,

March 31, 2019

I recently attended the National Association of Business Economists (NABE) 35th Annual Economic Policy Conference in Washington, DC. The conference touched on thought-provoking topics, such as the current geopolitical outlook, immigration policies, global debt, trade talks, and many more. There was even an appearance by former Chair of the Federal Reserve, Alan Greenspan. It was an interesting gathering of the economic elite.

U.S. demographic challenges was a hot topic – the story has been conveyed for years that slowing population growth will lead to slow economic growth. While political and fiscal implications were discussed at length during the conference, this newsletter will focus on the economic impact by analyzing:

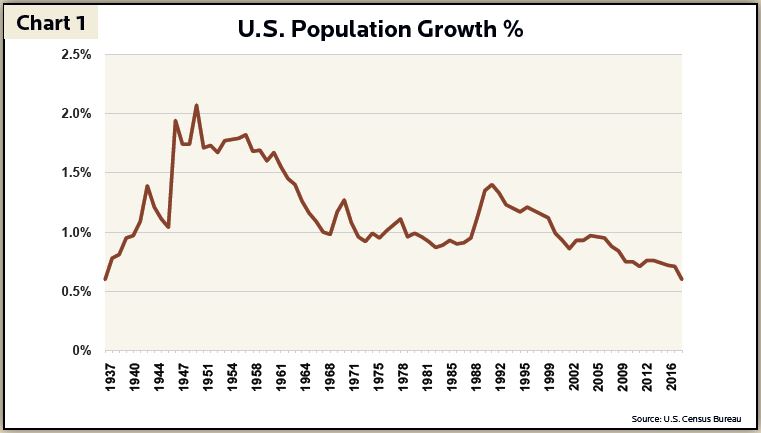

According to the Census Bureau, the U.S. population grew by a mere 0.60% over the past year. This was the lowest growth rate since 1937 during the Great Depression (Chart 1). However, decelerating population growth is not a new trend. The “baby boom” in the 1950s and early 1960s was relative to the subdued birth rates during the Great Depression. During those difficult economic times, couples struggled to start families, and immigration dropped. Following a postwar surge in the U.S. birth rate, population growth has mostly decelerated since 1950.

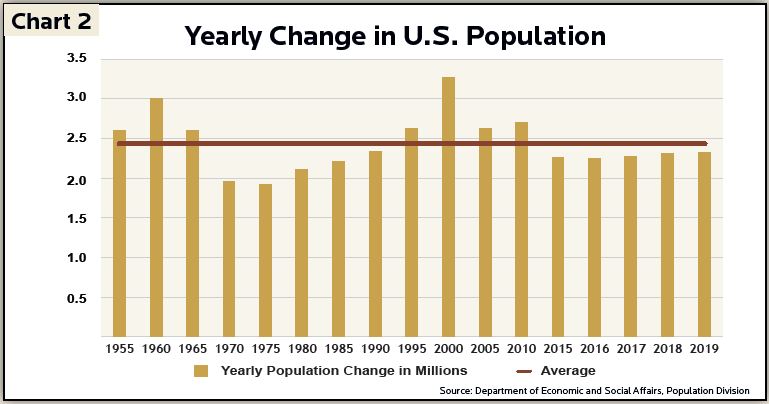

Many countries today are showing birthrates below replacement levels, which leads to an absolute decline in population. The U.S is far from this problem. Over the period referenced in Chart 2 below, the U.S added, on average, 2.4 million people per year since 1955. In 2018, the U.S. added 2.3 million people, up from 2.25 million in 2015. This is not far from the 2.6 million people added in 1955 and above the 1.95 million added in 1970. In other words, although the percentage rate of population growth declined, we are still adding roughly the same number of people each year.

The U.S. economy continues to grow, despite slowing population growth (Chart 3). During this period, real gross domestic product (GDP) per capita, a measure of a country’s economic output adjusted for inflation divided by its total population, continued to increase. Additionally, U.S productivity, a measure of how efficiently inputs such as labor and capital produce a given level of output, also continued to increase. Therefore, even though the population growth rate is decreasing, we are increasing investment and savings in physical capital, new technology and human capital.

The obvious way to counteract population decline is to have more babies, but that’s easier said than done. According to the U.S. Census Bureau, 34% of young people, or 24 million of those aged 18 to 34, lived under their parents’ roof in 2015. This is up from 26% in 2005. Astonishingly, more young adults lived with parents than with a spouse in 2016. Without another “baby boom” in sight to support the economy, the U.S. will need to rely on productivity.

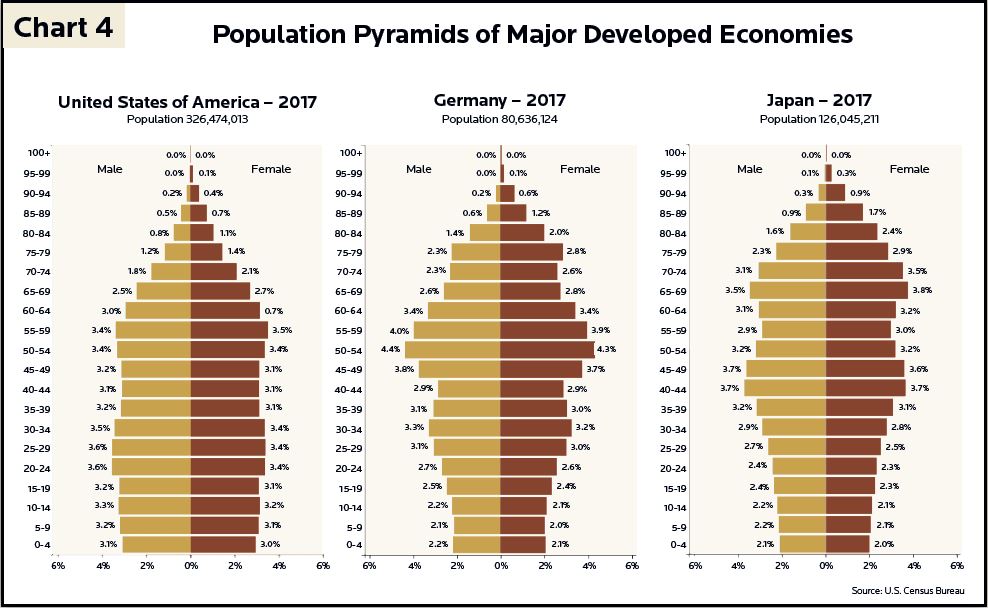

Even with decelerating population growth, U.S demographics look more manageable compared to other major economies. Chart 4 shows Japan and Germany have a much larger percentage of retirement aged citizens compared to the U.S. Their populations are now in decline, with Germany’s situation moderated by somewhat more liberal immigration policies relative to Japan’s very restrictive attitude toward immigrants. This could drag down economic potential, since fewer young people translates into a shrinking labor force.

Perhaps the Great Recession exacerbated the secular trend toward slowing population growth. The spike in young adults living with their parents should reverse as the job market continues to tighten and recapitalized banks extend more mortgage credit. Despite current political rhetoric, more immigration will likely be necessary to fill the void left by our aging population. Nonetheless, it is striking that the numerical growth of the U.S. population remained within a relatively tight range over the past 70 years.

From a purely economic perspective, our standard of living can continue its rise if we continue to invest in capital, technological innovation, and education. Our demographic fears, however, revolve around our ability to finance government liabilities, such as Social Security and Medicare. Absent these obligations, slowing population growth is not necessarily an economic problem. Maybe it is a cold comfort, but the economy can support rising living standards, even if our social insurance system must be reengineered to reflect changing demographic realities.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.