,

June 30, 2021

As the world recovers from the scourge of COVID, the financial markets will focus on evaluating the risks that come from increasing government debt worldwide. The U.S. was not alone in its issuance of massive fiscal stimulus to alleviate the pandemic’s economic collapse. With lockdowns and social distancing measures devastating economic production, global governments racked up more than $12 trillion of debt in 2020. Although wealthy, developed countries issued most of the debt, emerging (or developing) countries also ran up an unprecedented amount of debt, and some of the poorest nations have arranged debt service suspension programs to forestall outright debt crisis.

The good news is that forecasts for most developed and developing countries predict a return of economic growth for 2021 after such an abysmal global contraction in 2020. Undoubtedly, the fast action taken by governments the world over helped prevent the pandemic recession from becoming a much worse depression. Further, as global central banks intend to continue supporting the nascent economic recovery by keeping interest rates near all-time lows, most governments are not confronting an imminent debt crisis. Nonetheless, government debt will continue to be a long-term pandemic side effect, one that investors in international markets may endure safely if they devote increased scrutiny to government debt and deficits, tax rates, and inflationary impacts.

Government debt will continue to be a long-term pandemic side effect, one that investors in international markets may endure safely if they devote increased scrutiny to deficits, tax rates, and inflationary impacts.

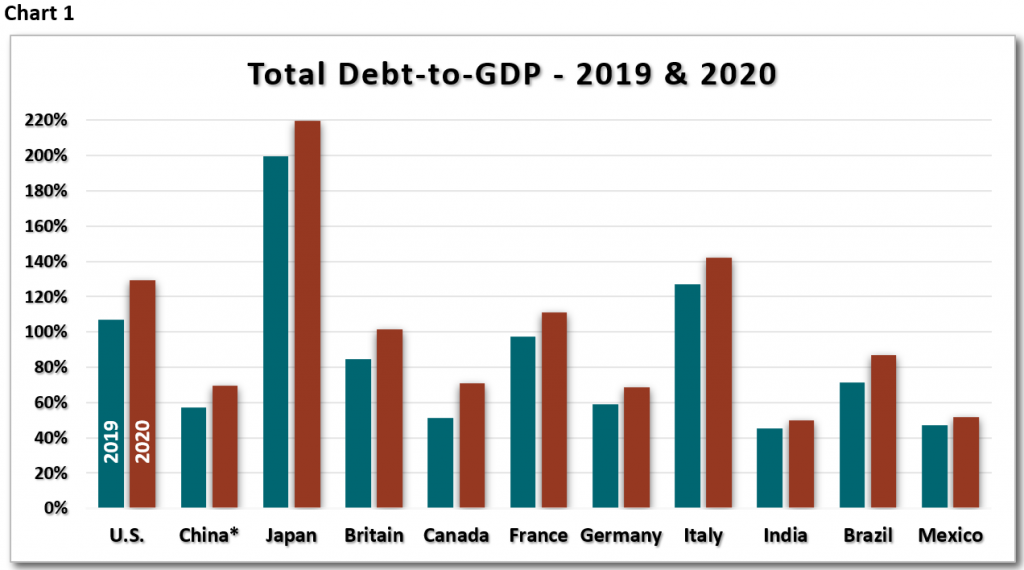

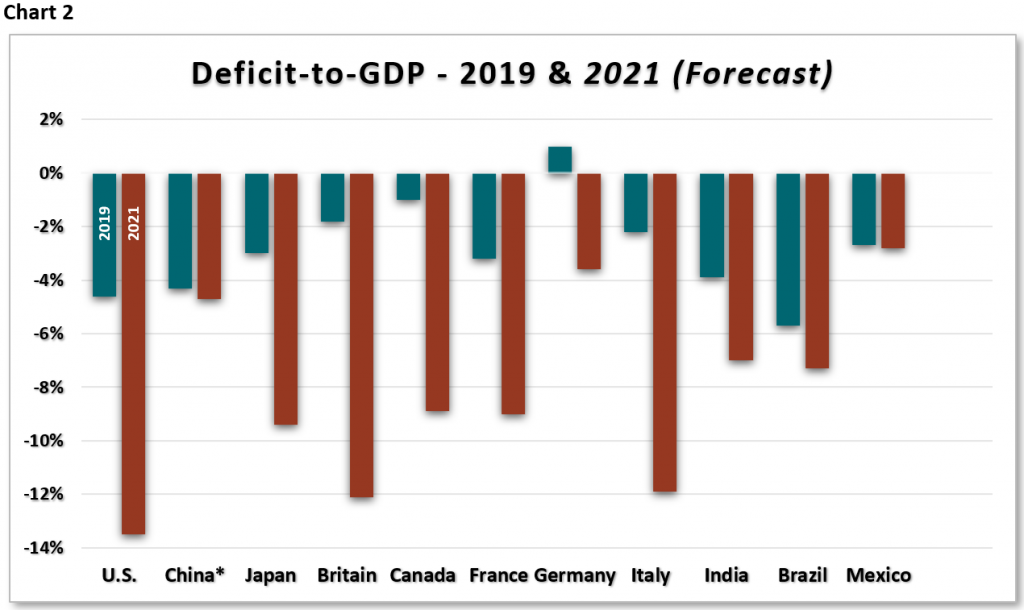

Charts 1 and 2 illustrate the pandemic-related surge in government debt and deficits for the seven wealthiest countries in the world along with four of the largest developing countries (China, India, Brazil, and Mexico). While the U.S. experienced the largest percentage increase in government debt relative to gross domestic product (debt-to-GDP), Japan, Canada, Britain, Italy, France, and Brazil likewise added hefty new debt loads.

When comparing government debt-to-GDP chart data, it should be noted that U.S. figures track total government debt (129%), although U.S. debt held by the public (not including intra-governmental transfers, like Social Security) is less alarmingly high at 99.8%. For China, government debt and deficit data are murky, as their socialist market economy includes many highly indebted state-owned banks and corporations. Overall Chinese government debt and deficit figures are likely much higher than charted.

Regarding government deficits in Chart 2, European Union members scrapped the 3% budget deficit threshold last year at the onset of the pandemic. Even formerly frugal countries like Germany bucked their budget surplus trends and ran a deficit. For more on Germany’s previous austerity and budget discipline, please see our 2Q 2019 Global Markets newsletter, “Germany’s Fiscal Austerity: An Impediment to Economic Growth.”

As the uneven global impacts of COVID continue in 2021, these government debt and deficit figures will continue to evolve. Except for the U.S. and possibly China, most countries in these charts continue to struggle with lockdowns and other restrictions along with varying vaccination timetables, which will likely exacerbate the need for government aid.

For a further explanation of how we think of the investment risks associated with government debt, watch our latest video.

The pandemic was crushing to emerging market economies, pushing more than 100 million people into extreme poverty. Although poor and developing countries have only limited access to global credit markets, aggregate government debt in emerging markets has risen to the highest level in 50 years. During that half century, emerging market investors have grappled with three major debt crises (early 1980s, late 1990s and 2008). Still, with over a decade of low interest rates in developed countries, slightly higher yielding emerging market debt has so enticed global investors that emerging market bonds now represent over 25% of the global bond market, up from 2% around the turn of this century. Despite multiple debt crises in the developing world, investors’ exposure to emerging market debt has risen dramatically while governments have likewise ratcheted up the debt.

Among the developing countries listed in Charts 1 and 2, India, Brazil, and Mexico each have unique pandemic debt factors to consider. Moreover, each country will be highly sensitive to the course of the U.S. economic recovery and interest rate policy. For example, Mexico perennially ranks as one of the countries borrowing the largest amount of dollar-denominated debt. This puts the country in a precarious position if U.S. economic growth strengthens the dollar, thus making it more costly for Mexico to repay its dollar debts with the peso.

Facing similar challenges, Brazil issued the biggest fiscal stimulus package of any emerging market last year. Although Brazil’s economic growth forecasts for this year are promising, Brazilians now contend with their highest daily COVID case rates since the onset of the pandemic. Similarly, although India managed the pandemic with less dangerous levels of government debt and deficit, analysts are lowering expectations for formerly robust economic recovery forecasts for 2021 after the troubling COVID surge that tailed off in late May.

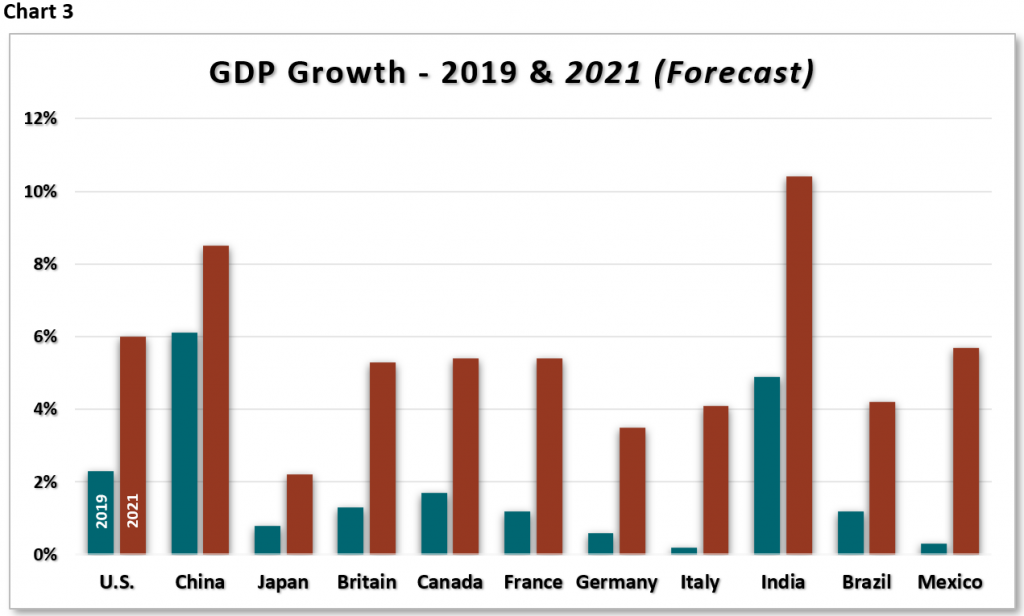

Even with COVID still ravaging many countries around the world this year, the ultimate direction of economic growth is rebounding positively. In the U.S. and some other countries, recent economic indicators and forecasts for the second half of 2021 suggest a probable economic boom. Chart 3 shows the resoundingly upbeat direction of global GDP growth, though economists may downgrade predictions for some countries, including India, Britain, and Brazil.

While global vaccination and economic reopening efforts have clearly been uneven, the economic strength of the U.S. and China, along with the attendant rise in consumer spending in those two nations, will help pull along those countries still struggling with the pandemic and managing increased debt loads. Further assistance is coming from the wealthiest countries. Under the encouragement of the World Bank and the International Monetary Fund, these wealthier nations (as defined by the G20) have collectively implemented a debt service suspension initiative (DSSI) for the poorest countries. The DSSI offers debt suspension and financial grants to highly pandemic-distressed countries, and the creditor nations have recently extended the initiative’s supportive measures through year-end 2021. Although such measures are not a panacea for the poorest countries, this shared global support has helped them avoid catastrophe thus far.

The U.S. economy is in the early innings of a possible boom unrivaled in the last 30 years. This has strengthened the dollar and triggered inflation trends for countries exporting goods to meet surging U.S. demand. Already this year, a few countries (such as Brazil, Russia, and Turkey) have been forced to raise local interest rates to tamp down inflation and keep their currencies from plummeting in value versus the almighty dollar. Especially in emerging markets, such monetary policy is a tightrope act, given such pitfalls as higher debt and deficit ratios and ongoing COVID-related economic weakness. Further, if inflationary trends in the U.S. become worrisome enough to force the Fed to raise interest rates sooner than expected, debt servicing and economic recovery will become ever more challenging for these countries.

The 2021 global GDP recovery forecasts are encouraging, but after such a massive debt splurge, investors will want to determine which governments have improved their productive activity for the long term, rather than squandering their stimulus spending and short-term growth in a way that resembles a sugar high. Investors with holdings in countries exposed to more perilous government debt ratios should be extra vigilant in seeking discounted equity valuations and premium bond yields when considering the debt side effect of COVID.

For our analysis of the implications of U.S. government debt for investors, read our latest Investment Insights newsletter.

The GHP Investment Advisors Global Markets Newsletter is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice and is not a recommendation offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.