June 15, 2023

Just days after Russia’s invasion of Ukraine the U.S. Treasury Department sanctioned Russia’s central bank, hindering their ability to tap their U.S. dollar (dollar) reserves to fund the war. These unprecedented sanctions against Russia’s war chest heightened concern among other countries at odds with America that the U.S. government could do the same to them. Many countries want to challenge dollar hegemony, but there are key reasons why they are unlikely to succeed anytime soon.

Under the Bretton Woods Agreement in 1944, the dollar was established as the world’s reserve currency, and other currencies were pegged to the dollar at a fixed exchange rate. The dollar was chosen for several reasons. Firstly, the United States was the largest economy in the world, emerging from World War II as the premier economic and military power. Secondly, the dollar was a stable and reliable and currency. Thirdly, the American legal system protected foreign owners of U.S. assets on the same strong basis as domestic contracts and property rights. Finally, the U.S. government was committed to maintaining the value of the dollar and the stability of the global financial system. Although the gold standard and fixed exchange rates were abandoned in 1971, the greenback remains the primary currency for international trade and finance.

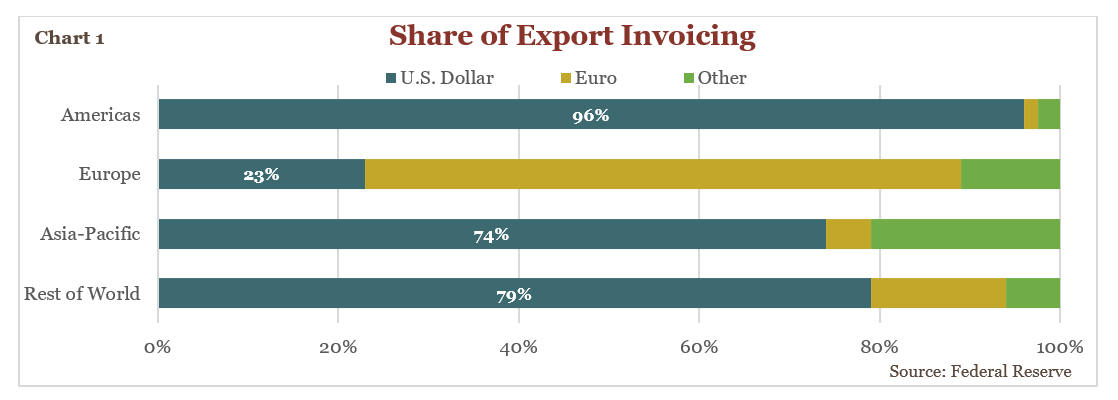

The dollar is dominant in global trade. From 1999 to 2019, the dollar accounted for 96% of trade invoicing in the Americas, 74% in the Asia-Pacific region, 23% in Europe, and 79% in the rest of the world (see Chart 1). The dollar is the accepted medium of international exchange for hundreds of countries, millions of businesses, and billions of people. The dollar benefits from a “network effect” whereby an asset gains more value because other people use it. This network effect would be extremely difficult to replicate for any other single currency.

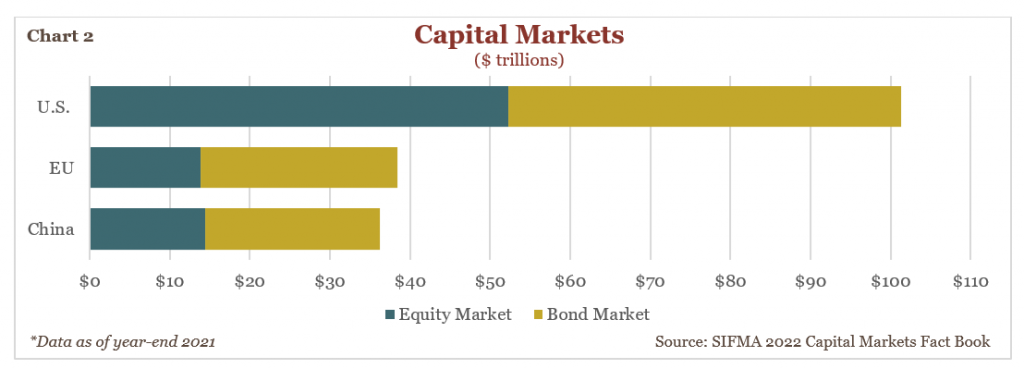

Another key factor affecting the durability of the dollar is the scale and quality of U.S. capital markets. Take China for example. Although Chinese companies earn significant export revenue, China lacks deep and trustworthy financial markets. The Chinese bond market is quite small, both relative to global capital markets (see Chart 2) but also as a percentage of its own Gross Domestic Product.

U.S. Treasury securities are a good example of globally trusted assets given their unparalleled liquidity and credit quality. Rather than turning away from dollar assets, foreigners are increasing their holdings. Since 2000, foreign investors increased exposure to U.S. government bonds sevenfold to just over $7 trillion (see Chart 3).

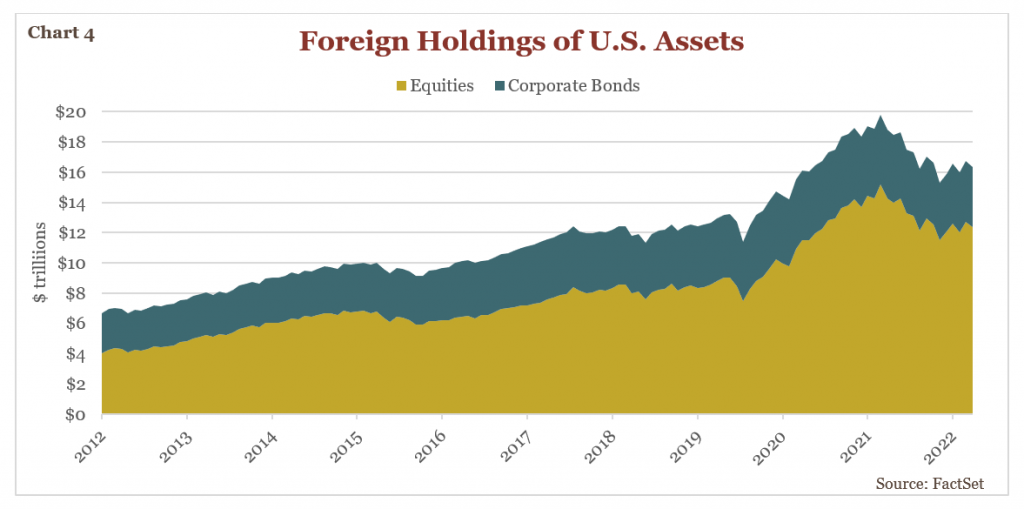

Foreigners hold dollars to not only to purchase U.S. government bonds but also American goods, services, and other investments. The U.S. offers a wide range of asset classes with relatively unhindered entry and exit for foreign investors, such as stocks, bonds, real estate, and private companies. Over the past decade international investment into U.S. stocks and corporate bonds nearly tripled (see Chart 4) to just over $16 trillion.

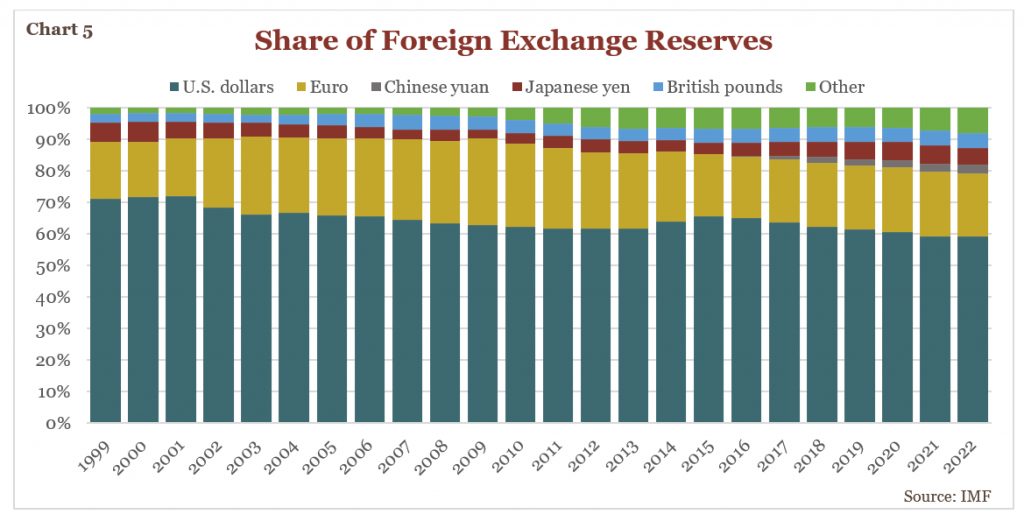

While other countries often have restrictions, less attractive assets, lower liquidity, and weaker legal protection, the U.S. benefits from an openness to trade, vast capital markets, and strong rule of law. These attributes are a key reason why the U.S. makes up 25% of the world economy, yet as of year-end 2022, 60% of global foreign currency reserves were denominated in dollars (see Chart 5). This is 3x larger than the euro and more than ten times the size of the Japanese yen, British pound, and the Chinese yuan. While there has been some diversification away from the dollar since the turn of the century (71% in 1999 vs. 60% today) most market share has been taken by a basket of other currencies (green bar below) rather than one single currency.

Even as headlines create buzz with countries discussing settling oil or other exports in different currencies, the dollar will continue to reign supreme in international trade for the foreseeable future. In one sense this is unfortunate. If other countries, particularly a big trading nation like China, implemented the rule-of-law then foreigners would rely on their money. So far, China and oil exporters such as Saudi Arabia, Russia, or Iran are not moving toward trustworthy legal systems. Without the rule of law foreign investors will not purchase assets like bonds, stocks, real estate, or companies in large volume. Of course, we would all be better off if the U.S. dollar lost prominence because other countries offered trusted financial systems.

It is worth noting that in the event of a shift away from the dollar, it is unlikely that another single currency would take its place. Rather a more diversified landscape would likely emerge with multiple currencies used more frequently. In fact, a more diversified international monetary system could benefit U.S. investors by reducing their exposure to currency risk and creating more opportunities for investment in non-dollar denominated assets. Although it is highly improbable for the dollar to be dethroned, the scenario of countries shifting away from the dollar should not be regarded as a doomsday scenario.

While the potential loss of the dollar’s dominant reserve currency status could bring about both positive and negative implications for the U.S. economy and investors, it does not appear imminent at present. The dollar continues to benefit from several structural advantages, and the demand for U.S. assets and products is likely to remain strong. Therefore, the prevailing outlook suggests that the dollar will maintain its position in the international financial system.

Global Markets is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal, or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. Individuals should seek advice from their own legal, tax, or investment counsel; the merits and suitability of any investment should be made by the investing individual. References to specific securities, asset classes, and financial markets are for illustrative purposes only. Actual holdings will vary for each client, and there is no guarantee that a particular account or portfolio will hold any or all of the securities listed. Past performance is no guarantee of future results. Investments carry risk and investors should be prepared to lose all or substantially all of their investment.