,

February 14, 2023

When Russia invaded Ukraine in late February last year, the world was already grappling with rising inflation, softening economic growth and retreating stock prices. The immediate global shock from the invasion last spring exploded on commodity prices, roiled currency markets and snarled already fragile supply chains. As the war reaches the one year mark this month, most commodity prices have fallen back to pre-invasion levels and Western economies, particularly the most vulnerable in Europe, have thus far avoided more threatening recessionary outcomes. Of course, it is impossible to forecast the direction the war will take in its second year, but as Ukraine gathers momentum on the battlefield, and as the European Union (EU) has surprisingly secured sufficient winter energy storages, for countries other than Russia and Ukraine, it looks as if the most punishing economic impact from the war is behind us.

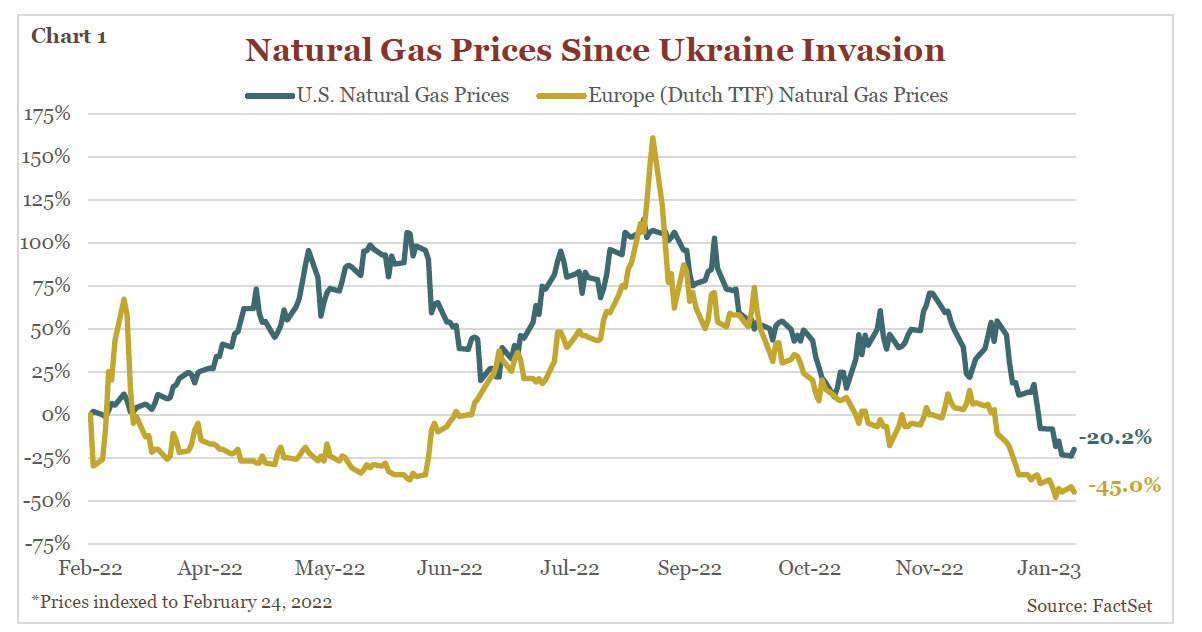

One of the primary risks we summarized during our May 2022 Annual Economic Forum was an energy crisis in Europe this winter, assuming Russia cutoff 50% or more of its natural gas exports to the Continent in retaliation to Western sanctions. As of this writing, Russia has throttled virtually all of its gas exports to Europe, and astonishingly, EU gas storage levels have risen comfortably above 80%, which has allowed prices to rapidly drop below pre-invasion levels, both in Europe and the U.S. (see Chart 1).

As with many things in life, some of this remarkable improvement was driven by stroke of luck – Europe’s winter has been quite mild thus far, reducing demand for gas to heat homes. The resupply of depleted EU gas levels has also been boosted by a rapid rise in exports of liquified-natural-gas (LNG) from the U.S. and Qatar as Europe scrambles to diversify its energy suppliers away from Russia. Also, winter energy storage levels were aided after many households and businesses cutback on gas consumption in response to both higher prices and government threats of mandatory winter rationing.

While recent momentum for Ukraine on the battlefield is the most encouraging development towards an eventual end to the war, Putin’s second worst setback is likely the EU’s ability thus far to avoid an energy crisis. Prior to the war, the EU imported more than half of its natural gas from Russia, which made it exceedingly vulnerable to Russia’s weaponization of energy supplies. Although the EU remains beset by major economic challenges this year, it appears to have dodged crisis level energy shortages this winter. As gas prices and heating bills moderate, EU governments will not be as encumbered in doling out additional subsidies to households, which may further solidify broad European support for Ukraine even as they continue to cautiously decouple from Russian energy sources.

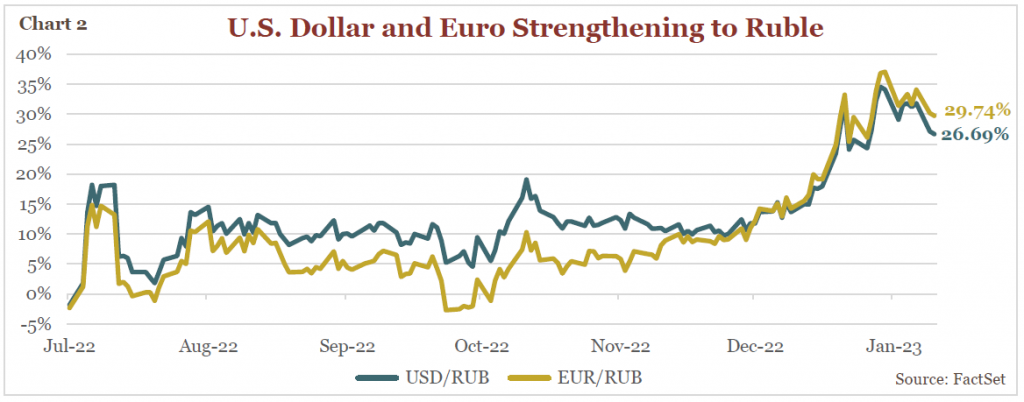

Another promising development for Western economies has been currency strengthening relative to Russian ruble weakness as energy prices have cooled from acutely inflated July 2022 levels. The ruble has been wildly volatile since the onset of war, initially falling by more than 40% in March, then staging a remarkable recovery by early summer, after the Russian central bank took emergency measures to protect the currency by raising rates to 20% and implementing strict capital controls. However, as 2022 ended with Europe skirting an energy crisis, the dollar and the Euro have strengthened considerably to the ruble (see Chart 2).

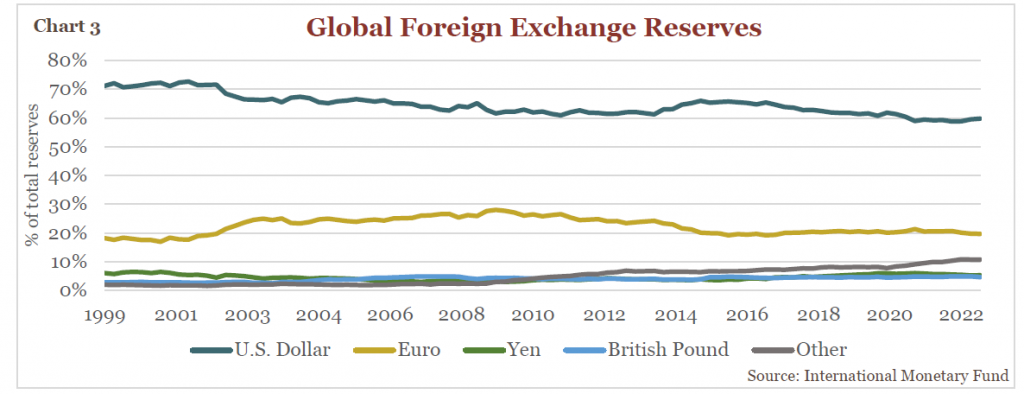

Moreover, the stability of the U.S. dollar along with the Euro has been notable when considering the initial outcry when all G7 countries sanctioned a freeze on Russian foreign currency reserves shortly after the invasion. Ultimately, the freeze cut Russia’s vast reserves of roughly $600 billion nearly in half, adding considerable pressure to its ability to stabilize the ruble. A few non-Western countries within the international community deemed this confiscatory and bemoaned the dominance of the U.S. dollar as the world’s reserve currency. Nevertheless, as the world begins 2023, the dollar remains unchallenged and quite stable as the world’s primary currency, with the Euro, likewise stable, as the world’s secondary reserve currency (see Chart 3).

Although Russia’s central bank surprisingly stabilized the ruble during the early months of the war, currency weakness has reemerged, further squeezing its war finances while pushing its economy closer to the brink.

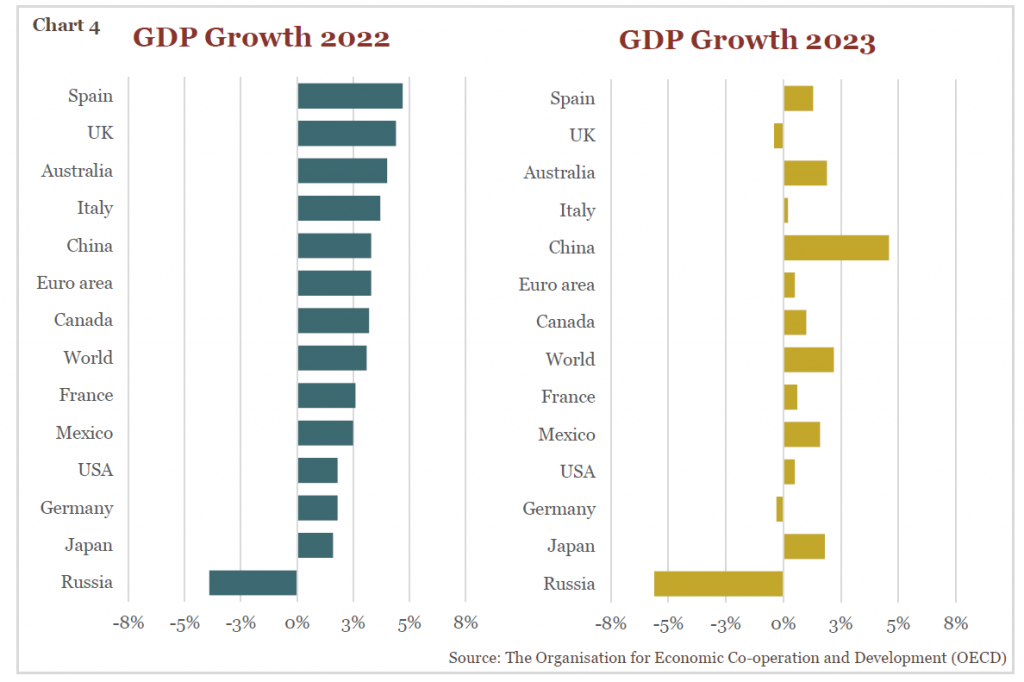

Notwithstanding the economic relief provided as global energy prices come off the boil, most Western countries are still experiencing a sharp slowdown in growth as we begin 2023, and some anticipate outright recession (see Chart 4).

Although European natural gas prices have fallen precipitously from the extreme highs of last summer, they remain roughly double the average price of the last decade. Higher gas prices from last summer have also hit close to home, as many of our Denver based clients have commented on the highest heating costs ever over the last two months, including me! Further, monetary policy across all rich developed Western countries has tightened with considerably higher interest rates, which has already triggered major government fiscal policy upheaval (e.g. U.K.’s abrupt removal of PM Liz Truss, U.S. debt ceiling debates, France’s battles with pensioners to raise retirement ages, etc.).

Most countries in Europe provided massive energy subsidies to households, which raised debt and deficit-to-GDP ratios from levels that were already deemed precarious. Outside of Germany, many of these countries sit on the razor’s edge with regards to fiscal headroom to extend subsidies if energy prices should spike again as the war continues. For example, Italy, which we highlighted in year’s past for carrying the highest debt/GDP ratio in the West, may be the first European country to push for peace negotiations with Russia, rather than continue supporting Ukraine at the risk of fiscal peril. On the other hand, Russia’s recession is expected to deepen significantly this year, which will undoubtedly threaten government resolve and popular domestic support to continue the war.

Just as Russia miscalculated with its ability to quickly take Kyiv, likewise, it has been unable thus far to effectively weaponize its energy resources against European importers. Despite its previously heavy reliance on Russian energy, the EU has proven resilient in maintaining ample winter energy storage levels. However, with China’s recent emergence from Covid lockdowns, Europe will have to compete even more aggressively for precious LNG imports, which will likely prevent energy prices from falling much further. Moreover, as Western countries contend with restrictive monetary policy and risky fiscal debt loads, ongoing support for Ukraine will not be automatic, generous, or undisputed. Conversely, Russia’s currency and economy have been faltering, especially in the second half of 2022, hindering its ability to assert its war agenda. As this war of attrition grinds into its second year, victory for either side or peace negotiations seem like far off possibilities. However, the frightening threat of EU homes without heat this winter has been averted, which assuages a major war related shock for Western economies.

Global Markets is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal, or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. Individuals should seek advice from their own legal, tax, or investment counsel; the merits and suitability of any investment should be made by the investing individual. References to specific securities, asset classes, and financial markets are for illustrative purposes only. Actual holdings will vary for each client, and there is no guarantee that a particular account or portfolio will hold any or all of the securities listed. Past performance is no guarantee of future results. Investments carry risk and investors should be prepared to lose all or substantially all of their investment.