,

March 31, 2016

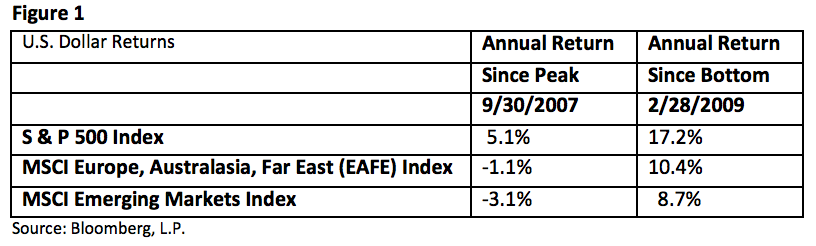

The financial crisis and Great Recession of 2008 – 2009 were global events. Unlike the American stock market, however, most international stock markets have not yet fully recovered to their pre-crisis levels. Figure 1 highlights the returns for three major global indexes from the peak of the prior business cycle in September 2007 as well as from the market bottom in March 2009.

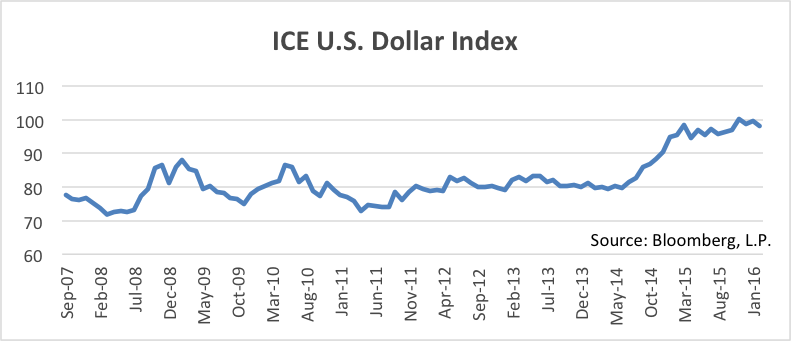

Part of the differential can be explained by the unexpected strength of the U.S. dollar during the recovery (Figure 2). A rising dollar hurts assets denominated in foreign currencies. Currency movements are notoriously unpredictable and people expected the dollar to weaken while the Federal Reserve was printing money with its Quantitative Easing policies in 2008 – 2013. Similarly, most currency analysts predicted the dollar would rise as the Fed boosted interest rates. So far in 2016, however, the U.S. dollar declined in value.

Figure 2

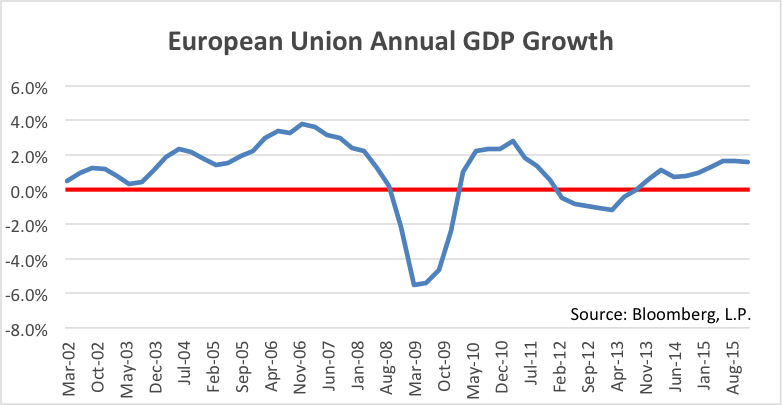

In addition, foreign markets – particularly in Europe – are plagued with continued fears of further banking and economic crises. Despite these fears, however, economic growth steadily improved since 2013 (Figure 3).

Figure 3

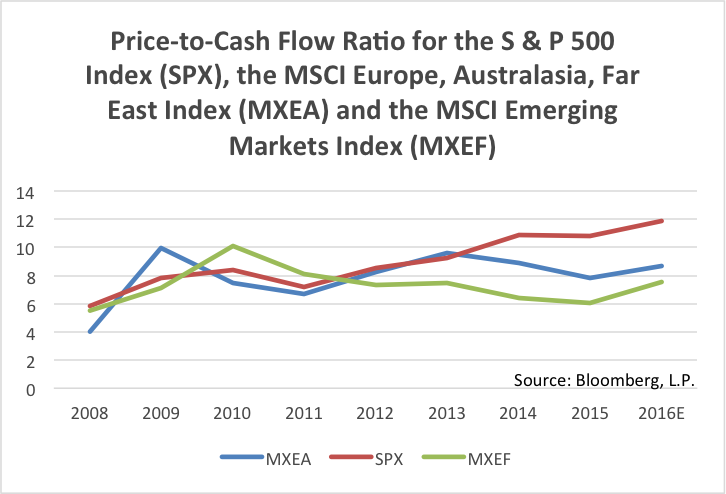

Ongoing worry about global events opened up a significant valuation differential among global markets. The MSCI Europe, Australasia, Far East (EAFE) Index is dominated by the developed, industrialized countries excluding the United States. As you can see in Figure 4, this index sells for a 27% discount to the U.S. at the present time based on Price-to-Cash Flow ratios. Other indicators such as Price-to-Earnings (P/E) or Price-to-Book Value (P/BV) tell a similar story. The MSCI Emerging Markets Index trades at an even steeper 36% discount to the S & P 500 Index. Some of these discounts are justified because of higher risk and potentially slower growth, but the valuation spreads in the past have not always been this great.

Figure 4

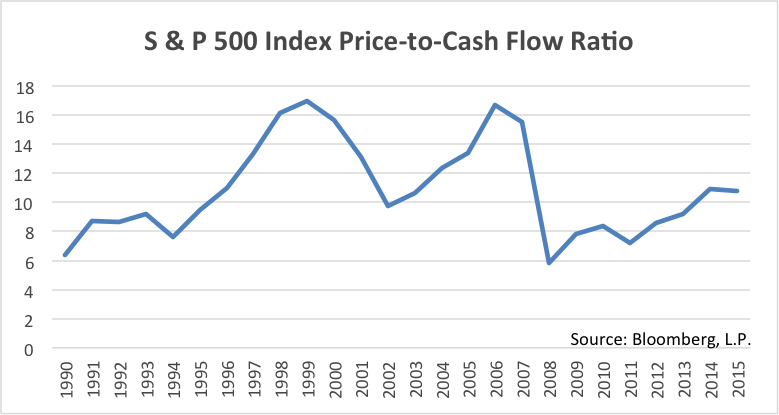

Global stock markets are cheaper than the United States, but the U.S. is also inexpensive. The S & P 500 Index P/CF ratio is higher than the 2009 low, but still well below the 2006 and 1999 peaks (Figure 5). At the peak of the technology bubble in early 2000 American large capitalization growth stocks (the asset class with the highest valuation at that time as well as the biggest subsequent crash – about -48%) sold for 29 times cash flow! Today large capitalization growth stocks are still the most highly valued asset class in the stock market, but the S & P 500 Growth Index sells for a much more reasonable P/CF of 14.9.

Figure 5

In our fourth quarter 2014 Global Markets newsletter we asked whether foreign diversification is still worthwhile1. Our conclusion is the same… The nature of diversification is that some parts of our portfolios do well while others might languish for a time. We prefer, of course, when everything works simultaneously, but diversification is necessary because financial markets are unpredictable. Many foreign markets are experiencing problems, just as the U.S. did over the past several years. We emphasize countries where we believe these problems are being addressed and deemphasize countries that refuse to adjust appropriately. In addition, our funds focus on companies that remain profitable with solid balance sheets and reasonable valuations. We continue to believe that is the recipe for long-term investment success, in the United States and around the world.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.