,

September 30, 2016

(For Part I, See our 2013:Q3 Newsletter at www.ghpia.com)

In the early stages of the financial crisis the Federal Reserve reacted slowly. The first signs of distress in mortgage bonds appeared in July 2007, but the Fed only cut interest rates from 5.25% to 4.75% in September of that year. The Fed gradually recognized the growing magnitude of the problem, but its interest rate policy was consistently behind the curve. By January 2008 they lowered interest rates to only 3.75%. Even after Lehman Brothers collapsed in September 2008 the Fed cut interest rates by just 0.50%. Recognizing an emergency situation, they reduced rates again three weeks later to 1.0%. The Fed finally pushed short-term interest rates to zero in December 2008 just as the panic was nearing its climax.

As the crisis abated it became clear the economic damage was vast with nearly 16 million people unemployed, millions of homes lost in foreclosure, and financial markets in tatters. Nine years since the financial crisis first began and seven years since reaching bottom in 2009, we are still living with the legacy of this traumatic episode. The economic hole was so deep we spent most of the past seven years refilling it.

Despite a slow start early in the financial crisis, the Federal Reserve eventually switched to a more aggressive stance. In addition to its zero interest rate policy (ZIRP), the Fed implemented several rounds of “Quantitative Easing (QE)” to stimulate economic recovery. Through large purchases of mortgage and Treasury Bonds, the Fed pushed the yield on 10-year Treasury Bonds to well below 2.0% in 2012. By late 2013 median household income was once again trending upward and employment steadily growing. In December 2013 the Federal Reserve started to “taper” their bond purchases, slowly reducing them each month until finally ending QE in October 2014.

As QE ended the reduced monetary stimulus pushed the U.S. dollar higher, which resulted in multiple simultaneous effects. First, the Chinese currency (yuan) was linked to the dollar. As both currencies strengthened, Chinese exports and economic growth slowed. Second, commodity prices plummeted due to reduced Chinese demand and because many commodities are transacted in dollars on world markets. For example, oil prices fell nearly 60% between June 2014 and January 2015 from $107 per barrel to $45. Third, interest rates in the United States declined. This last development surprised the Federal Reserve as well as most analysts. They did not anticipate the instability in global commodity and currency markets and the subsequent flood of foreign capital into U.S. Treasury Bonds.

Upon terminating QE in October 2014 the Federal Reserve shifted attention toward ending ZIRP. Once again speculation regarding the coming interest rate increase pushed commodity prices lower, the dollar higher and Treasury Bond interest rates yet lower. The impact on emerging market countries was dramatic – particularly those that export natural resources. From October 2014 through early 2016 the dollar appreciated 75% against the Brazilian Real, 107% relative to the Russian Ruble, 55% against the South African Rand, 44% vs. the Mexican Peso, 27% vs. the Chilean Peso and 22% relative to the Peruvian Sol…just to name a few.

The Fed finally hiked interest rates by 0.25% in December 2015. Similar to the QE taper, tighter monetary policy was transmitted through global commodity and currency markets rather than U.S. interest rates. Yields on the 10-year Treasury Bond touched 1.5% while Europe and Japan experimented with negative interest rates. Although the method was not traditional nor the result expected, the seemingly small shift in Fed monetary policy between the QE taper in December 2013 and the end of ZIRP in December 2015 was, in fact, quite deflationary. Inflation as measured by the Consumer Price Index (CPI) fell to a mere 0.1% for 2015 (the Fed’s stated inflation target is 2.0%). Inflation is now accelerating as the global effects recede, but the CPI averaged just 1.0% so far in 2016.

The preceding discussion outlined our nine-year journey from 5.25% interest rates to 0%. Along the way we experienced “The Great Recession.” The recovery began seven years ago, but the economy only left the Intensive Care Unit (ICU) three years ago with the Fed’s QE taper. Even now we are only slowly disconnecting our economic life support systems. The U.S. is probably healthy enough to survive in a higher interest rate environment, but the global economy is not. Since we live in a globally interconnected economic system the Fed will continue to remove the monetary breathing and feeding tubes gingerly.

Analysts and financial gurus regularly appear on television to declare an imminent recession or market collapse. We believe they are looking through the rear view mirror. Inflation-adjusted Gross Domestic Product (GDP) in the United States is only 9.9% higher than its prior peak in December 2007. Economic expansions are typically much larger than this. The peak-to-peak economic expansion from 2000 through 2007 was

17.3%, the two business cycles from 1990 through 2000 and 1981 through 1990 resulted in 40% and 35% GDP increases respectively. Median household incomes experienced similar gains in each of these cycles. At present, median household income remains 6.5% below its 2007 peak.

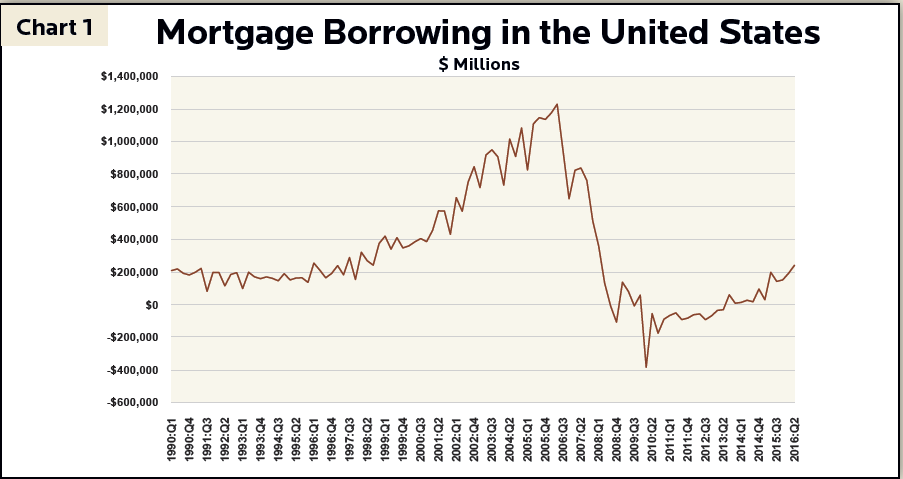

Other signs of economic froth are also not present at this time. Mortgage borrowing declined until 2013 and is 90% lower than the pre-financial crisis highs and only now approaching early 1990’s levels (see chart 1).

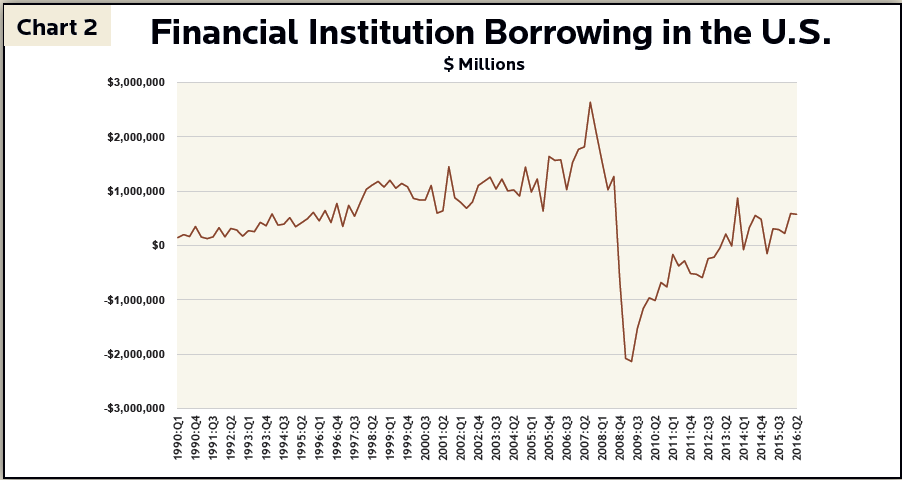

Similarly, borrowing by financial institutions in 2015 was 92% lower than the 2007 peak and 69% lower than the average for the 1990’s (see Chart 2).

Banks and other financial institutions are well capitalized, corporate balance sheets flush with cash and household debt back down to manageable levels. While the accumulation of federal government liabilities remains troubling, state and local governments are in much better financial shape compared to several years ago.

Banks and other financial institutions are well capitalized, corporate balance sheets flush with cash and household debt back down to manageable levels. While the accumulation of federal government liabilities remains troubling, state and local governments are in much better financial shape compared to several years ago.

Interest rates are low because of Federal Reserve policies, but they are also low because the demand for capital is weak. Borrowing is already picking up as the economy heals, but there is a long way to go in this credit cycle. Even though long-term interest rates continued to decline after the Fed ended QE, monetary policy already tightened. As the global impacts of this tightening diminish in the coming quarters and years, interest rates should rise.

We are in somewhat unprecedented territory as the business cycle returns to a more normal economic environment, but we can look to similar periods in history for some guidance. The last time inflation and interest rates were consistently low was in the 1950’s and early 1960’s. At that time inflation averaged 1.3%, the Fed Funds rate averaged 2.75% and the yield on the 10-year Treasury Bond averaged 3.6%. While we cannot predict the future, we believe these historical numbers provide useful benchmarks as interest rates rise. The economy fell into a deep hole during the “Great Recession” and we are barely back to the rim seven years later. If history is any guide, we will build a large mound on top of this refilled hole before the next recession.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.