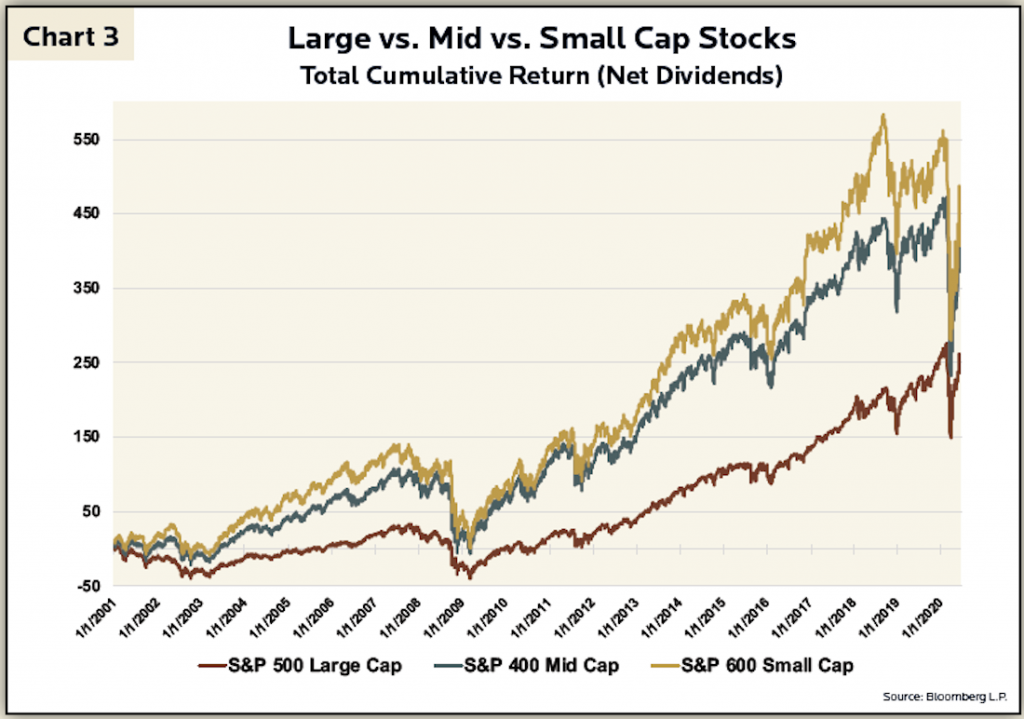

The benefits of long-term diversification are highlighted in Chart 2. As this “Periodic Table of Asset Class Returns” makes clear, some asset class groupings may outperform for several years, but top performers during one period often move to the bottom of the charts in subsequent periods, and vice versa. Over the past 20 years, medium and small companies outperformed the largest 500 companies, as they did over the last 90 years (Chart 3). In the interim, however, there are times where the reverse is true.

Over short periods, small and mid-cap companies can sometimes be more volatile investments, such as when liquidity dried up in the early weeks of the pandemic crisis. In the long run, however, smaller companies often offer greater upside by virtue of their size. An uptick in revenue generally has a proportionately greater effect on operating income from smaller companies than for larger ones, just like a gain or loss of five pounds has a greater impact on a 120-pound dieter than a 250-pound dieter. As liquidity returned to the stock market in May and June, trading volumes improved, and smaller company stocks started to close the gap with larger companies.

In recent times, the S&P 500 index has presented as an attractive basket of investments because its weighting and performance reflect the flourishing of tech companies during the lockdown, even as other industries are adversely affected. At GHPIA, however, our investment benchmarks and our experience over the past quarter-century lead us to believe this over-valuation is unlikely to last. We firmly believe the market-cap weighed approach used by the S&P 500 index tilts too heavily towards the larger companies in concentrated sectors.

As a solitary portfolio asset, the S&P 500 index does not provide sufficient diversification by company size, style, or sector to reduce risk over the long term. GHPIA will continue to strategically diversify our equity portfolios into and beyond many of the companies in the S&P 500 index. What is important to us, beyond a company’s asset class or sector, is its fundamentals, and we will continue to seek companies in all classifications that demonstrate profitability, stability, and reasonable valuations.

At the gym, it is easy to exercise the same muscles on the most familiar machines. It takes discipline to go further and work every muscle group. Keeping at it, by tending to the whole body, month after month, year after year, leads to lifelong physical – and fiscal – health.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.