,

August 15, 2024

Portfolio concentration is when a portfolio has a significant portion of its total value allocated to a small number of investments. This can result in greater potential returns but also higher risk. You might be surprised to learn that most global stock indexes – including the S & P 500 Index – are highly concentrated.

Index funds are often praised for their ability to offer investors broad exposure to a large number of companies within a single, convenient vehicle. However, a closer examination reveals that many of these funds, despite being designed to represent a substantial portion of the market, are in fact highly concentrated in a few holdings.

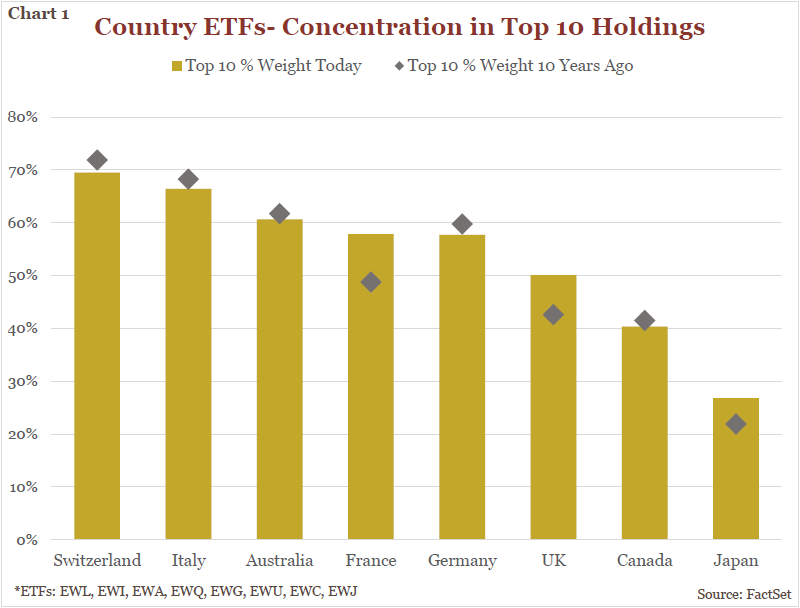

Take for instance G-7 and other advanced economy country specific MSCI exchange traded funds (ETFs). Except for Japan, all currently hold more than 40% of their assets in just 10 companies (see Chart 1). The Switzerland ETF, for example, holds nearly 70% of its assets in just 10 stocks, with 42% of the fund allocated to just three stocks. Italy is similar, with the top 10 stocks making up 66% of the fund and the top four stocks making up 39% of the fund.

The reason for such heavy concentration in these ETFs is that they are market capitalization-weighted (think of market capitalization as the size of a company in the stock market—the bigger the company, the bigger its slice of the pie). Foreign markets are generally characterized by a small number of large companies that operate in more mature industries, such as Financials, Industrials, and Consumer Products. As a result, a few large companies, often in key industries, dominate the market.

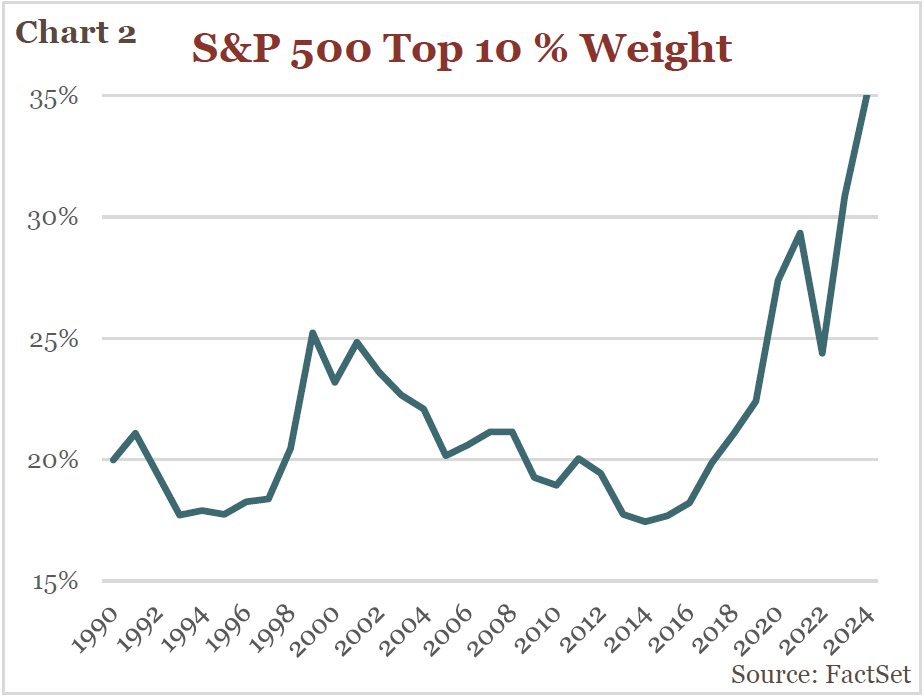

While concentration has long been a feature of foreign markets, it hasn’t always been at the front of investors’ minds when buying domestic funds here in the U.S. However, the recent AI boom has driven concentration in the S&P 500, also market cap weighted, to levels not seen in over five decades. Since 2019, the share of the top 10 companies as a percentage of the S&P 500 Index has grown from 19% to approximately 35% as of today (see Chart 2). Delving deeper, the top three companies now account for nearly 19%—the same weight that the top 10 had just five years ago.

As a result, the impact of the largest stocks on the overall market performance has greatly increased. This strategy of overweighting certain stocks can be beneficial during periods of market euphoria, like we’ve seen in recent months. Several mega-cap technology stocks, now known as the Magnificent Seven, have performed exceptionally well of late. However, in 2022, these stocks were down an average of 46%, leading to a painful overall loss for the S&P 500.

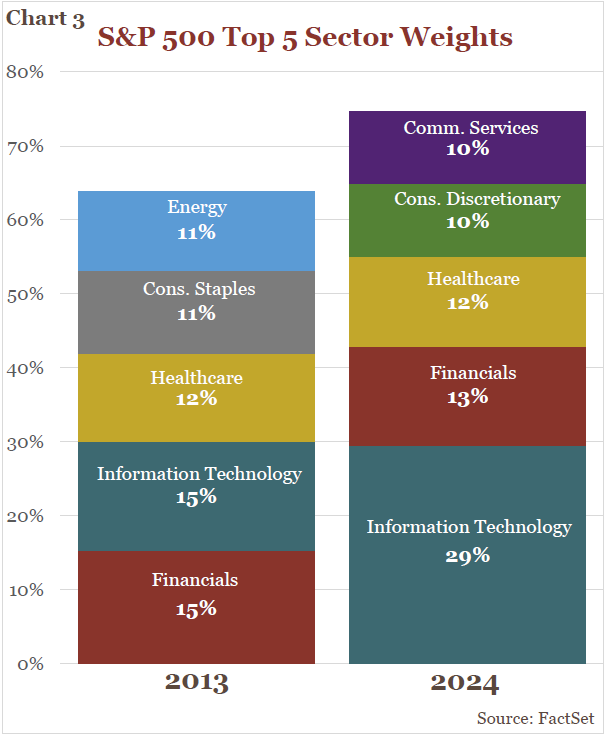

As large companies continue to dominate global equity markets, investors’ perception of sector (i.e. industry) diversification has also diminished. Among the foreign country-specific funds mentioned earlier, all eight have more than 75% of their holdings in just five sectors (out of 11 total sectors). In countries like Switzerland, Italy, and Canada, this figure exceeds 85%. Recently, the U.S. market has mirrored this trend, becoming more sector-concentrated like many foreign markets. Back in 2013, the top five sectors in the S&P 500 accounted for 64% of the index; this has since increased to 74% in 2024 (see Chart 3). Information Technology alone now constitutes nearly 30% of the S&P 500—double what it was just five years ago. The problem with high exposure to a single sector is that the assets within that sector tend to be highly correlated. This lack of diversification means that if the sector experiences a downturn, the entire portion of your portfolio concentrated in that sector could be negatively impacted.

Market concentration, especially in market capitalization-weighted funds, is more the norm than the exception. Both international and U.S. equity markets are increasingly dominated by a small number of large companies, resulting in heightened exposure to the performance of these few assets. While this concentration can deliver significant returns during market upswings, it also amplifies risk during downturns. Simply holding the S&P 500 or country-specific ETFs often leads to a level of concentration that exceeds what we at GHPIA consider suitable for our clients’ financial goals and risk management.

As highlighted above, international markets are well-known for their high concentration levels, which is why we thoughtfully construct our international portfolios to avoid excessive exposure to any single company. The broad-based international ETFs we select are strategically diversified across developed markets, spanning a variety of industries, sectors, company sizes, and investment styles. This approach ensures a more balanced exposure rather than focusing solely on the largest companies in each country.

We apply a similar strategy when investing in domestic stocks, whether through a carefully curated individual stock portfolio or a portfolio of funds. Ideally, we prevent any single stock from exceeding 3% of the overall portfolio, trimming positions that cross this threshold whenever possible. By categorizing investments into growth and value investment styles, across a multitude of sectors, and further distinguishing by company size (small, mid, and large capitalization), we aim to capture a broader spectrum of the market, which is essential for building truly diversified portfolios.