,

December 31, 2019

Now that I have your attention, did you know trades at the big online brokerage firms are now free? To chase greater market share, on October 1, 2019, Schwab announced it would cut commissions on trades for stocks and exchange-traded funds (ETFs) to zero. TD Ameritrade followed suit later the same day, as did E-Trade the following day. Fidelity’s holdout ended when it jumped on the zero-commission bandwagon in mid-October.

These big brokerage firms have finally adopted the free business model of many big online tech firms. The idea is to give away the product for free, attract new clients, and then find other revenue streams.

This reduction of trade commissions to zero has been in the works for more than four decades, beginning with a federal rule change that ended fixed-commission trading. Burdened by the weight of increased pricing pressure, brokerage firms reevaluated their business models. Consolidation in the industry has begun and will likely continue.

But what does this trend mean for individual investors? More specifically, what does this mean for clients of firms like GHP Investment Advisors that use the big brokerages for trade execution and asset custody?

This race to zero began when the U.S. Securities Acts Amendments of 1975 ended fixed trade commissions. May 1, 1975, known within the brokerage industry as May Day, changed the stock market forever. Prior to the act, all brokerages charged a fixed-rate commission for all trades with a component that varied based on the size of the trade. For example, per the New York Stock Exchange, in 1973 a purchase of $20,000 would result in a $22 trade fee + 0.9% of the amount traded, or a total of $202 ($22 + (.009*$20,000)). This cut into investors’ profits, as the total cost could run into the hundreds or thousands of dollars per trade. This fixed commission had an outsized impact on retail investors but favored large institutions that could take advantage of their economies of scale.

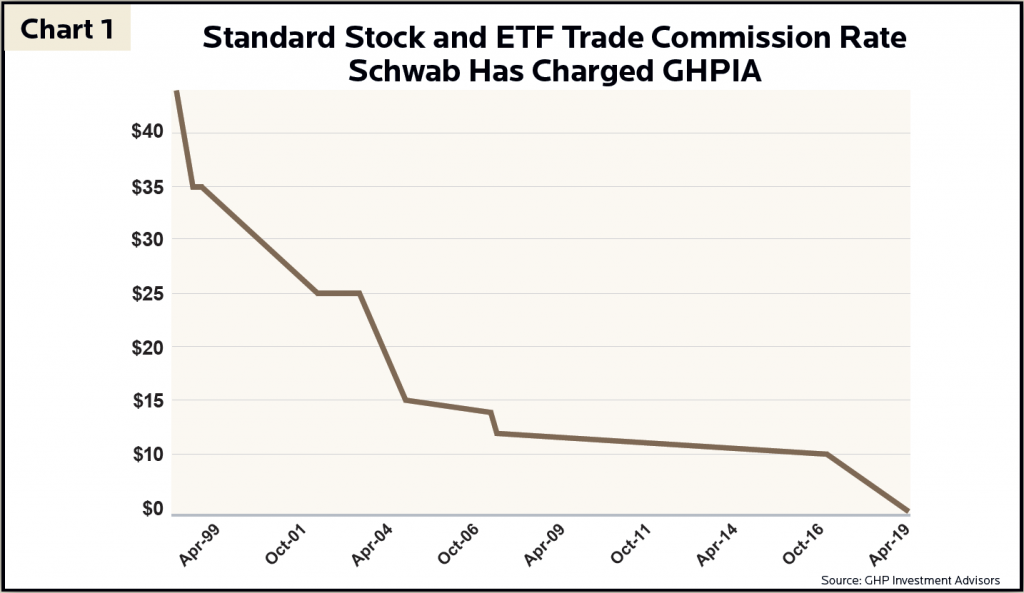

Some brokers used May Day as an opportunity to increase their fees based on an assumption the competition would do the same and use negotiable commissions to their advantage. But Charles Schwab, a newsletter writer who founded his namesake company in 1971, saw an opportunity to go in the opposite direction. The Charles Schwab Corporation began offering discounted stock trades on May 1, 1975, becoming one of the first discount brokerages. Schwab offered an affordable fee of $70 per trade, setting off fierce competition in the industry. From there, commissions kept falling, reaching $13 per trade in 2005 and getting as low as $4.95 per trade in 2019, before hitting rock bottom on October 1, 2019. Chart 1 reflects historical trade commissions on stocks and ETFs since GHP Investment Advisors’ inception. You can see how far and dramatically trade commissions fell in just the last two decades.

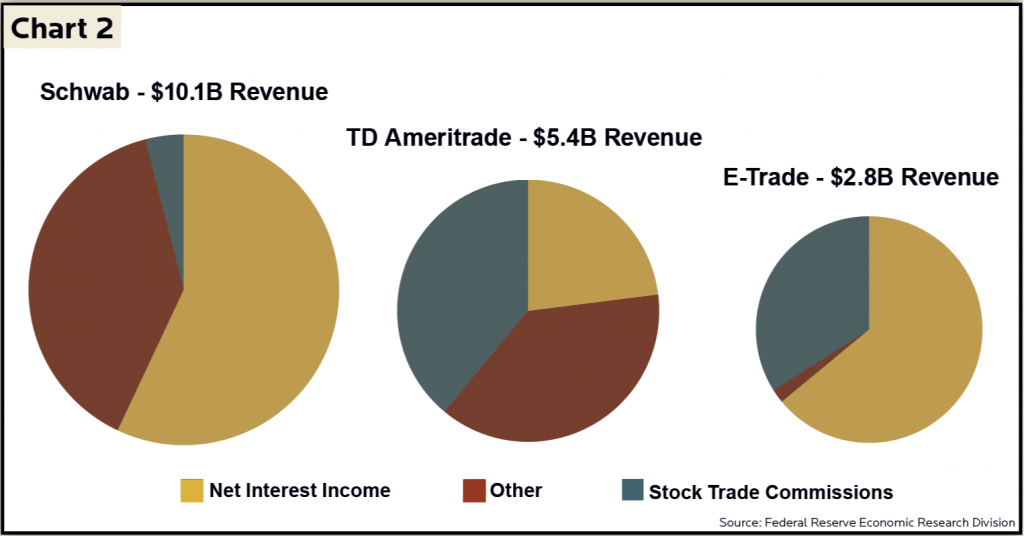

Schwab, based on its 2018 financial statements, stands to lose around $400 million in annual revenue from eliminating commissions. This reduction represents only about 4% of Schwab’s total revenue, which may not seem substantial, but TD Ameritrade and E-Trade are not so fortunate, with trade commissions making up 36% and 34% of 2018 revenues, respectively (see Chart 2).

Why is Schwab willing to give up trading fees and lose revenue? The answer is net interest margin, another key revenue source. Brokers move clients’ uninvested cash from their accounts to the brokers’ banks or banking affiliates and pay clients a modest interest rate on the funds. The brokers then lend that cash to new borrowers at a higher interest rate. The spread between the interest rate paid to clients and collected from new borrowers is net interest margin. For example, Schwab currently pays .06% on clients’ cash and collects a higher interest rate when it lends out those funds. As displayed in Chart 2, 57% of Schwab’s revenue comes from net interest income. That’s why Schwab can cut trade commissions without damaging the overall business. The low interest rates on cash are why we at GHPIA regularly monitor cash balances to convert to higher yielding money market funds.

Although TD Ameritrade and E-Trade are much smaller than Fidelity and Schwab, as well as much more dependent on trade commissions, they had no choice but to drop fees in order to compete. TD Ameritrade was already suffering from a price gap in which they were charging $6.95 per trade, $2.00 more than the other brokers. TD Ameritrade CEO Tim Hockey said that, although he wasn’t expecting commissions to fall as quickly as they did, it did remove the “cloud of the price differential.” E-Trade’s CFO, Michael Pizzi, did not favor the shift and felt that it was “value-eroding” and “irrational,” but like TD Ameritrade, E-Trade felt dropping fees to zero was the only way to stay competitive.

But instead of increased competition, this race to zero led to increased consolidation. On November 25, 2019, less than two months after TD Ameritrade joined Schwab in dropping commissions, Schwab announced it was buying TD Ameritrade.

Why would Schwab buy a brokerage business that effectively lost 36% of its revenue eight weeks earlier? Clients will now enjoy free trading in return for the firm’s access to their cash, which Schwab can lend out to earn net interest income. Schwab will continue to grow assets under management, currently at $3.25 trillion. By adding TD Ameritrade, it will reach $5.1 trillion. This should help make up for the lack of trade commission revenue.

The reduction in trading fees is a nice benefit to GHP Investment Advisors’ clients. Last year, GHPIA clients paid less than .025% in aggregate of assets under management in trade fee commissions on stock and exchange-traded fund (ETF) transactions, so the shift will save clients about $2.50 for every $10,000 in investments. While nothing will change about GHPIA’s strategy, this reduction in fees will compound in our client accounts’ values over time. We will continue to be a long-term buy-and-hold investment advisor, despite the lower trading costs.

As the brokerage industry moves toward a business model that monetizes volume of assets instead of trading activity, GHPIA will maintain a watchful eye, in order to ensure our clients continue to receive the best service from our custodial partners. For now, clients should appreciate the benefits the race to zero is bringing them, benefits that should make it easier for us to keep clients’ portfolios balanced and growing.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.