,

February 15, 2024

China, the world’s second largest economy with gross domestic product (GDP) of $17.9 trillion, is currently experiencing an economic slowdown. The International Monetary Fund (IMF) anticipates GDP growth to dip below 3.5% by the end of the decade, a significant decline from the 7% average growth achieved over the past 15 years. While several factors contribute to this deceleration, the most obvious is their deteriorating property sector. The specter of a potential government stimulus fueled property bubble emerged post Great Financial Crisis, a risk we underscored in a 2014 Global Markets Newsletter – China: 35 Years of Rapid Growth…How Many More. However, the first tangible sign of the bubble bursting happened over two years ago when one of the largest Chinese property developers, China Evergrande Group, failed to make interest payments on its debt. Fast forward to today, Evergrande has officially been forced to into liquidation by a Hong Kong court, and Country Garden Holdings, once the largest property developer in China by revenue, is also in default. Bloomberg estimates 34 of the top 50 Chinese real estate developers defaulted or missed payments during the past 3 years.

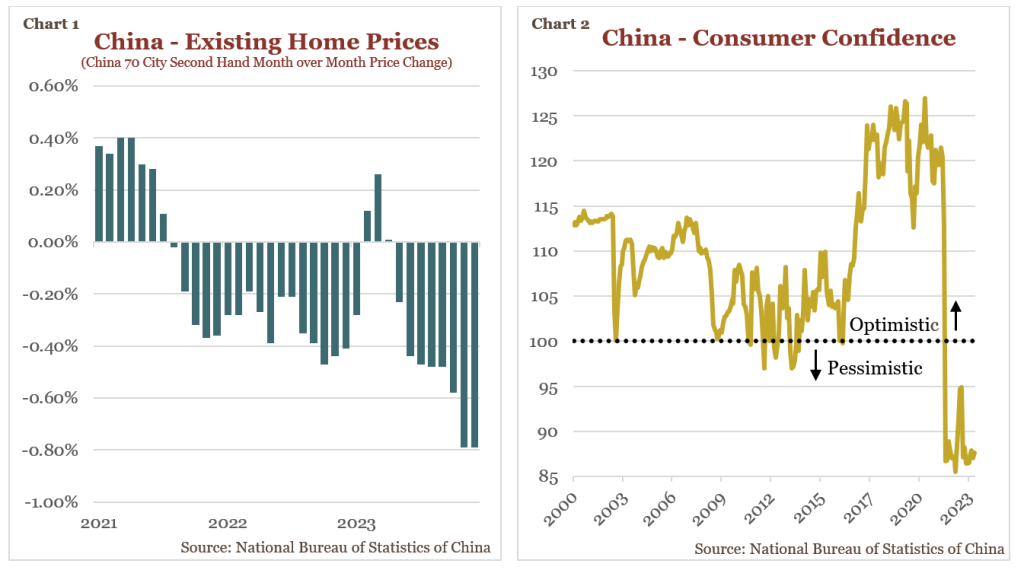

The tumultuous state of China’s property sector has resulted in unpaid suppliers and prospective homebuyers facing significant delays or non-delivery of apartments. The diminishing confidence in developers is mirrored in the sharp decline of new home sales, plummeting by 34% year over year in January for the country’s top 100 developers. Concurrently, existing home prices experienced a downward trend, declining in 26 of the past 36 months (see Chart 1).

The decline in home prices has created a strain on consumer confidence (see Chart 2) and spending as homeowners perceive a decrease in their wealth, leading to reduced expenditures on non-essential items. Concerns about a potential ripple effect are now showing up in other parts of the economy. Exports, another key driver of China’s GDP growth, hit a 3-year low last year, the consumer price index (CPI) moved into deflationary territory, youth unemployment hit record highs, and credit demand from households and businesses is reaching multi-decade lows.

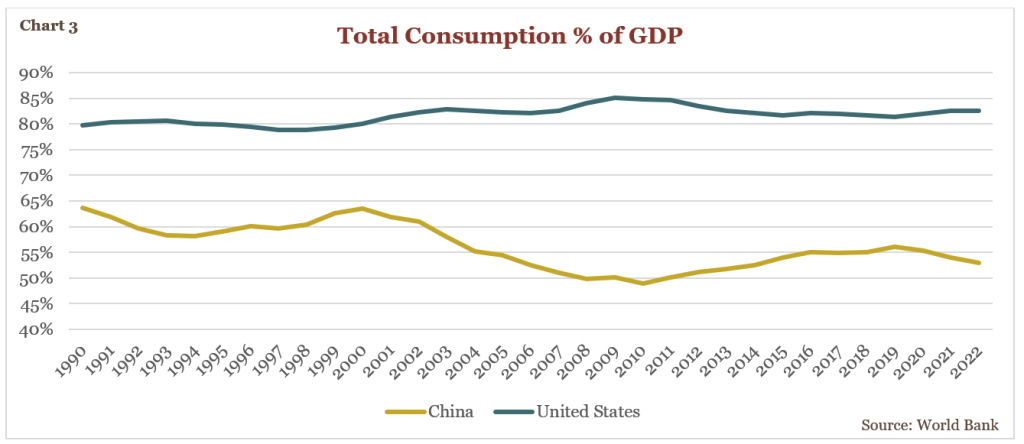

At its peak, investments, encompassing areas like buildings, factories, and housing infrastructure, constituted 45% of China’s GDP, with the residential property sector alone contributing a quarter of the country’s GDP. However, the persistent challenges faced by the sector, stemming from excessive debt levels, oversupply, and unfavorable demographics has Chinese leaders seeking growth alternatives, with a renewed focus on bolstering domestic consumption. The goal of raising consumption makes sense given the high level of savings in China. However, the high savings rate in is exacerbated by a weak financial system. The weak financial system, in turn, is rooted in the inadequacies of the legal system, which is hampered by a lack of robust rule of law in the country. Today consumption accounts for just 53% of China’s GDP, down from 64% in 1990 and significantly lower than advanced economies like the United States at 82% (see Chart 3).

At GHPIA, we hold the view that achieving this rebalancing act will prove exceedingly challenging. The absence of a true rule of law in China will only perpetuate a decline in consumer confidence and trust. Consumers are likely to remain hesitant to engage in an economy marked by fraud, unfair business practices, and insufficient legal protection, thereby impeding future economic growth.

The Chinese stock market has not been spared from the economic malaise currently facing China. Since the start of 2021 the MSCI China Index is down nearly 50% (see Chart 4). While some investors might perceive Chinese stocks as potentially undervalued due to the substantial selloff, we continue to limit our exposure

given the lack of transparency and reliability of financial reporting for Variable Interest Entities (VIEs), the structure many Chinese companies use to list abroad (for an in depth review of VIEs, see our 2022 Global Markets Newsletter – What Do You Own When You Invest in Chinese Stocks?).

Our strategy of restricting exposure to Chinese companies has proven advantageous for our clients in recent years. However, we recognize the headwinds that certain U.S. companies may encounter, stemming from both the economic slowdown in China as well as the growing geopolitical tensions between China and the West. For example, Apple Inc. (AAPL), who generates nearly a fifth of their sales from China, saw sales in mainland China decline 13% in the latest quarter. U.S. semiconductor equipment companies and chip makers are seeing sales slump as Chinese manufacturing activity contracts and U.S. exports controls on advanced chips kick in. While exposure to China will likely persist for many businesses, our team will continuously monitor companies to ensure our long-term investment thesis remains intact.

The bursting property bubble in China has exposed critical vulnerabilities in its economy, from overreliance on investment to a weak financial system hindering consumption growth. While rebalancing towards domestic consumption appears logical given high savings rates, achieving this transformation hinges on a crucial factor: establishing a robust rule of law. Without it, consumer confidence and trust will remain elusive, impeding future economic growth and any significant shift towards an advanced economy.

Global Markets is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal, or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. Individuals should seek advice from their own legal, tax, or investment counsel; the merits and suitability of any investment should be made by the investing individual. References to specific securities, asset classes, and financial markets are for illustrative purposes only. Actual holdings will vary for each client, and there is no guarantee that a particular account or portfolio will hold any or all of the securities listed. Past performance is no guarantee of future results. Investments carry risk and investors should be prepared to lose all or substantially all of their investment.