,

December 31, 2020

I want to begin our year-end letter by thanking all of you. Like my partners, I am a social person, and social distancing has played on my nerves. Nerves already rattled by the constant health concerns for my family, fires in our high country, racial tensions, and of course, the election cycle. Fortunately, your conversations, laughter, and debate with us throughout this stressful year helped to shorten that distance and ease those nerves.

In a Wall Street Journal editorial this November, Lance Morrow recalled the poet John Keats’s term of “negative capability.” Keats wrote in a letter to his brothers that negative capability “is when a man is capable of being in uncertainties, mysteries, doubts, without any irritable reach after fact and reason.” To Morrow, that means “genius has the instinct sometimes to wait, and wait, and wait a little more, and allow the dust to settle, thoughts to mature, and truths to emerge. Hasty certainty tends to be a fool.”

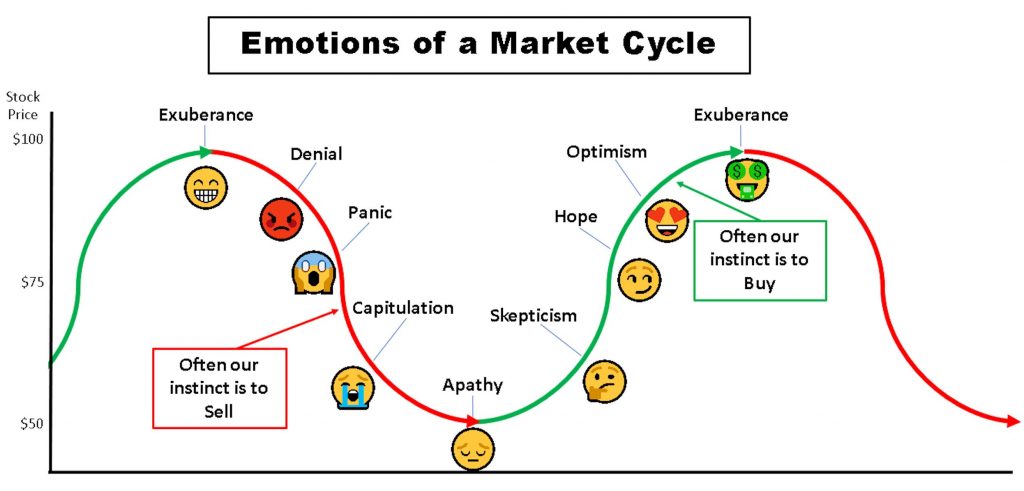

Morrow’s essay relates negative capability to 2020’s political disputes, but it is also relevant to investing. As the year draws to a close, equity markets have recovered from the 35-40% losses encountered in mind-paralyzing speed this March. No one’s negative capability went untested as the pandemic arrived. Wracked by countless doubts and uncertainties, even the steadiest investors experienced the full gamut of emotions in such a rapid market cycle.

As your advisor, we must not only summon negative capability during panicked market selloffs, but also scale back and take profits in growth markets when exuberance and greed may impair our better judgment.

Prevailing over our most human fight-or-flight impulses in such harrowing circumstances requires the use of many tools in the advisory toolbox. Among these are three critical necessities that have been our guidelines this year: Patience with diversification, Protecting cash flow, and Processing information into context. This is my version of the 2020 PPP, so let us unpack each P to further understand how it can help us find strength in negative capability throughout the torrent of emotions in a market cycle.

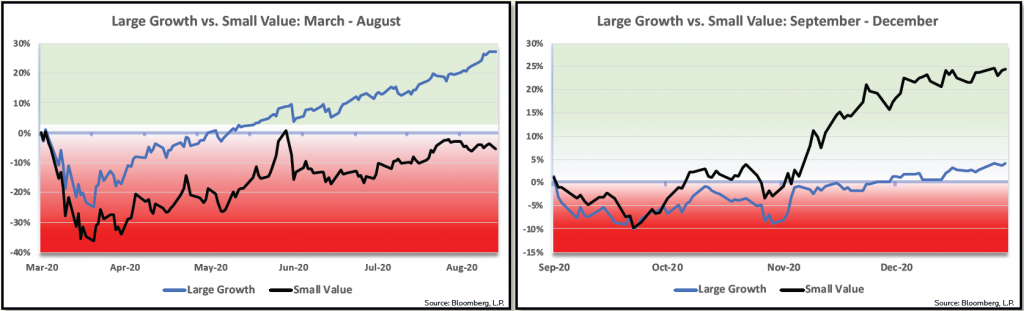

Yes, I know, we stress the importance of diversification until the cows come home. In Carin Wagner’s 2nd Quarter letter, “Fiscal Fitness: Why Diversification Matters,” she cited the dangerous risks of portfolio concentration in only a few sectors (such as technology stocks), which can be moderated by diversifying across a wide variety of reasonably valued and steadily profitable stock sectors. This year, however, economic lockdowns and social distancing measures allowed tech stocks to flourish while most other stock sectors slid toward oblivion, mightily testing our patience for diversification.

The encouraging vaccine announcements in the 4th quarter have rewarded us for our patience. As reports of the incredibly high rates of vaccine efficacy suggest a potential endgame to the pandemic in the year ahead, economically cyclical stocks have staged a healthy rebound over the past few weeks. For example, the charts below display the significant outperformance of the Large Growth Index (i.e. tech stocks) over the Small Cap Value Index (i.e. small banks, energy, and cyclical stocks) from March to August. Since September, however, Small Value stocks have surged, as opportunistic investors have seized on their far less expensive valuations relative to Large Growth stocks. While we still have a mountain to climb to return to economic normality, these last few months offered a clear example of the benefits of patient diversification.

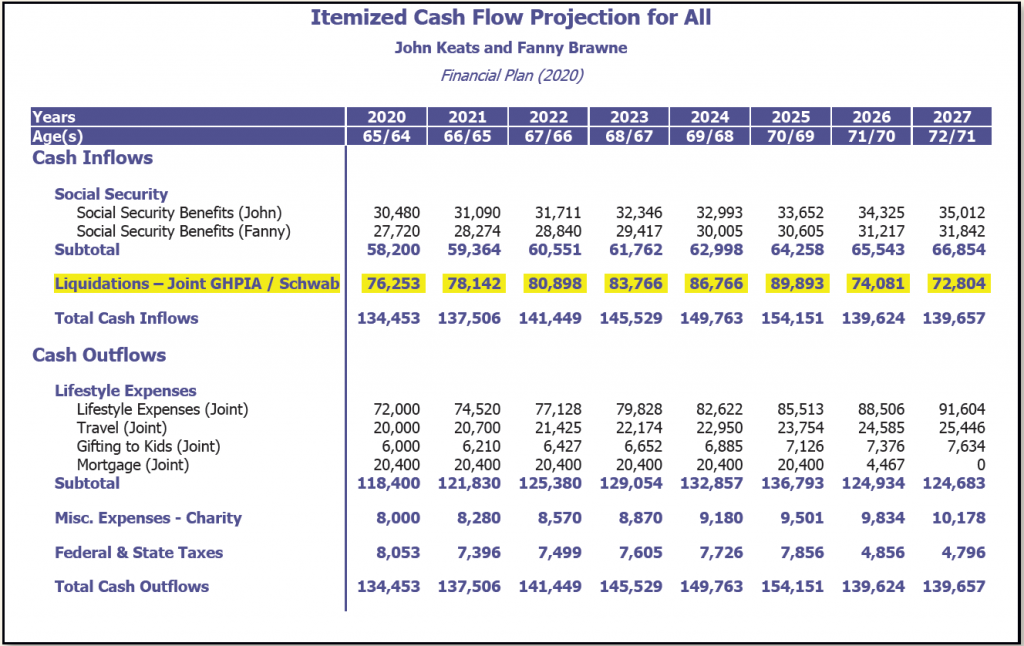

Most of you have engaged in retirement modeling exercises with our financial planning team. During these comprehensive reviews, we gain a firm understanding of your cash flow needs. We seek to accurately quantify how much you will withdraw from your portfolio annually, and we then extrapolate your likely income and spending as closely as possible for the next decade.

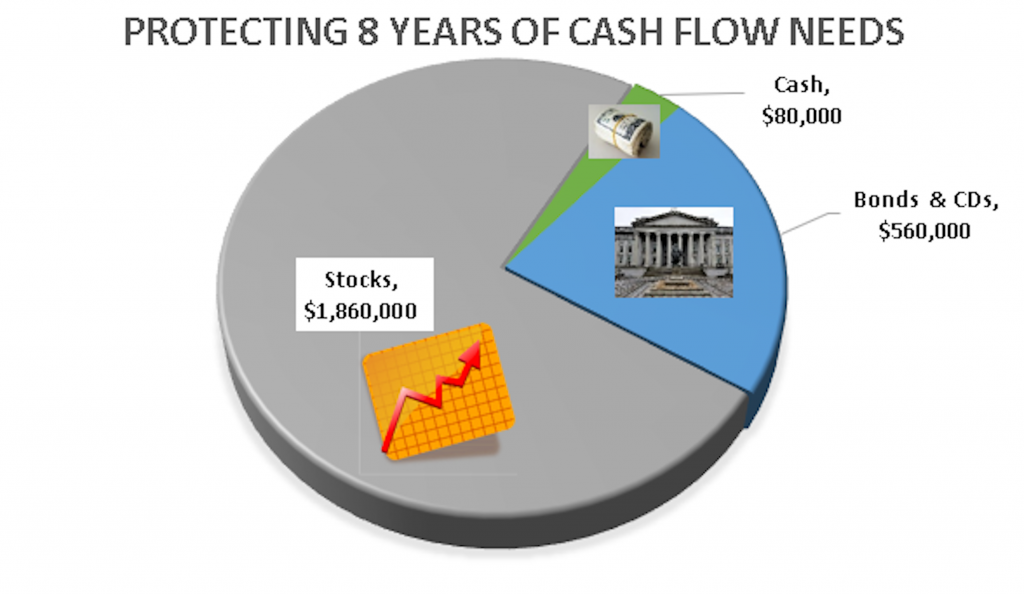

In the example provided, Keats and his muse Fanny expect to withdraw an average of $80,000 per year from their portfolio. While our portfolio strategies are tailored to each unique client, we generally advise clients to set aside a minimum of five years of their withdrawal needs in safe assets like cash, bank CDs, and short-term bonds. In this case, we advised that John and Fanny target eight years, or $640,000, for these highly conservative investments. The remainder of their portfolio ($1,860,000) is allocated towards growth assets in diversified stocks.

Put to the test in a year like 2020, as the stock portion of the Keatses’ portfolio dropped 35-40% this spring, the safe side of the portfolio acted like a shock absorber. This buffer provided the psychological comfort from impulsive panic-selling, which allowed the stock portfolio to recover as this short yet very severe market cycle has played out. While the stock portfolio was only depressed for about eight months, the strategic design of this allocation protects cash flow for up to eight years.

As we adjust to the Information Age, many of us are overwhelmed with the deluge of data and communication bombarding us daily. In a fast-moving and horrific year like this, it often feels impossible to make sense of the chaos. As your wealth advisors, one of the essential value propositions we extend is assisting in how to filter all this information and focus on context, on the bigger picture.

For example:

During the GHPIA staff’s regular Squawk Box and Investment Committee meetings (which in 2020 have moved to Zoom), we hold internal debates concerning these and other financial and economic trends. Our process establishes debate teams, and challenging our colleagues’ assertions is encouraged. As analysts and advisors, we are constantly seeking to synthesize context from the minutia of data gleaned from our research so we can provide you with straightforward, considered, and actionable advice.

I once saw Rodney Dangerfield in Las Vegas with my parents, and when he flubbed one of his jokes, he deftly recovered by stating, “I’ve gotta lotta bleeping jokes.” We likewise have a lot of bleeping tools to keep your wealth goals on track despite the occasional portfolio flub or market setback. We employ a variety of safeguards beyond these highlighted PPP principles to allow our long-term portfolio management to withstand the punches taken in a bruising market cycle like 2020 and still be in the ring when investments begin to recover and flourish. As your advisor, we must not only summon negative capability during panicked market selloffs, but also scale back and take profits in growth markets when exuberance and greed may impair our better judgment. Excessive pessimism and unbridled optimism may be equally costly.

We appreciate your patience and fortitude throughout the nausea-inducing market cycle this year. As we embark on 2021 with uplifting news regarding initial vaccine efficacy, we wish you good health and prosperity, and we hope to be visiting with you in person again someday soon.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.