,

September 30, 2021

By now, you have heard of cryptocurrencies, and maybe you even own some. Most investors were not lucky enough to have bought before the hype. But if you did, it might be time to consider recognizing your gains and diversifying.

Whether you have seen gains or losses or are just watching from the sidelines, crypto has taken on a life of its own and has attained a cult-like following. The cryptocurrency market has exploded beyond popular names like Bitcoin and Ethereum and is estimated to be worth upwards of $2 trillion, with nearly 10,000 different currencies circulating worldwide. Many investors are playing this cryptocurrency speculation game with the goal of timing the market for quick riches, but as with many trendy investments, the money may run out before hope does.

That does not mean crypto has no future. Still, according to GHP Investment Advisors’ (GHPIA) analysis of cryptocurrencies, we believe the current risks outweigh the potential future benefits. The risks are many, but the notable ones are exposure to possible regulation, high volatility, and a lack of intrinsic value.

Given the risks, including regulation, volatility, and valuation, it is hard to see why the cult of crypto continues to grow.

What is the source of the obsession with cryptocurrency? It may have to do with its novelty. Unlike ordinary currency, like dollars or euros, cryptocurrency is a digital, virtual type of money that has no tangible form, like paper bills or coins. Cryptocurrency exists only in electronic form. Instead of storing dollars in your wallet or at the bank, cryptocurrencies are stored on digital files. The digital files are stored on a blockchain. A blockchain is a ledger database that stores information in searchable, limitedcapacity blocks. Once each block is filled, it is linked in the chain to other filled blocks, forming a timeline of unalterable data. This shared, tamper-proof blockchain protects the security of crypto transactions.

Crypto coins can be acquired in two ways, by mining them or buying them. Mining is performed using very sophisticated computers that solve extremely complex computational math problems. This process is costly in terms of energy and server power, and it is only sometimes rewarding. Still, once a math problem is solved correctly, the miner is rewarded with a newly generated crypto token. To purchase already-mined tokens, one must create a “wallet,” an account on an exchange. One can purchase cryptocurrency with the money one has deposited in the wallet, either U.S. dollars or, for some purchases, another cryptocurrency.

Cryptocurrencies were created to be decentralized – free from regulation and the control of one person or government. Since a cryptocurrency is neither controlled by a central bank nor backed by a sovereign government, it has no one defending the currency, and no one country is responsible for it.

Government intervention and more regulation in the crypto markets has been a hot topic. Even the recent $1 trillion infrastructure bill passed by the Senate included provisions for crypto regulation. Much of the talk has been around stopping cryptocurrency crime, tax evasion and stablecoin regulation. A stablecoin is a type of cryptocurrency that is backed by another currency or reserve asset to ensure greater price stability. The IRS has begun to examine cryptocurrencies, imposing large fines for failure to report gains from crypto transactions.

Other countries are also trying to regulate cryptocurrency. China clamped down by banning new coin offerings and shutting down mining operations in parts of the country.

Much of this regulation comes on the heels of large ransomware attacks, like the one that shut down the Colonial Pipeline in May 2021. A 2019 research paper published in The Review of Financial Studies found that approximately one-quarter of bitcoin users are involved in illegal activity. It estimated that around $76 billion of illegal activity per year involved Bitcoin (at the time, 46% of Bitcoin transactions), which is close to the scale of the U.S and European markets for illegal drugs. Others argue that these types of statistics are overstated; a report in Forbes placed the volume of illegal transactions last year at a smaller but hardly comforting $10 billion. Either way, the ability to remain anonymous when using cryptocurrencies makes it hard to punish any user who engages in illegal activities.

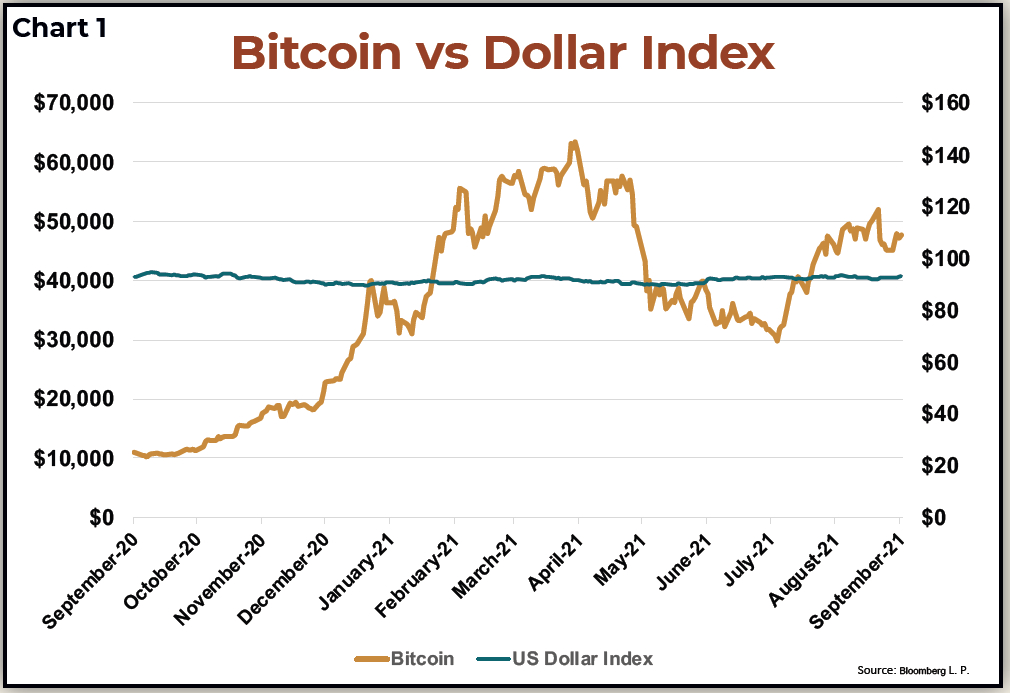

Volatility has become synonymous with cryptocurrencies, and you will need strong nerves to trade them. It is not uncommon to see large daily moves in these currencies, as shown in the Bitcoin daily price chart below. The blue line in the chart is the U.S. Dollar Index (USDX), which indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. You can see how steady the dollar is during these volatile Bitcoin moves.

This crypto volatility can come from any pretext and at any time. For example, when Tesla CEO Elon Musk tweeted at the beginning of February 2021 that the company would start accepting Bitcoin as payment for its vehicles, the price of Bitcoin jumped from just over $35,500 a coin to over $57,000 a coin, a 60% increase within three weeks. On May 13, Musk tweeted that Tesla would no longer accept Bitcoin, and by June, the price fell more than 32%, from $54,700 to $37,000. On June 13, Tesla rescinded the decision, causing an immediate surge in Bitcoin’s price.

This volatility is not only based on tweets, as El Salvador learned on September 7, 2021, when the Central American nation announced it has adopted Bitcoin as legal tender. Bitcoin fell 17% within minutes. It is hard to see how Bitcoin or any other decentralized currencies can be a reliable unit of measure or a stable currency.

The biggest risk of cryptocurrencies is that they have no intrinsic value. Intrinsic value is a measure of what an asset is worth. By worth, we do not mean the market price of an asset on any given day, but rather, the underlying fundamentals that determine whether the market value of that asset is reasonable.

For example, when we are evaluating a stock that we may add to our clients’ portfolios, we look at that company’s financial statements and build predictive models to create an informed expectation of future cash flows and growth. The indicators we study include how much debt a company has relative to its assets, how steady its margins are, and how its financials compare to its peers and competitors in its sector and asset class. These data help us figure out what a reasonable price for the stock should be based on its likely future growth.

Since crypto has no expected future cash flow, we cannot value it as an asset. Nor can we easily value it as a currency, as a medium of exchange. Some goods and services can be purchased legally with crypto, but not very many. Illegal activity may account for most of its accepted uses as payment even if such activity represents only a minority of trading. Because of the absence of future cash flow and “spendability,” cryptocurrencies do not provide us with the ability to model future value.

Crypto might be an inflated bubble with unlimited downside risk. Investors could someday find their crypto assets are worth $0, with no underlying asset behind them. At GHPIA, we are not venture capitalists betting on low-probability events, even when they might have potentially large payoffs many years down the road.

One element that keeps a cryptocurrency from complete devaluation is scarcity. For example, the maximum number of Bitcoins that can ever exist is 21 million, with only 2.2 million left to be mined at this writing. Once all 21 million have been mined, however, who is to say what each one is worth? How many Bitcoins will it take to buy a loaf of bread or a gallon of gas? More important, could you even use your coins to purchase these goods?

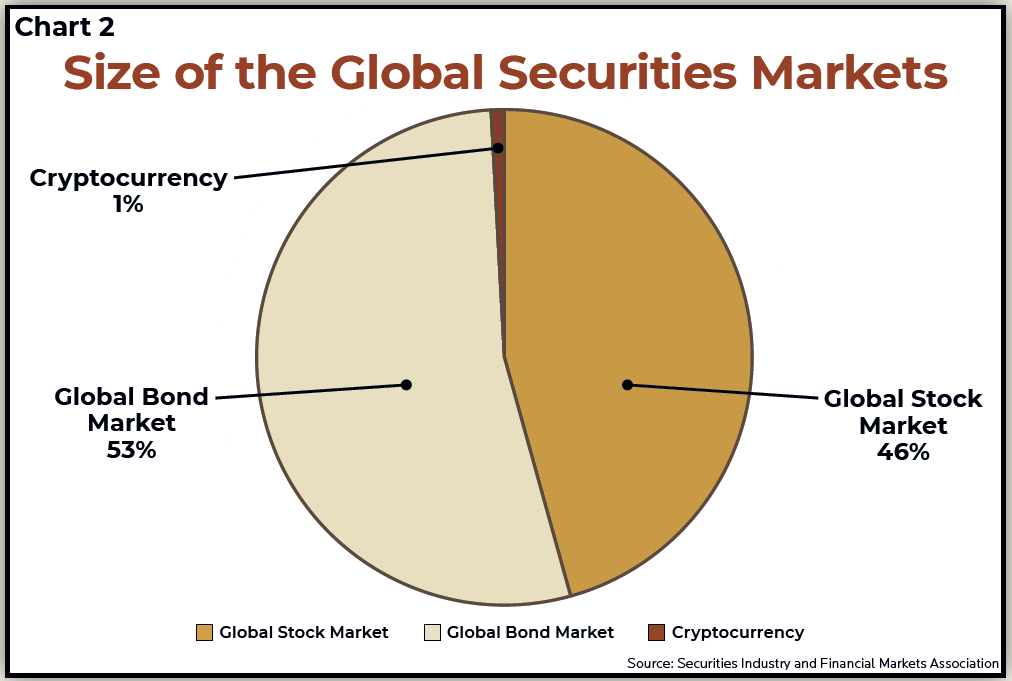

Regardless of the hype surrounding cryptocurrencies, the asset class remains a minimal portion of the overall global securities market. As shown in the chart below, the nearly $2 trillion crypto market represents just under 1% of global securities market capitalization, with stocks representing 46% at $106 trillion and bonds representing 53% at around $124 trillion. Considering how small the sliver is, the FOMO (fear of missing out) that some investors who do not own crypto may feel is misplaced.

Given the risks, including but not limited to regulation, volatility, and valuation, it is hard to see why the cult of crypto continues to grow. For now, the markets see cryptocurrency as another investable asset class, such as real estate, equities, and fixed income. Someday, GHPIA may join other financial analysts in considering crypto as part of a welldiversified investment strategy. But until we can attach a plausible value to them, we will not be recommending cryptocurrencies for our clients’ portfolios.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.