,

October 13, 2023

In recent years, the world has witnessed a remarkable surge in the adoption and integration of Artificial Intelligence (AI) across various industries. This AI-driven investment boom, bolstered by advancements in machine learning, data analytics, and computing power, is revolutionizing the way businesses operate, make decisions, and deliver value to shareholders and customers alike. However, the adoption of AI, while holding the potential for substantial productivity enhancements, also introduces societal challenges, including the anticipated worker displacement and the need to cultivate new skill sets. In this newsletter, we will explore the inner workings of AI, examine how businesses are harnessing this transformative technology, explore the possible repercussions on society, and delve into investment opportunities in the space.

AI is a broadly defined term and likewise is being applied to a wide array of applications across different industries, ranging from healthcare and finance to transportation and entertainment, with the goal of enhancing efficiency, accuracy, and automation in various tasks and processes. As the technology develops at a rapid pace, more and more firms are adding themselves to the roster of enterprises that are developing some form of it to be used in their operations.

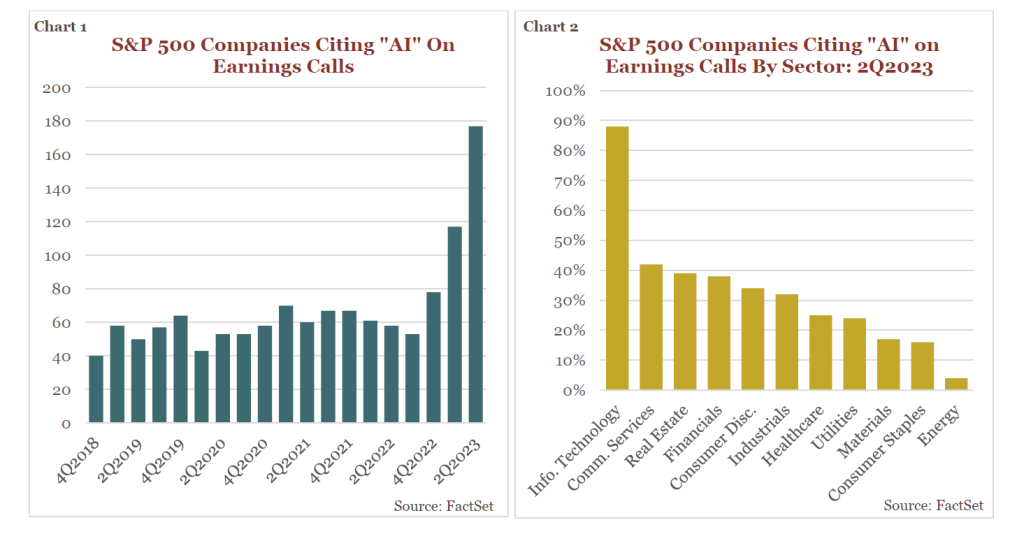

This paradigm-shift has evidenced itself on corporate earnings calls of late. When looking at S&P 500 companies, close to 180 firms of the 500 members in the index, referenced AI in some form on their latest calls (see Chart 1). Of the industries with the highest occurrence, close to 90% of S&P 500 technology firms mentioned investments in this innovative field (see Chart 2).

In essence, AI technology seeks to create machines and software that can mimic, to varying degrees, the cognitive abilities of humans, allowing them to perform tasks autonomously, make decisions, and improve their performance through learning from data and experiences. Below is a simplified overview of how AI works:

The current AI boom can be attributed to several key factors.

The current AI boom is reshaping industries and revolutionizing the way businesses operate, offering the promise of increased productivity and efficiency. For some industries already, embracing AI technology is no longer a choice, but a necessity for staying competitive in the modern business landscape. Here are examples of some of its most prominent uses in key industries today:

Healthcare – Medical Imaging

AI-powered medical imaging is revolutionizing diagnostics. Machine learning algorithms can analyze medical images such as X-rays, MRIs, and CT scans with remarkable accuracy. AI can detect subtle anomalies that might be missed by human radiologists, leading to earlier and more accurate diagnoses. This not only saves lives but also reduces the time and labor costs associated with diagnostic processes.

Finance – Fraud Detection

The finance industry has long been using AI for fraud detection, but its capabilities are continually improving. AI algorithms can analyze immense sets of transaction data in real-time, identifying unusual patterns and flagging potentially fraudulent activities. This not only potentially saves financial institutions billions of dollars, but also enhances the abilities of regulators alike.

Manufacturing – Quality Control

AI-powered computer vision systems are revolutionizing quality control in manufacturing in many industries, from semiconductors to automobiles. These systems can inspect products with precision, identifying defects or irregularities with accuracy rates that render human technicians somewhat obsolete. This ensures that only high-quality products reach the market, reducing waste and improving customer satisfaction, but also improving a firm’s efficiency and productivity.

Retail – Supply Chain Optimization

AI is enhancing supply chain management by providing real-time visibility into inventory levels, demand forecasting, and logistics optimization. Retailers can use AI to analyze historical sales data, current demand, and even external factors like weather forecasts to make accurate inventory decisions. This enables firms to streamline their supply chains, reduce excess inventory, and respond quickly to changing market conditions.

Agriculture – Precision Farming

AI is making agriculture more efficient through precision farming techniques. Drones equipped with AI algorithms can monitor crop health, detect diseases, and optimize irrigation. AI can identify pests and diseases in crops with high accuracy. Robotic systems equipped with AI are being used for tasks like planting, harvesting, and weeding. These enabled machines can work around the clock, reducing the need for manual labor and increasing productivity on farms.

Transportation – Autonomous Vehicles

The transportation industry is at the forefront of AI-driven innovation with autonomous vehicles. AI algorithms power self-driving cars, trucks, and drones. These vehicles can operate with high precision, reduce accidents caused by human error, and optimize fuel consumption. AI is also being used to optimize traffic management systems in smart cities.

Utilities – Energy Grid Optimization

AI is transforming the energy sector by optimizing the distribution of electricity. AI algorithms can predict weather and energy demand patterns, optimize energy production from renewable sources, and reduce energy wastage. AI is improving the energy efficiency of buildings and industrial processes at the same time. This results in a more reliable and sustainable energy grid for operators and customers.

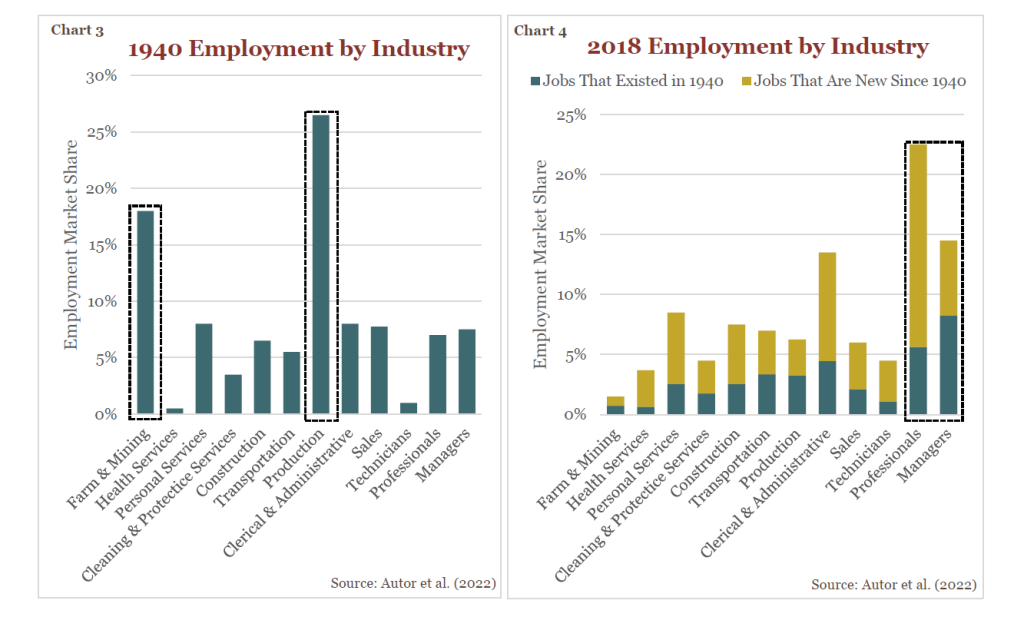

Notwithstanding the substantial potential benefits, the advent of AI introduces multifaceted challenges and considerations, with particular emphasis on the labor market. While AI is poised to displace workers in certain industries, historical precedent demonstrates that technological innovation leads to job creation. For example, a recent study by economist David Autor estimates that 60% of U.S. workers in 2018 were employed in occupations that did not exist in 1940. Notably, labor-intensive jobs like farming and production, which collectively accounted for nearly 40% of the workforce in 1940 (see Chart 3 below), have been replaced by newly created professional and managerial jobs (see Chart 4 below). Looking across the entire labor market, the study estimates that 85% of employment growth since 1940 can be explained by technologic advancements and the creation of new positions.

From an investor’s perspective, the progress in the field of AI holds the potential to yield substantial benefits for numerous companies and sectors in the coming years, however, it is important to remain disciplined regarding valuation and anticipated growth rates. For example, Nvidia (NVDA), who is the market leader in advanced GPUs and at the forefront of AI hardware, currently trades at 105x trailing twelve-month earnings and is expected to grow earnings at 38% per year through 2027. While NVDA may certainly live up to the hype, investors in this stock should be prepared to endure substantial declines in value should it fall short of these lofty expectations.

Fortunately, for investors that remain disciplined in their approach, there is a vast universe of reasonably valued companies that stand to benefit from advancements in AI. The amalgamation of substantial labor cost savings and higher output from non-displaced workers raises the possibility of a productivity boom for companies adopting the technology. While the ultimate impact of AI hinges upon its capabilities and adoption timeline, the economic potential of AI looms large, should it deliver on its promise.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal, or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. Individuals should seek advice from their own legal, tax, or investment counsel; the merits and suitability of any investment should be made by the investing individual. References to specific securities, asset classes, and financial markets are for illustrative purposes only. Actual holdings will vary for each client, and there is no guarantee that a particular account or portfolio will hold any or all of the securities listed. Past performance is no guarantee of future results. Investments carry risk and investors should be prepared to lose all or substantially all of their investment.