,

December 31, 2013

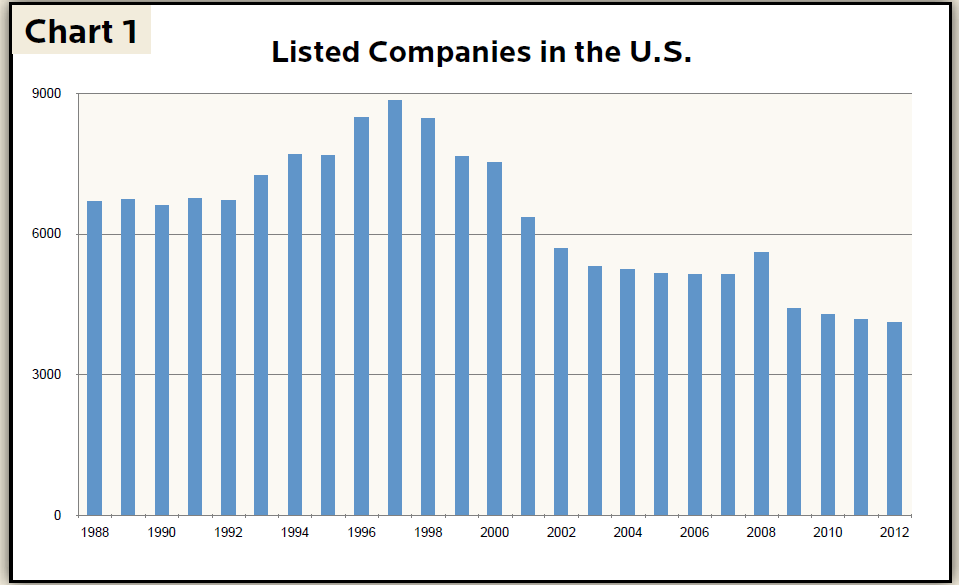

Although stock prices soared in 2013, other indicators of stock market vigor have barely begun to recover. Since the late 1990’s the number of companies listed on U.S. stock exchanges fell from almost 9,000 to slightly more than 4,000 today (Chart 1). According to an annual survey by Gallup, stock ownership declined from 65% of American adults to 52% currently and IPO activity has been weak ever since the technology bubble crashed in early 2000. Despite these negative trends, there are emerging signs that the stock market could once again become a vital engine of economic growth and long-term wealth creation.

During its long history the stock market experienced periods of disfavor, derided as a bastion of manipulation and irrationality, as well as periods of speculative euphoria. In between these, however, were longer periods in which the stock market fulfilled its basic function of steadily channeling investor savings into innovative companies and large scale business opportunities. Over time stocks spread the wealth of business ownership to millions of Americans.

The past 15 years of crashing bubbles, intensified regulation and depressed corporate valuations pushed thousands of companies out of the public equity markets and derailed the IPO desires of many private companies. We believe the tide is turning. Equity valuations now offer better incentives to go public and the government recently eased certain expensive regulations. As a result, in coming years the U.S. could regain leadership in the worldwide ownership revolution.

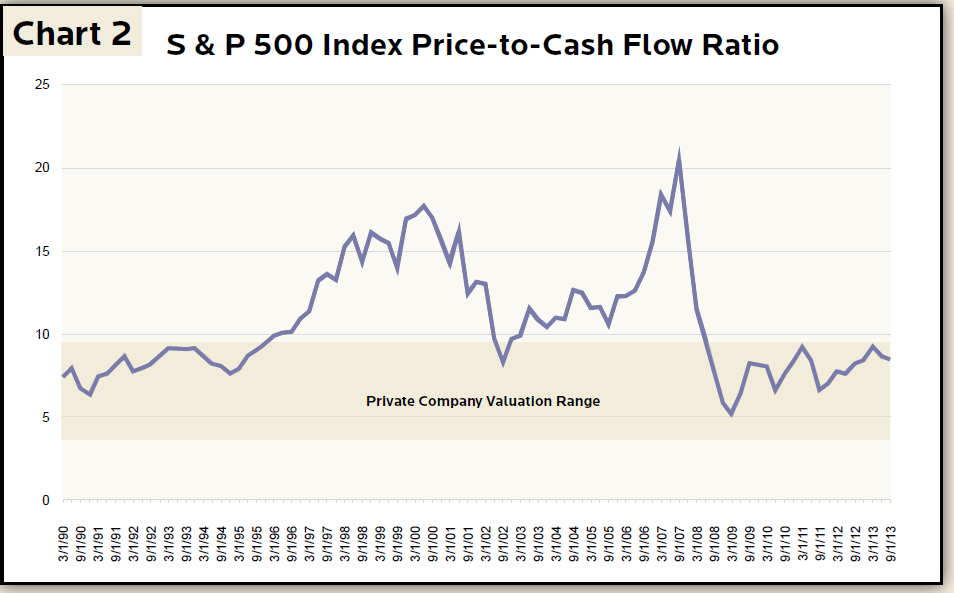

There is no mystery surrounding the decline of listed companies in the United States. Heightened regulation raised the cost of going public while falling stock prices depressed valuations. Both of these trends are now reversing. The JOBS Act, which was signed into law in 2012, loosened some of the more onerous listing requirements for companies with less than $1 billion in revenues. Meanwhile, as you can see in Chart 2 the valuation gap between public companies and private companies is once again expanding. These changes should result in a more favorable climate for IPO activity as the cost/benefit ratio continues to improve.

Public companies should sell for a higher valuation than private companies of similar size and risk. Public company stock is more liquid, i.e. it can be sold for cash quickly without significantly diminishing its value. Publicly traded stock can also be held in a more easily diversified portfolio. Regulation might be expensive, but it also gives public companies greater financial transparency and heightened protection for minority shareholders. In other words, publicly traded stock brings a number of advantages that investors’ value. Therefore, private companies have an incentive to go public when the gains in valuation exceed the costs of regulatory compliance.

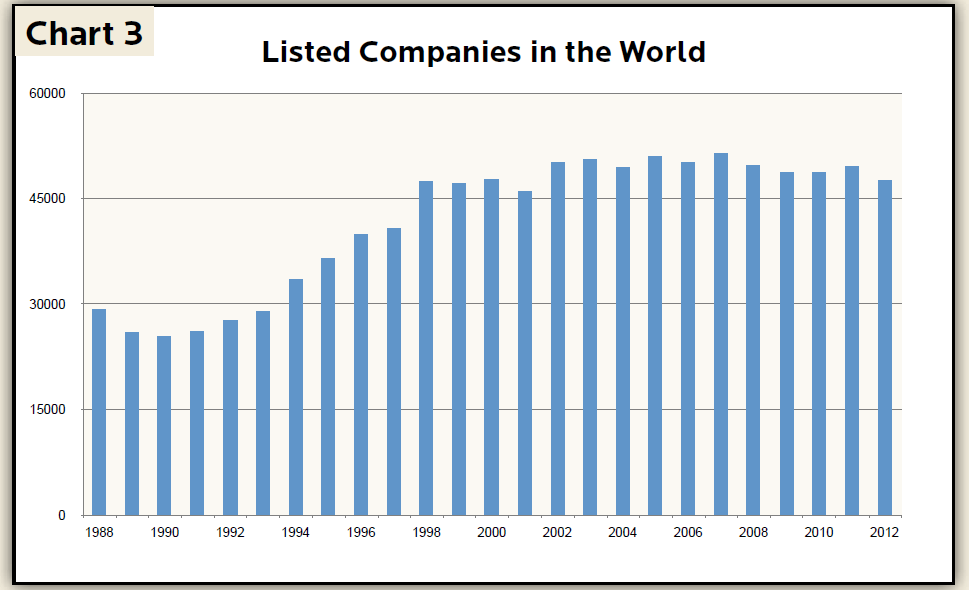

While the number of publicly traded companies declined in the United States, the opposite was true around the word. As you can see in Chart 3, the number of listed companies on world stock exchanges grew from about 25,000 in the early 1990’s to more than 47,000 today. Similarly, total world market capitalization increased from $9.4 trillion in 1990 to $60.3 trillion today. This astonishing increase in wealth is now spread among more than 500 million people vs. 100 million 20 years ago (precise data is unavailable so these numbers are based on academic studies and GHPIA estimates, but reflect direct stock ownership as well as indirect holdings through funds or pensions). If the next 20 years behave like the past two decades, the total value of the world’s stock markets could approach $250 trillion with 80,000 to 100,000 publicly traded companies and more than 2 billion investors. Of course, expanded investment options bring greater opportunity but also more complexity and risk.

The public markets in the U.S. receded in importance over the past 15 years, but we do not believe this is a permanent situation. The stock market is still the most efficient method for savers to gain the benefits of corporate ownership. Recent bubbles and market chaos brought stock ownership into question, but fears will once again fade as stocks continue to perform.

One reason we feel confident more companies will tap the stock market in the future is that there are many large private companies that could go public when the timing is right. According to the Census Bureau there are about 6 million companies in the U.S. with at least one employee. Of these there are approximately 18,000 companies with 500 employees or more (in addition there are 90,000 firms that employ between 100 and 500 people). Over the past decade the number of large firms in the U.S. increased by more than 1,000 even as the number of publicly traded companies shrank by half.

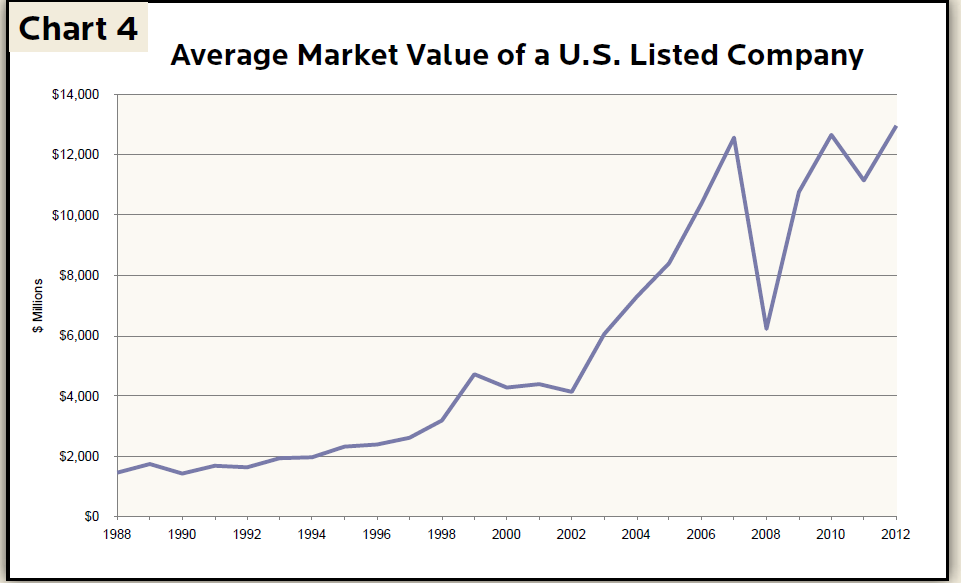

In the late 1990’s the ratio of public companies to all large companies in America was close to 50%, whereas today the ratio is perhaps 1/3. In our view, this is just one reason why the number of companies listed on U.S. markets could increase significantly in the coming decade. The average size of public companies is also increasing. Chart 4 highlights that the average market value of a U.S. listed company increased from $1.5 billion in the early 1990’s to more than $12 billion today. Access to capital allows big companies to get larger, another major incentive to go public.

Globalization is vastly increasing the scale of business. In order to access world markets companies need to raise large amounts of capital from millions of people. Countries that create environments conducive for companies to raise the necessary capital will continue to succeed. Despite recent market turmoil the United States remains the best home for capital investment in the world. Our advantages range from a reliable legal system to highly competitive markets. Countries shifting toward ownership capitalism will reap similar rewards, but only if they keep improving their legal and institutional framework.

Government pension systems are facing demographic and financial constraints, bank finance is shifting toward capital markets, and state owned capitalism (such as in China or Russia) will always fall short even if some companies succeed for a time. For all of these reasons, and more, stock markets are expanding around the world.

Share ownership spreads the wealth. Stock ownership allows small investors to gain access to large corporate opportunities otherwise reserved for small elite groups. However, manipulation, scandal and miscommunication remain problematic for investors, as they have been throughout the stock market’s history. More choices at home and abroad translate into greater complexity for investors. Events in unexpected places continue to ripple through global financial markets. As such, analysis and discipline is necessary even as we continue to bet on a bright future for global ownership capitalism.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.