,

March 31, 2020

It is hard to find words that can adequately describe the reaction to the COVID-19 global pandemic. “Shock” does not do it justice. Those of us who vividly remember the morning of September 11, 2001 were shocked to watch terrorists crashing airplanes into the World Trade Center. A more descriptive word might be “consternation,” which Dictionary.com defines as “a sudden, alarming amazement or dread that results in utter confusion; dismay.” In the panicked aftermath of 9/11, air travel ceased and the stock market closed for one week. The potential health, economic, and financial risk from this pandemic – and our response to it – is much larger.

Amid this time of uncertainty, the entire GHP Investment Advisors team extends its hand to our clients. Like all of you, Carin, Mike, I, and everyone at GHPIA are doing our best to make sense of this situation. We are trying to decipher the financial and economic implications of widely varied scenarios of health risks and government policy responses. The analysis we articulate in this letter and our other communications to our clients will necessarily shift as events reveal themselves. Nonetheless, we all need to grapple with very difficult questions.

At GHPIA, we believe it is our fiduciary duty to ask difficult questions and weigh trade-offs that others may not want to consider. We try to quantify scenarios that are only quantifiable in an economic sense, not in unquantifiable human terms. The ancient Jerusalem Talmud teaches us, “Whosoever destroys one soul, it is as though he had destroyed the entire world. And whosoever saves a life, it is as though he had saved the entire world.” So our society should certainly take dramatic actions to protect human lives from the COVID-19 threat.

Yet history teaches us that extreme economic distress can also destroy lives. Economic and financial anxiety contributes to a wide variety of health risks and constraints on our medical resources. There is also the risk of social and political unrest. The Great Depression of the 1930s triggered social upheaval and a world war that cost more than 60 million lives. The link between economic distress during the Great Depression and the events of World War II was so clear and so searing that every industrialized country fundamentally reshaped its economic, social welfare, financial, regulatory, political, and international diplomatic systems to prevent a recurrence.

If the pandemic is not contained very quickly, it will ultimately require conversations regarding health care risk relative to economic consequences that experts and policy makers are only now beginning to broach. Despite this reticence, we at GHP Investment Advisors, Inc. are openly discussing and quantifying these trade-off scenarios so we can understand the implications for your financial resources and your own lives.

Last year, the Gross Domestic Product (GDP) of the United States was $21.5 trillion. This is the value of the goods and services we exchanged in billions of transactions. Many of those transactions required face-to-face interactions among human beings. In one sense, we are lucky this pandemic afflicted us in the electronically interconnected, software-driven, 21st century. In an earlier era where face-to-face interaction was required for almost all transactions, social distancing policies would have caused even sharper reductions in economic activity.

If we divide $21.5 trillion of annual GDP by the 366 days in this leap year, we get average daily GDP approximating $60 billion. Of interest to us at GHPIA has been the government report that breaks GDP down by industry. We scrutinized this report to make our own estimate of economic impact, and we compared our assessment to similar analyses produced by other major financial institutions. Although it is difficult to know for sure, we believe daily GDP dropped by 30%, or $18 billion, since March 16th, when most states enacted closures for certain businesses such as restaurants.

How long until those daily GDP declines match the cumulative decline experienced during past economic crises? During the financial crisis of 2008 and 2009, GDP fell by a total of 4.3% and unemployment peaked around 10%. If current social distancing policies remain in place, the total drop in GDP will approach 4.3% in 51 days, or by mid- May. During the Great Depression, GDP declined 30% between 1929 and 1932 and unemployment exceeded 20%. It will take 358 days with the current social distancing policies in place to experience a similar decline in economic activity. Even the worst-case scenarios produced by the CDC, NIH, and WHO do not envision maximum social distancing for that length of time.

In the short run, unemployment rates are likely to spike drastically. Almost 16 million people work in the restaurant industry, and an estimated 30 million people work in industries facing closures or severe business restrictions including hospitality, tourism, retail trade, and transportation. If all these people lose their jobs, the unemployment rate will approach 25%. Most likely, recently enacted government financial support of idled businesses, as well as a variety of risk-sharing arrangements between employers and employees, landlords and tenants, and lenders and borrowers, will mitigate some of the temporary job losses. Nonetheless, the rise in measured unemployment will be steep, though cushioned somewhat by the significant increase in federal government unemployment insurance benefits.

This recession will follow a very different playbook from typical economic downturns. In a typical downturn, the business cycle follows a pattern whereby excessive credit allows households to consume well above their means while simultaneously allowing companies to invest in excess capacity. The resulting recession is, therefore, a reckoning where debt-fueled demand contracts as lenders pull back. With falling demand, companies cannot easily service the debt they incurred to expand capacity during the boom. Bankruptcies rise and financial institutions fail. The 2008- 09 financial crisis followed this typical pattern, except that the debt-fueled boom and bust were much larger than normal.

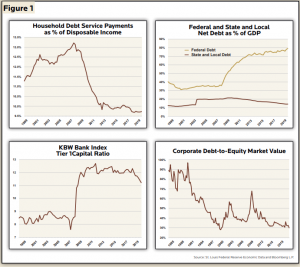

Partly due to regulations enacted after the financial crisis, we enter this period of economic contraction in good financial shape. (See Figure 1.) Banks and financial institutions are well-capitalized. Households have far less debt than before the financial crisis, as do corporations. State and local government finances are mostly recovered. Although the federal government has significantly more debt now than before 2008, the U.S. has immense borrowing capacity, and interest rates are very low.

Despite the dramatic reductions in GDP and alarming spikes in unemployment, our financial and economic capacity will most likely remain intact if the period of social distancing remains reasonably short.

Of course, there is no guarantee that we will not have to impose social distancing again later if the virus resurfaces, as some public health officials warn. While the economy can withstand even a brutal three months or so of halted activity, the results will be more problematic if the shutdown lasts much longer or recurs and hammers an already weakened system.

At that point – and unfortunately, well before that point – Americans will need to consider the trade-offs of our current curtailment policy. We will have to ask tough questions about whether wrecking the economy to save lives may not ultimately cost more lives than it saves. Will we have to restart the economy and risk exposing more people to the virus in order to prevent loss of life from financial devastation and the social and political chaos that might follow? How do we even begin to make those kinds of decisions?

As Americans, we are not used to scenarios with nothing but unfavorable options. In such situations, we often find it hard to be objective, especially when all the alternatives confront us with risks that could affect us personally or those we love. Traditional American ingenuity and innovation may yet save the day with coronavirus tests, vaccines, and treatments, but they might take some time to develop. We may take comfort in the knowledge that the economy entered this crisis from a position of strength and will be restored to health as the pandemic recedes.

Here at GHPIA, where we have our own tough choices to make on behalf of our clients, we try to make them objectively, based on facts, not fears. Now is the time to maintain our reasoned approach. We still believe, based on history and experience, that the investment benchmarks and guidelines that served us well through the other two major financial calamities of the past 20 years will continue to do so today and tomorrow.

We are in this together for the long run, and we remain committed to acting in the best interests of our clients. We wish you all good health and happiness now and during the stressful months ahead.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.