,

June 30, 2015

Judging by the rising costs of college over the last forty years it appears Americans agree with Plato. Since the 1970’s, college tuition expenses increased over 1,200% or approximately 7.3% per year. In comparison, the consumer price index (CPI) increased 3.7%, and even inflation for medical expenses rose by only 5.6% per year. As tuition costs mounted, student loan levels likewise skyrocketed. In the last 15 years, total student loans outstanding grew exponentially from less than $200 billion to over $1.2 trillion, of which roughly 90% were Federal government loans. As a result of these trends, there is a growing public discourse questioning the value of a college degree at these loftier price levels coupled with the escalating risks borne by indebted students pursuing higher education.

Concurrent with increasing tuition costs, student enrollment at traditional 4-year universities more than doubled over the past 40 years. Including demand at 2-year and for-profit colleges, overall enrollment now eclipses 40% of the 18-24 year old demographic, which is one of the highest enrollment rates in the world. This rising demand was spurred by three primary factors:

As Americans embark further into the Information Age, a bachelor’s degree is proving more essential to launch young employees into higher earnings potential throughout their careers. Those who fail to invest in a college degree are falling behind as our economy shifts towards more information technology and service based professions.

To answer the question “is college still a worthwhile investment?” we created a model to quantify the value, which is similar to the financial planning models we build for our wealth management clients. We used the following assumptions:

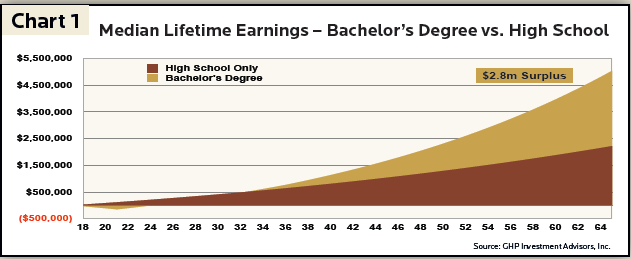

Considering our assumed student loan liability of $150,000 along with $115,000 in opportunity costs from delayed entry into the workforce, one can enjoy a 14% lifetime rate of return on attending college for four years (Chart 1). This rate of return exceeds growth expectations for lower risk investments such as bonds and real estate and even for typically higher risk investments such as stocks.

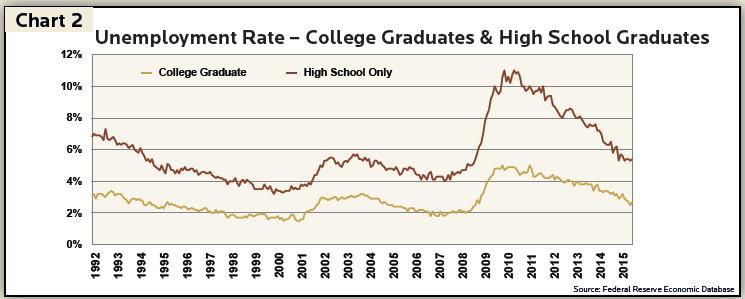

Beyond the upside return potential offered via the earnings premium, there is likewise downside risk protection garnered by college graduates. Chart 2 illustrates the greater job security college educated workers experience. During the last recession unemployment rates for individuals lacking a college education spiked to more than 10%, while their college educated counterparts had unemployment rates closer to 5%. During times of expansion and boom, the disparity between the two is only around 2%, but the Great Recession disproportionately penalized workers with less education.

Since 2010 outstanding student loan debt represented the 2nd largest form of consumer debt in America, surpassing both credit card debt and auto loan debt. Although total student debt levels now exceed $1 trillion, household mortgage debt remains significantly larger at well over $9.3 trillion. Undoubtedly these swelling student debt levels, carried during a difficult employment market for young graduates, present new risk factors which ripple throughout our entire economy. These borrowers will likely delay investing for retirement, starting families and buying a first home. Likewise, as over 90% of the total student loan debt has been extended by the Federal government, this debt may also present a risk for U.S. taxpayers. Nevertheless, more thorough analysis of the distribution of student loan debt offers some softening to these potential risks.

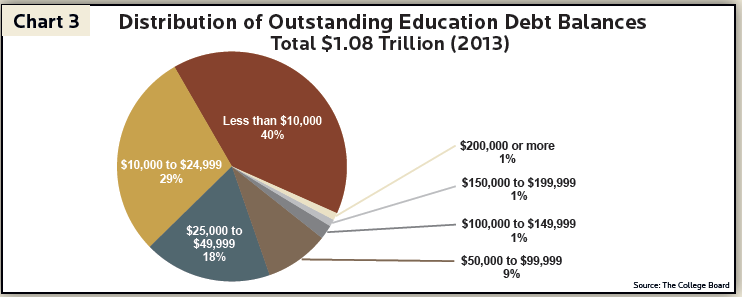

Over 40 million Americans or about 12% of our population is saddled with some form of student loan debt. About 28 million or 70% of those student borrowers have total debt levels of $25,000 or less – roughly the equivalent of what it costs to buy a standard American car (Chart 3).

Only 4% of those with student loans, or approximately 1.6 million borrowers (less than 1% of the total U.S. population), have debt burdens exceeding $100,000. Further, as the labor market improves, recent 3-year default rates have started to decline. According to the U.S. Department of Education, the 2014 default rate dropped to 13.7% from 14.7%, and this figure is less than 8% when excluding embattled for-profit colleges. In comparison, subprime mortgage default rates peaked at 17% in 2009.

Although current student loan levels do not foreshadow a future crisis near the magnitude of the recent subprime mortgage crisis, it is difficult to ignore the correlated trends of the last 15 years – expansion of Federal government lending to students and escalation of college tuition costs. As we head into an election year, the political dialogue is beginning to percolate with numerous proposals to either rein in Federal lending levels or shift a larger percentage of student debt to the private sector. Further, there have been a few interesting ideas to tie loan repayment schedules to actual earnings of the recent graduate as well as index loan interest rates to the future earnings potential and job placement metrics for a declared college degree or field of study.

Will College Prices Continue to Grow by 7.3% per Year?

Just like your Economics 101 professor lectured, when demand rises and supply is held relatively tight, prices ultimately go up. Universities over the last 40 years enjoyed a doubling of enrollment demand and the exponential expansion of student loan credit. These trends accelerated in recent times as the Baby Boom Echo generation matriculated, and as the earnings premium for college graduates continued to increase appreciably. Further, elite private universities with global brands maintained limited admittance (or supply) for prospective students. For example, in 2013 Stanford and Harvard accepted 5.7% and 5.8% of their applicants respectively. This allowed these elite universities to maintain pricing power, which consequently influences pricing at colleges throughout the country.

With our market economy, however, supply often catches up to rising demand, effectively curtailing prices. The recent emergence of for-profit universities and online college platforms represent a potential increase in higher-education supply, despite initial steps fraught with challenges to establish legitimacy. Nevertheless, it is likely these alternative higher-education options will take root and eventually could offer less expensive routes to a degree for price conscious students.

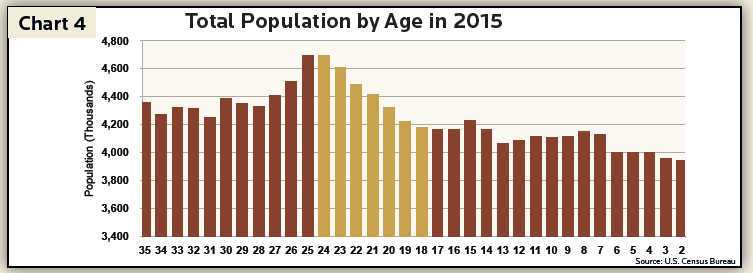

Moreover, analysis of current U.S. birth rates demonstrates slower college-aged population growth (Chart 4) for the next two decades. Although colleges want to replace declines in domestic enrollment with more international students, the U.S. government limits the number of annual student visas granted. Our analysis projects the Federal government will not grant enough visas to replace the diminished demand by U.S. students. Enrollment over the last three years at 4-year universities has declined roughly 3% per year, highlighting a potential secular change in demand.

On the student loan front, for the first time in over 20 years, annual Federal lending levels started to decline. We are now beginning to see regulation to deny or reduce loan dollars extended to students attending universities with poor graduation rates or job placement trends. Proposals are likewise mounting to limit student loan credit and financial aid only to universities that cap tuition increases.

Considering all of these parallel developments, we find it unlikely aggregate college tuition expenses will continue to increase over 7% per year for the next 40 years. While tuition costs at elite private schools may continue to rise, we believe overall college tuition increases will grow slower than the last 40 years. In other words, tuition will keep rising but at a slower rate, and some colleges may even be forced to lower tuition as a more competitive landscape for student enrollment arises.

Ultimately we do not see a crisis in the making for future college costs and student loan levels. We do see a growing importance for families to save for these expenses and to continue pursuing higher education.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.