,

November 15, 2022

On October 7th, 2022, the Biden administration announced new export control regulations, aimed squarely at China’s burgeoning advanced semiconductor industries. The new restrictions on specific leading-edge chip technologies are directed at halting China’s technological growth in key areas, including artificial intelligence (AI) and supercomputing. With this substantial policy-shift, the U.S. is explicitly trying to freeze China’s domestic manufacturing abilities beyond a certain threshold; with specific capabilities and product benchmarks targeted in the comprehensive regulations. The U.S. policy moves will be seen as deeply provocative, not only in China itself, but also in export-heavy tech hubs like South Korea and Taiwan, whose own semiconductor industries rely heavily on China’s nascent business for expansion and research and development funding. This new U.S. strategy, if effective, is certain to have deep impacts across the worldwide technological, economic, and geopolitical spectrums.

To understand the gravity of the new regulations it is key to understand why semiconductors are so important. Essentially, they control the flow of electric currents, allowing our devices to function. They are used in nearly every digital product from PCs to refrigerators, televisions, mobile phones, automobiles, and military drones. While basic legacy chips provide simple functions like powering on a device, new advanced chips provide the ability for vehicles to drive themselves, automated trading in capital markets, machines that can diagnose and treat illnesses, and AI-powered advanced simulation systems for the military. These innovative technologies have shown themselves to be not only critical to the future of economic strength, but of future global military power. Underpinning it all, we find semiconductors and the technological abilities they unlock.

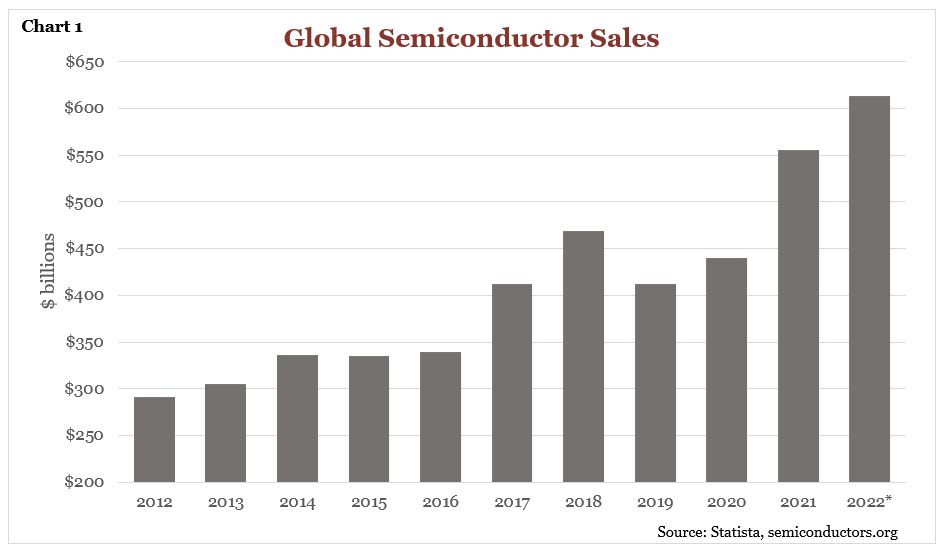

As part of a national focus towards science and technology in their official policy, China has started its push to make itself into a formidable competitor in the semiconductor industry that has nearly doubled in the past decade (see Chart 1 below) and is expected to reach nearly $1 trillion in total sales by 2030.

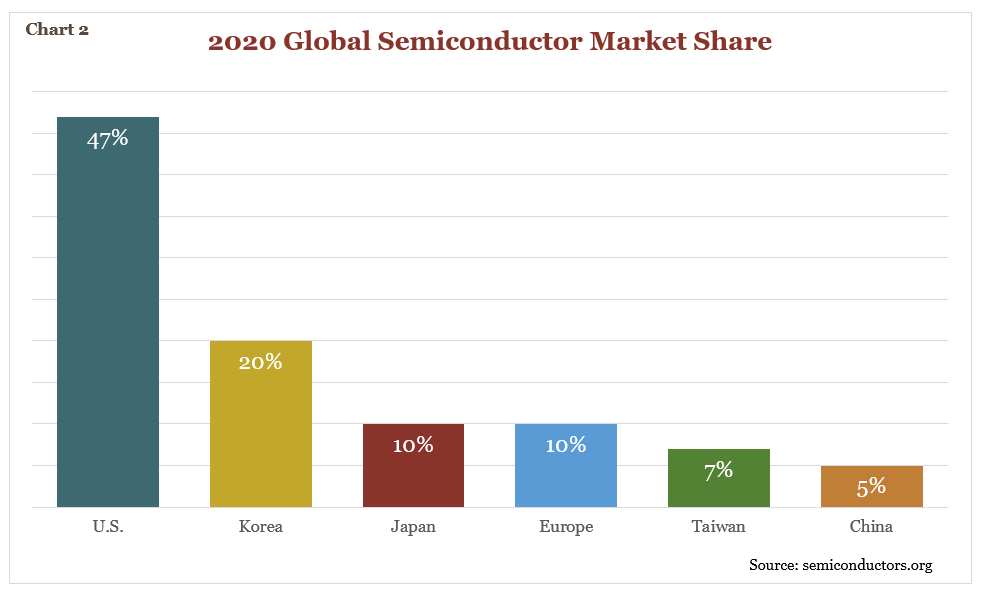

While China continues to be the largest consumer of semiconductors, a title held since 2005, they only recently began their push to bring manufacturing onshore. As of 2020, they controlled only 5% of global market share (see Chart 2 below), however plans to build out manufacturing capacity and expand their footprint into other parts of the supply chain could drive their market share up to an estimated 17% by 2024.

While some of the growth will undoubtedly be in the legacy chip space, they continue to close the gap to western nations on advanced chip design and fabrication. Advancements include mass-producing high-end memory products which are used in state-of-the-art smartphones and computers and AI research and commercialization hardware.

The Chinese military’s ties to its domestic commercial industries are deeply intertwined. Per the U.S. State Department, “Military-civil fusion is a strategy with the goal of enabling China to develop the most technologically advanced military in the world.” Therefore, prior U.S. sanctions and export controls could not realistically hinder China’s military without also targeting their commercial tech industry, which, up until now, the United States has been more hesitant to do. With these latest actions, the current U.S. administration is now indicating a willingness to charter policies that go directly after China’s commercial semiconductor manufacturing capabilities. By targeting advanced computing and leading-edge node semiconductor manufacturing, high-end AI chips (or components to make them) can no longer be sold to any entity operating in China, whether that is the Chinese military, a Chinese tech company, or even a U.S. company operating in China. Not only can advanced chip sales not occur anymore, but sales are also banned for any piece of advanced equipment or software that can be used to design, fabricate, and test the chips. Also of significant importance, there are now restrictions on U.S. persons and their work in the Chinese chip industry. No expertise may be given by these persons to the Chinese semiconductor industry going forward if the subject items are covered by the restrictions.

By implementing this ‘strangle’ or ‘chokehold’ strategy to fulfill its goals, the U.S. is targeting four key areas where China carries a heavy technology debt. The four focus points of the U.S. strategy are as follows:

1) Block Chinese access to high-end chips: This stops the outright purchase of the sensitive semiconductors. There are two performance thresholds for the export controls related to speed and interconnect ability. The purpose here is to limit the restrictions to chips, intended to be networked together in the data centers or supercomputing facilities, that develop and run robust AI models.

2) Block Chinese access to the software designing the advanced chips: This covers the electronic design automation (EDA) software that is crucial to the development of these technologies. Without this core development software, designing an AI chip through an indigenous industry structure would be next to impossible.

3) Block Chinese access to the manufacturing equipment used to make advanced chips: This cuts access to the modern machinery used to make a leading-edge chip. By taking away access to the devices that develop, test, build and package the chips, things are made even more difficult for the Chinese. Much of this machinery requires too intensive support and service from the OEM manufacturers, working closely with the end users. Those support channels are now also closed with the regulations.

4) Block Chinese access to U.S.-built components used to manufacture their own semiconductor equipment: Lastly, U.S. built components cannot be used to recreate advanced machinery in China. It ensures that one of the U.S.’s strongest competitive advantages, the machinery expertise, stays where it originated.

The ramifications of these actions are immense. From reshoring advanced semiconductor manufacturing (via the CHIPS and Science Act) to potential asset write offs and changing the balance of power in Asia, the downstream effects will be manifold. All nations will be expected to comply or face loss of access to U.S. expertise and components themselves. However, this may encourage European and Asian players to develop their own components and equipment, ones that can be sold to China without restrictions. This creates the need for U.S. firms to stay on top of their technological advantages, with robust research and development expenditures for an extended period. A strong development environment will be needed to keep the lead U.S. firms currently enjoy.

The global semiconductor industry is highly complex. Hundreds of companies from different countries are required to collaborate to formulate the entire supply chain. The U.S., as well as China, are just pieces to the overall puzzle for semiconductor manufacturing. While countries like China currently specialize in packaging of chips, the U.S. leads the way in electronic design automation (EDA) and manufacturing equipment, which are considerably more important for fabricating advanced chips. Going forward, the new export controls will certainly put pressure on several cutting-edge U.S. companies. As an example, U.S. based KLA Corporation (KLAC), who controls close to 60% of the world’s market for metrology and inspection equipment and had 30% of their total sales in China last year, recently guided to a $750 million hit to revenue in 2023, or only 8.5% of total projected sales. While this government action will dampen growth opportunities for KLAC and other U.S. based semiconductor companies in the near term, our belief is that dominant industry positions will be maintained as supply chains are realigned for the subject items. Longer term these new regulations should thwart China’s ability to develop leading edge chips, protecting the U.S. national security interests and preserving U.S. chip companies’ vitally important intellectual property.

The GHP Investment Advisors Quarterly Global Markets Newsletter is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice and is not a recommendation offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past Performance is no guarantee of future results.