,

January 27, 2023

“If you can keep your head when all about you are losing theirs…..” Rudyard Kipling

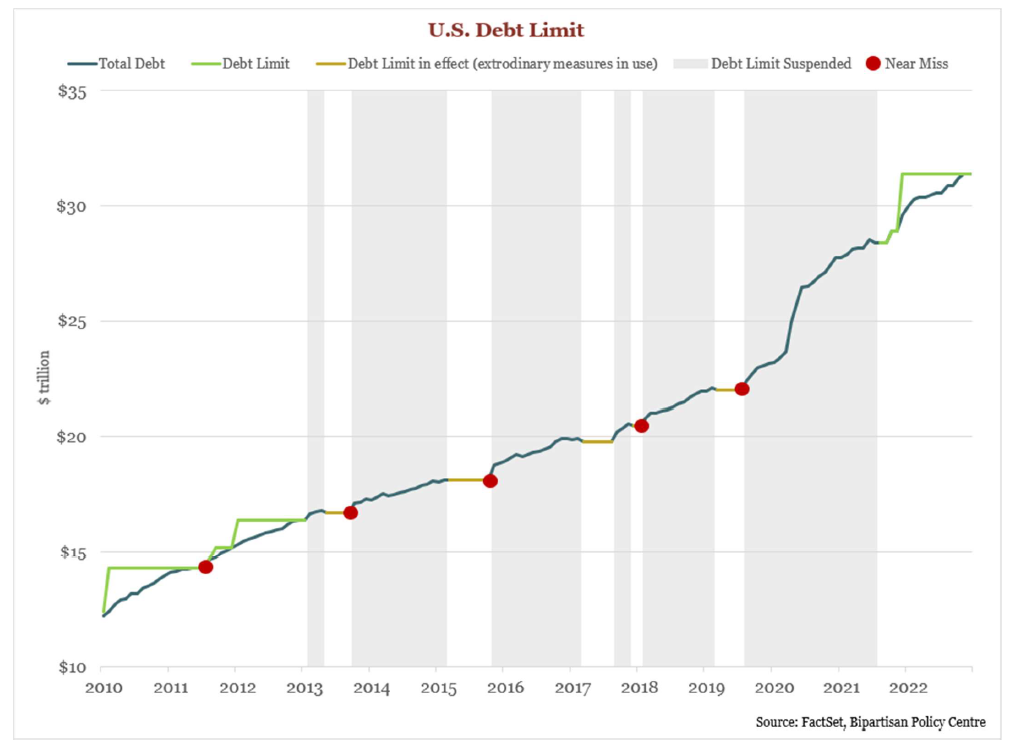

Last week U.S. gross federal debt (debt held by the public and traded on the open market and intragovernmental debt or debt that one government entity owes to another) breached the debt limit of $31.38 trillion, prompting the Treasury department to take extraordinary measures to keep the U.S. from defaulting on its obligations. These measures, or accounting maneuvers, include suspending investments for certain government accounts which will allow the Treasury to keep paying obligations until approximately early June. If Congress does not reach an agreement to increase the debt ceiling by that time, some facets of the government will shutdown and payments may default until a future agreement is reached.

Raising the debt ceiling does not allow the government to increase future borrowing or spending, rather it ensures the government can pay for spending it has already committed to legislatively. Generally a procedural formality, the debt ceiling has been raised 78 times in the last 62 years, mostly without contentious debate. However, as our Federal debt-to-GDP levels have risen to highs only previously surpassed around WWII, procedural ratcheting of the debt ceiling has become fraught with rancorous partisan debate and brinkmanship.

It is worth remembering this is not the first time the U.S. has been in this situation. We have discussed frequently during the years following the 2008 financial crisis how households, banks and corporations have significantly improved their debt ratios, yet, conversely, Federal government debt has ballooned from roughly $10 trillion to more than $31 trillion. As government debt has risen to untenable levels, this marks the seventh time in the last 12 years the U.S. has breached the debt ceiling and implemented emergency measures.

2011 was the most threatening of these many debt ceiling battles over the last few decades, wherein Congress reached a deal just days before the extended deadline. This troubling time in history did not come without repercussions as Standard and Poor’s downgraded the stellar U.S. credit rating for the first time ever and the equity markets saw their most volatile trading weeks since the financial crisis, dropping nearly 20% between late July and early August. By the end of 2011, however, markets had recovered and finished the year with slight gains, while the catastrophe of a U.S. debt default was averted.

Congress is heading for yet another debt ceiling showdown and we would not be surprised if we come perilously close to the June default deadline. While it is encouraging these Congressional debates are taking place before any bond market repricing or warning signs (i.e. UK’s 2022 bond market meltdown after Liz Truss’ tax reform proposal), it is it is quite possible this threat of government shutdown will temporarily roil the financial markets and cause significant volatility in the months ahead. However, we are confident fiscal calm will eventually be restored, as it has been so often in the past, and the unflinching long-term investor will be rewarded for riding out yet another storm.