December 31, 2020

I want to begin our year-end letter by thanking all of you. Like my partners, I am a social person, and social distancing has played on my nerves. Nerves already rattled by the constant health concerns for my family, fires in our high country, racial tensions, and of course, the election cycle. Fortunately, your conversations, laughter, and debate with us throughout this stressful year helped to shorten that distance and ease those nerves.

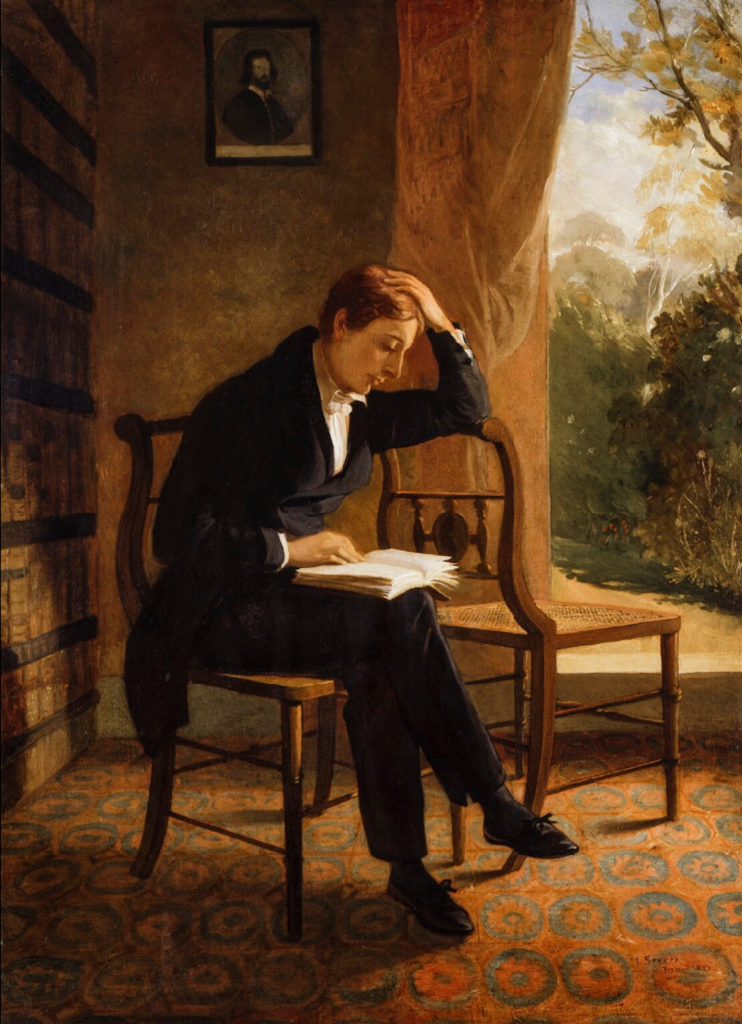

In a Wall Street Journal editorial this November, Lance Morrow recalled the poet John Keats’s term of “negative capability.” Keats wrote in a letter to his brothers that negative capability “is when a man is capable of being in uncertainties, mysteries, doubts, without any irritable reach after fact and reason.” To Morrow, that means “genius has the instinct sometimes to wait, and wait, and wait a little more, and allow the dust to settle, thoughts to mature, and truths to emerge. Hasty certainty tends to be a fool.”

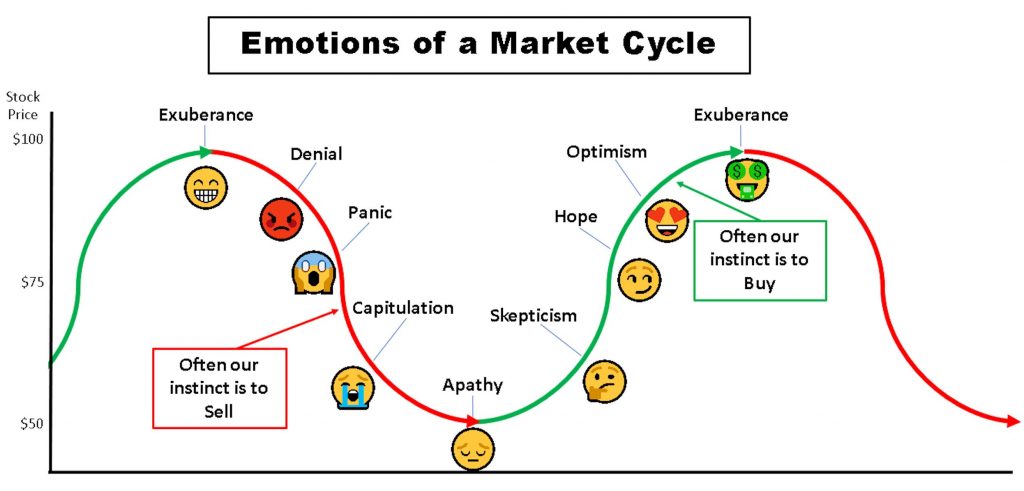

Morrow’s essay relates negative capability to 2020’s political disputes, but it is also relevant to investing. As the year draws to a close, equity markets have recovered from the 35-40% losses encountered in mind-paralyzing speed this March. No one’s negative capability went untested as the pandemic arrived. Wracked by countless doubts and uncertainties, even the steadiest investors experienced the full gamut of emotions in such a rapid market cycle.

As your advisor, we must not only summon negative capability during panicked market selloffs, but also scale back and take profits in growth markets when exuberance and greed may impair our better judgment.

Top Row L to R: Brad Engle, Mike Sullivan, Sebrina Ivey, Christian Lewton, Jason Kitner

Bottom Row L to R: Carin Wagner, Angela Kennedy Lee, Jenny Merges, Brian Friedman, Deirdre Mcguire, Barbara Terrazas, Reed McCoy