,

September 15, 2023

Yield Curve Control (YCC) represents a prominent monetary policy instrument employed by central banks to regulate the yields of specific maturities of government bonds. This is achieved through a commitment to acquire any quantity of bonds at a predetermined target price. Nations employ YCC to stimulate economic growth, avert deflationary pressures, and guide market expectations concerning future interest rates. Notably, the Bank of Japan (BOJ) has been implementing YCC since 2016 as a part of its overarching strategy to achieve dual objectives: fostering economic growth and maintaining a stable 2% inflation rate. Recent adjustments made by the BOJ in its YCC framework have the potential to exert global influence.

Japan, the world’s third-largest economy, resorted to YCC measures following a prolonged period often referred to as the “Lost Decade,” which, in reality, extended over several decades.

The “Lost Decade” denotes a protracted phase of economic stagnation and subdued growth that ensued after the collapse of the Japanese asset price bubble in 1990. This bubble originated from a rapid surge in real estate and stock prices, driven by excessive speculation and easy credit. The bursting of this bubble led to a precipitous decline in asset prices, leaving financial institutions burdened with significant non-performing loans and the overall financial sector in disarray.

To address the prevailing economic malaise, the Japanese government and the BOJ implemented a suite of monetary policy adjustments, banking sector reforms, and fiscal stimulus measures bearing similarities to the policy responses witnessed in the United States during the global financial crisis and the COVID-19 pandemic. While Japan did experience a degree of economic revival in the mid-2000s, these policies yielded limited results as the nation continued to grapple with structural and demographic challenges that persistently hampered economic performance in subsequent years.

A confluence of factors, including the global financial crisis, an aging population, low birth rates, labor market rigidity, and substantial government debt have perpetuated Japan’s economic underperformance. Consequently, Japan has resorted to the implementation of YCC measures in its quest to rekindle economic growth.

Yield curve control measures serve several pivotal functions as a monetary tool:

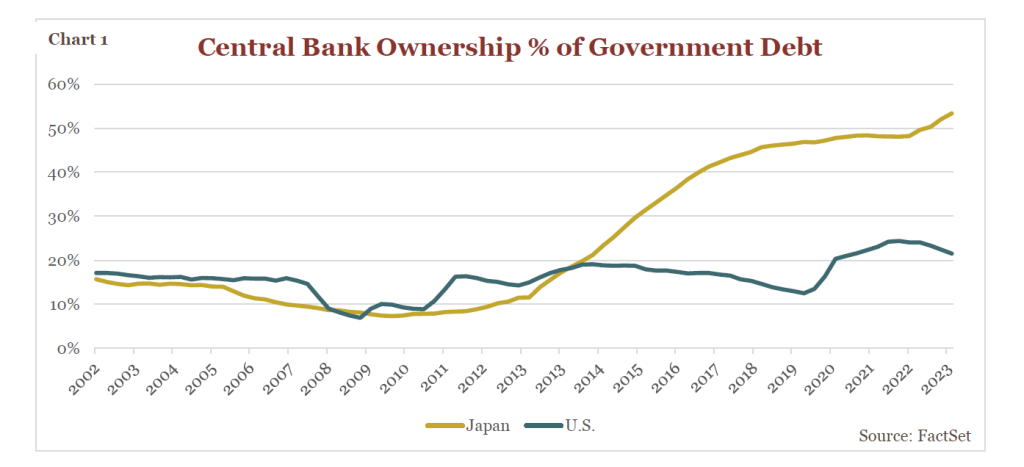

Initially, Japan initiated YCC measures with the objective of anchoring the yield on its 10-year Japanese government bond within a range of 0.0% to 0.25%. To attain this target, the BOJ has consistently engaged in extensive purchases of Japanese government bonds to sustain the 0% yield goal. Given the inverse relationship between bond prices and yields, the BOJ’s bond purchases led to rising bond prices and, consequently, declining yields. By purchasing sufficient quantities of bonds, the BOJ effectively determines the prevailing interest rates. This intervention significantly expanded the BOJ’s balance sheet to the extent they now own more than 50% of all Japanese government debt (see Chart 1). For the sake of comparison, the U.S. Federal Reserve, despite embarking on an extensive quantitative easing initiative during the pandemic, owns just 20% of all U.S. government debt.

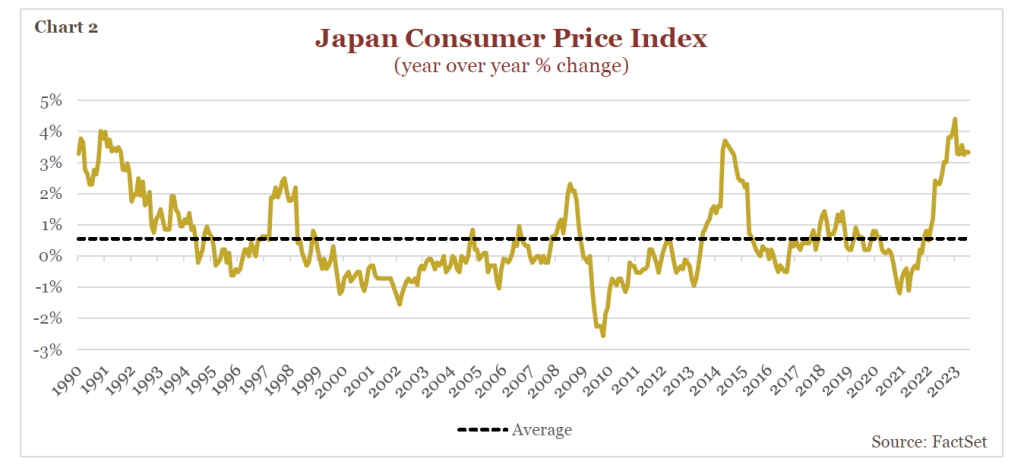

In December 2022 the BOJ shocked financial markets when it increased the yield target band for the 10-year Japanese government bond from 0.25% to 0.50%, then later pledging in July of 2023 to buy long-term bonds at up to 1%. While the increases may appear to be modest, they carry the potential for substantial repercussions in both global bond markets and the Japanese economy, especially if rates experience rapid escalation. BOJ Governor Kazuo Ueda’s statement that the bank is “willing to let yields rise more flexibly” signifies a departure from the previous steadfast commitment to maintaining 0% yields. This shift in approach is largely in response to mounting inflationary pressures within Japan, which, like numerous other economies worldwide, has grappled with its highest inflation levels in 24 years, currently standing at 3.3%, significantly exceeding historical norms over the past three decades (see Chart 2).

Japan’s prolonged period of near-zero interest rates prompted Japanese investors to seek higher yields abroad, resulting in the accumulation of nearly $3 trillion in foreign investments. This accumulation has positioned Japanese investors as the largest foreign holders of U.S. government debt, with holdings exceeding $1 trillion (see Chart 3).

The potential consequences of the BOJ permitting an increase in interest rates could end the purchase of foreign bonds by Japanese investors and cause selling and repatriation of funds back into the Japanese bond market. Such activities could elevate global bond yields and, subsequently, exert downward pressure on foreign bond prices. This development could impact the global equity market as well, as the escalation of bond yields increases the cost of capital for corporations, which, absent other alterations, reduces the present value of future cash flows for companies. Furthermore, an increase in Japanese bonds yields (or even the perception of an increase) will likely bolster the Japanese yen against foreign currencies.

While it remains premature to definitively assert whether the BOJ will wholly abandon YCC, the recent modifications underscore the bank’s willingness to tolerate higher yields in support of the Japanese economy. Nonetheless, the BOJ confronts a complex balancing act as it strives to bolster the Japanese economy while simultaneously addressing inflationary pressures. If pursued, the transition to higher interest rates in Japan is anticipated to unfold gradually, allowing global markets the opportunity to adapt and react carefully.

The yield on the U.S. 10-year Treasury bond currently hovers around 4.25%, in stark contrast to the Japanese 10-year yield which is still only at 0.71%, a discrepancy that will likely continue to favor U.S. treasury demand.

Global Markets is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal, or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. Individuals should seek advice from their own legal, tax, or investment counsel; the merits and suitability of any investment should be made by the investing individual. References to specific securities, asset classes, and financial markets are for illustrative purposes only. Actual holdings will vary for each client, and there is no guarantee that a particular account or portfolio will hold any or all of the securities listed. Past performance is no guarantee of future results. Investments carry risk and investors should be prepared to lose all or substantially all of their investment.