,

June 30, 2016

As children we were taught to use the Food Guide Pyramid to assist with making daily food choices. Eating a variety of food groups while adhering to the appropriate serving sizes improves our odds for living a long and healthy life. Similarly, with investing, we use asset allocation to reduce risk by spreading investments across a range of asset types such as cash, fixed-income and equities. Diversification is the first cousin to asset allocation and can be just as effective in minimizing portfolio risks as a balanced diet minimizes health risks.

Many equity investors believe simply investing into the S&P 500 Index provides sufficient diversification to decrease their portfolio risk. They may do so with the notion that investing solely into this index (or basket) holding a stake in 500 of the largest blue-chip companies within the United States provides attractive and sensible one-stop-shopping. In fact, the S&P 500 Index is generally deemed the best representation of the U.S. stock market and a bellwether for the economy. However, at GHP Investment Advisors, Inc. (GHPIA), we believe in investing beyond the S&P 500 Index in order to build a more diversified “pyramid” for your equity portfolio. We achieve wider equity diversification and portfolio balance by investing into companies of various sizes (large-cap, mid-cap, small-cap), styles (growth and value), industry sectors (health care, tech, financials, etc.) and countries of domicile. In other words, while the S&P 500 is a good start, our equity portfolio grocery list is quite a bit longer.

The Periodic Table of Asset Class Returns (Below) provides the historical performance of 8 different equity asset classes (or indices) holding stocks of a particular size, style and location. Each yearly column stacks the best to worst performing equity asset classes by rate of return. By quickly studying the performance data, displaying the multitude of colors shifting annually, it is clear no obvious and persistent pattern emerges for one particular equity index over the last 20 years.

If your view was limited to only the years 1995-1999, it would appear the S&P growth index (in red) would be the best asset class to hold, while foreign companies and small-cap-value the stock indices to avoid. The S&P 500 growth index at that time grew overweight with trendy overvalued stocks in the technology and telecom sector. When the tech bubble popped in early 2000, portfolios with excessive concentration to this growth index paid dearly by suffering considerable losses or under performance relative to other indices for the subsequent 7 years. This period illustrates how the inexorable randomness and volatility in the equity markets amplifies the necessity for diversification beyond merely one asset class.

Of course, company size, style and sector are important considerations, but there are many other fundamental and dynamic factors guiding our equity investing decisions. For example, a properly balanced equity portfolio must also be allocated in accordance with the projected course of interest rates or the overall business cycle. Likewise, individual stock selection must be attentive to company debt levels, cost structure, profit stability and risk of obsolescence.

For GHPIA, equity investing does not involve impulsively trying to predict which asset class or individual stock will become the top performer relative to its peers inside of a given year. Instead, our investing method encompasses thoroughly diversified portfolios targeting fundamentally sturdy companies selling for reasonable valuations, and then we maintain this disciplined and balanced diet for the long run.

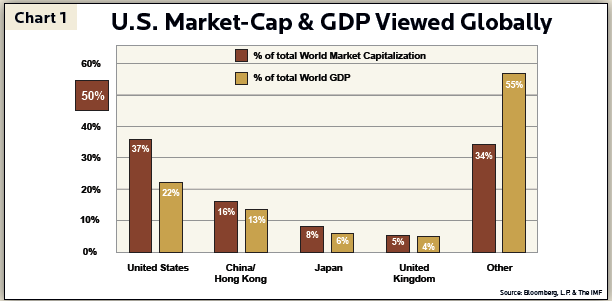

Beyond company size, style and sector, we also believe foreign equity exposure is essential for portfolio diversification. Although the U.S. enjoys the largest stock market system in the world, when viewed globally, our financial markets only represent a minority 37% of the total (Chart 1). Likewise, while the U.S. is the biggest economy with a GDP over $18 trillion, this is only 22% of total worldwide economic output. Finally, maintaining a partial allocation to foreign investments tamps down volatile shocks in the currency markets by spreading portfolio holdings beyond U.S. dollar denominated assets.

We are living in an increasingly globally connected economy and financial market system which requires equity investment beyond our borders to further mitigate risk and enhance long-term portfolio balance.

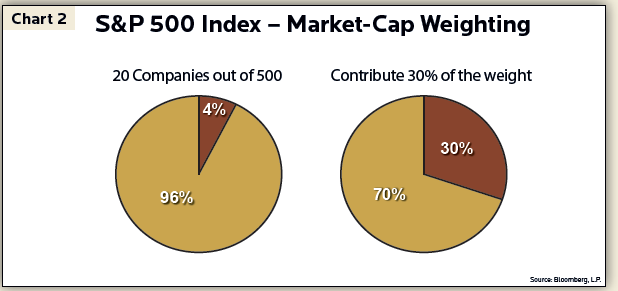

Another compelling reason to expand an equity portfolio beyond merely the S&P 500 centers on the market-cap-weighted structure of this index. The 500 companies or components within the S&P 500 Index are not all treated equally with respect to your investment dollars. The index assigns a weighting to each of these companies derived from their respective market capitalization (cap) – or the total value of all stock shares owned by the public.

For example, Apple’s market-cap of over $500 billion represents one of the largest companies in the S&P 500 Index, while Owens-Illinois, a glass container company with a market-cap of only $3 billion, represents one of the smallest companies in the index. Pursuant to market-cap-weighted rules, Apple’s influence on your S&P 500 Index investment performance and allocation is 200 times larger than that of Owens-Illinois’. To illustrate the distorting effect of market-cap-weighting a bit further, if these companies were simply weighted by their total number of employees, Apple and its 110,000 employees would hold only 3 times the influence to Owens-Illinois and their 27,000 employees.

Thus, with market-cap-weighting, the biggest, most-popular stocks sway returns more than their plain-Jane classmates. As a result of this methodology, the 20 largest companies in the S&P 500 Index, or just 4% of the total 500 components, contribute over 30% of the weight (Chart 2).

Investors must therefore acknowledge they are not equally diversifying into 500 companies, instead they hold considerable concentration to the top 20 companies such as Apple, Google, Amazon and Facebook. To put this top-heavy aspect of market-cap-weighting in better perspective, if you were attempting to balance out the 30% performance influence of those largest 20 companies at the top of the index, it would require the combined market-cap of over 370 companies rolled up from the bottom of the index. These bottom-side companies include everyday names such as Southwest Airlines, Humana, Kellogg, Waste Management, eBay, O’Reilly Auto Parts, etc.

Currently, many of the giant mega-cap companies in the S&P 500 Index, primarily in the technology sector, are selling for high market valuations. The market has a tendency of paying excessive premiums for these popular and exciting companies. One way we avoid succumbing to this peer pressure to chase potentially overvalued stocks is by adhering to our quantitative benchmarks which help to signal more fundamentally sound investment opportunities. For example, we believe large-cap-growth companies selling for price to earnings (P/E) ratios around, or less than, 27 are generally good values. Currently, the entire S&P 500 Index is selling for a median P/E ratio of 20 (as of 6/30/2015) which reflects moderate valuations on the whole. However, the average P/E ratio for the top 20 companies within the index is 36 times earnings, indicating the market-cap-weighted approach is favoring the “in” companies selling for loftier, and potentially more treacherous valuations.

While the market-cap-weighted method is skewed towards those companies with larger market-caps, an alternative technique to obtain diversification within an asset class is to utilize an equally-weighted method. This approach does not play favorites based on size – every stock has the same weight.

Think about the difference between a market-cap-weighted portfolio and an equally-weighted portfolio approach with relation to the influence various size states wield within the U.S. House of Representatives versus the Senate. More populous states such as California and Texas receive additional delegates in the House, similar to the influence larger companies have in the market-cap-weighted S&P 500 Index. Conversely, state population size holds no sway with the equally-weighted U.S. Senate chamber as each state receives 2 seats, effectuating a marvelous system of checks and balances within our legislative branch.

Likewise, GHPIA implements a number of measures within each equity portfolio to drive a more balanced market-cap weighting beyond the top-heavy S&P 500 Index. For example, we target a fairly equal allocation into small-cap and mid-cap companies to go along with the typical large-cap exposure gained within the S&P 500 Index. By instituting these portfolio checks and balances we aim to avoid market-cap and sector concentration, particularly when large, mega-cap companies are selling for high valuations.

For 20 years, GHPIA has strategically diversified our equity portfolios into, and beyond, the S&P 500 Index. We stand firmly behind our belief that the market-cap-weighted approach used by the S&P 500 Index tilts too heavily to the larger and at times more expensive, “hot” companies. As a solitary portfolio asset, this index does not provide sufficient diversification by company size, style, sector and international exposure to satiate our appetite for fully balanced, risk-adjusted portfolio benchmarks.

Eating a balanced diet is imperative for our long-term health much as diversification is necessary for a financially healthy investment portfolio. The U.S. Health department recommends eating a variety of vegetables, fruits, grains, low-fat diary, oils, and protein foods regularly. Likewise, it is important to maintain investment balance to reasonably priced companies of various sizes, growth trends, industries, and regions. While our bodies do not function properly if we eat only one or two of the recommended food groups daily, exposure to only U.S. large-cap companies can similarly inflict harm on the long-term growth of an investment portfolio.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.