,

December 31, 2016

Over 2,500 years ago, Aesop’s fable “The Tortoise and the Hare” delivered this simple moral espousing the benefits of steady perseverance. Over the last 90 days, numerous examples taken from the financial markets lend further credence to the timeless indelibility of this story’s powerful message. The following summarizes two specific episodes from the 4th quarter of 2016 demonstrating the hare-like perils of hare-brained investment strategies. Likewise, a third example highlights where substantial rewards have recently been amassed from a formerly slumbering sector of the stock market.

“While there is nothing more fun than leverage on the way up, there is nothing more deadly than leverage on the way down.” – Warren Buffett

In May of this year, the Wall Street Journal published an article titled “The New Oil Trader: Moms and Millennials”. The piece highlighted the large, short-term profits earned by everyday investors buying a rather exotic product called an exchange-traded note, or ETN, tracking crude oil prices. The ETN referenced was VelocityShares 3X Long Crude Oil, symbol UWTI, issued by Credit Suisse Bank. The strategy behind UWTI uses derivatives to leverage the daily price swings for crude oil by up to 3 times. In other words, if oil prices rise 2% for your investment period, then UWTI should return 6% to your bottom line. Or in reverse, a 2% decline in oil prices would create a 6% loss for the investor.

Like moths to a flame, the allure of tripling investor returns overnight made UWTI one of the most popular exchange-traded products this year, when measured by total daily volume of shares trading hands. However, we deem ETN products like UWTI to be wholly unworthy of our investment consideration for two crucial factors:

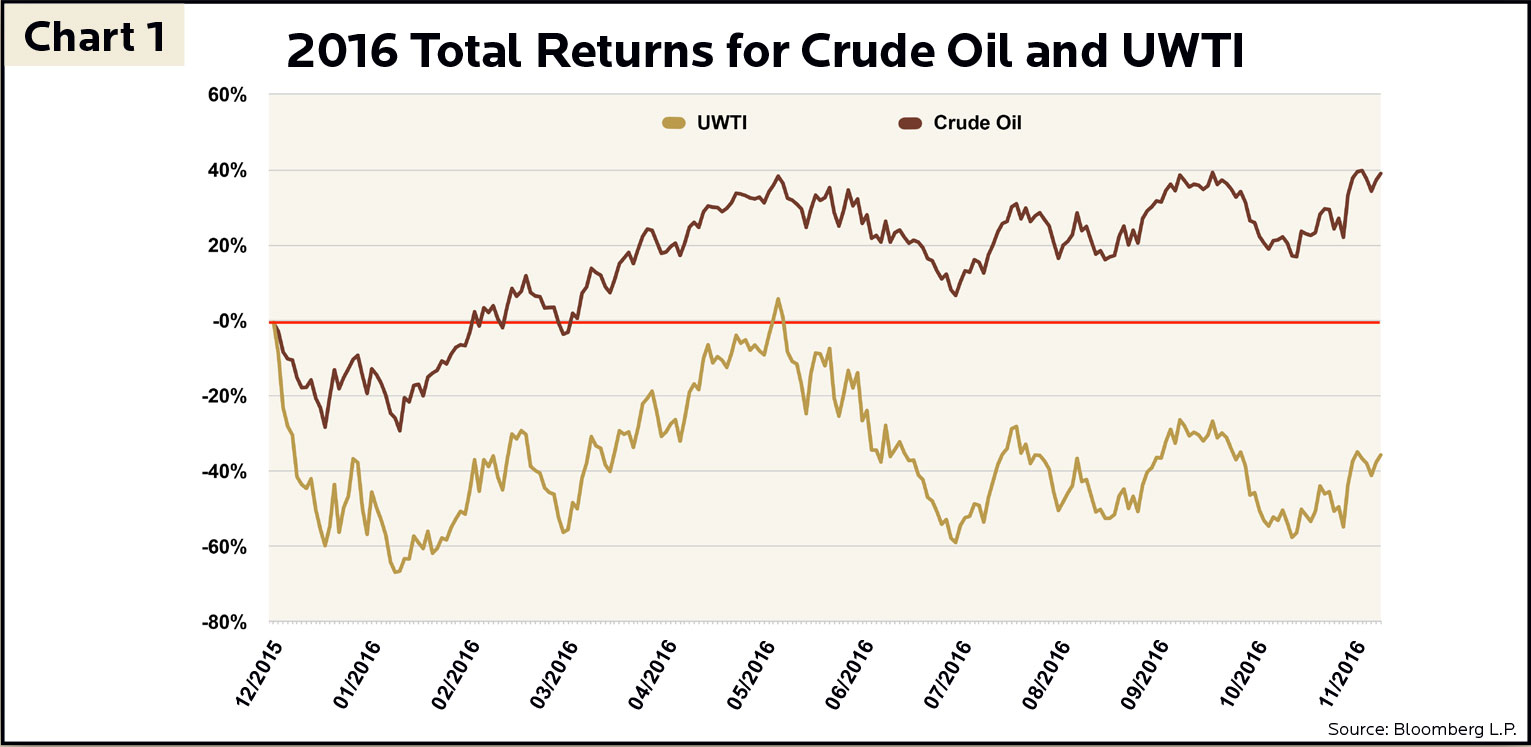

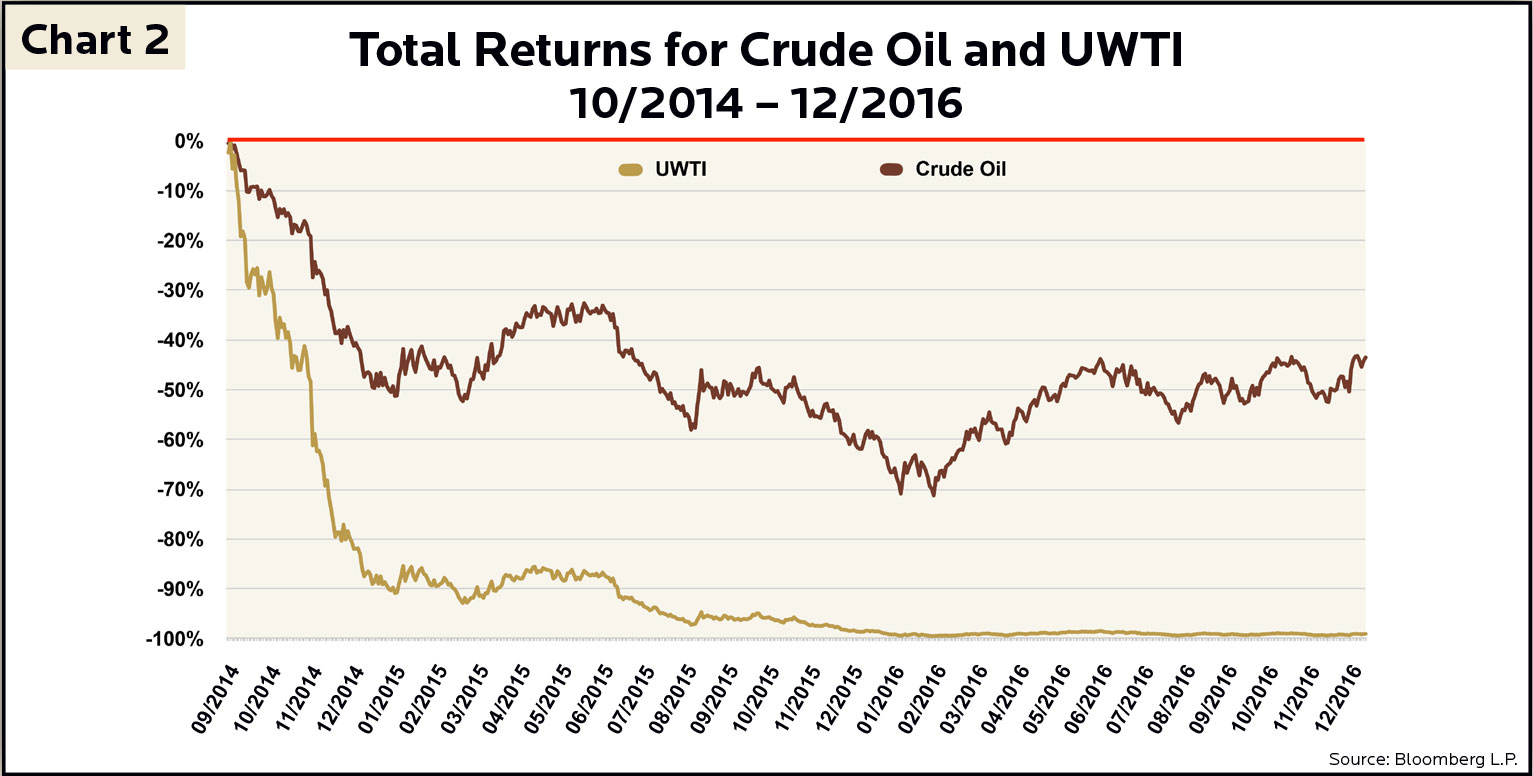

Unfortunately, like the hare, many investors and speculators trading in UWTI recently suffered astounding losses. Crude oil prices have risen this year by 40% through mid-December, conversely, shares of UWTI have fallen by 35% during this timeline (see Chart 1). Even worse, while crude oil prices declined 40% since October 2014, the “deadly” leverage within UWTI hammered its share prices down by 99% (see Chart 2). With such devastating losses, Credit Suisse moved to delist VelocityShares (UWTI) from the New York Stock Exchange on December 9th. The race is not always to the swift.

Since the creation of the Federal Reserve in 1913, there has never been a longer period of falling bond interest rates than the 35-year secular rate-decline cycle we are experiencing right now (and I used to think the Chicago Cub’s losing streak was lengthy!). Back in the early 1980’s a 30-year U.S. Treasury bond yielded over 15%. Earlier this year, the 30-year Treasury bond yield fell to the historically low depth of 2.1%. Meanwhile, bond prices, which move inversely to bond yields, continued rising.

Just as Aesop’s self-assured hare misjudged the possibility of losing to the tortoise, investors seeking the supposed safety of long-term U.S. Treasury bonds may have underestimated their interest rate risk (i.e. the risk of a bond’s price falling as interest rates rise).

Even before our November elections, conditions were improving for interest rate increases in response to rising inflation and falling unemployment. These conditions accelerated with the election of Trump increasing the likelihood for further inflation resulting from tax cuts, regulatory rollbacks and infrastructure spending proposals.

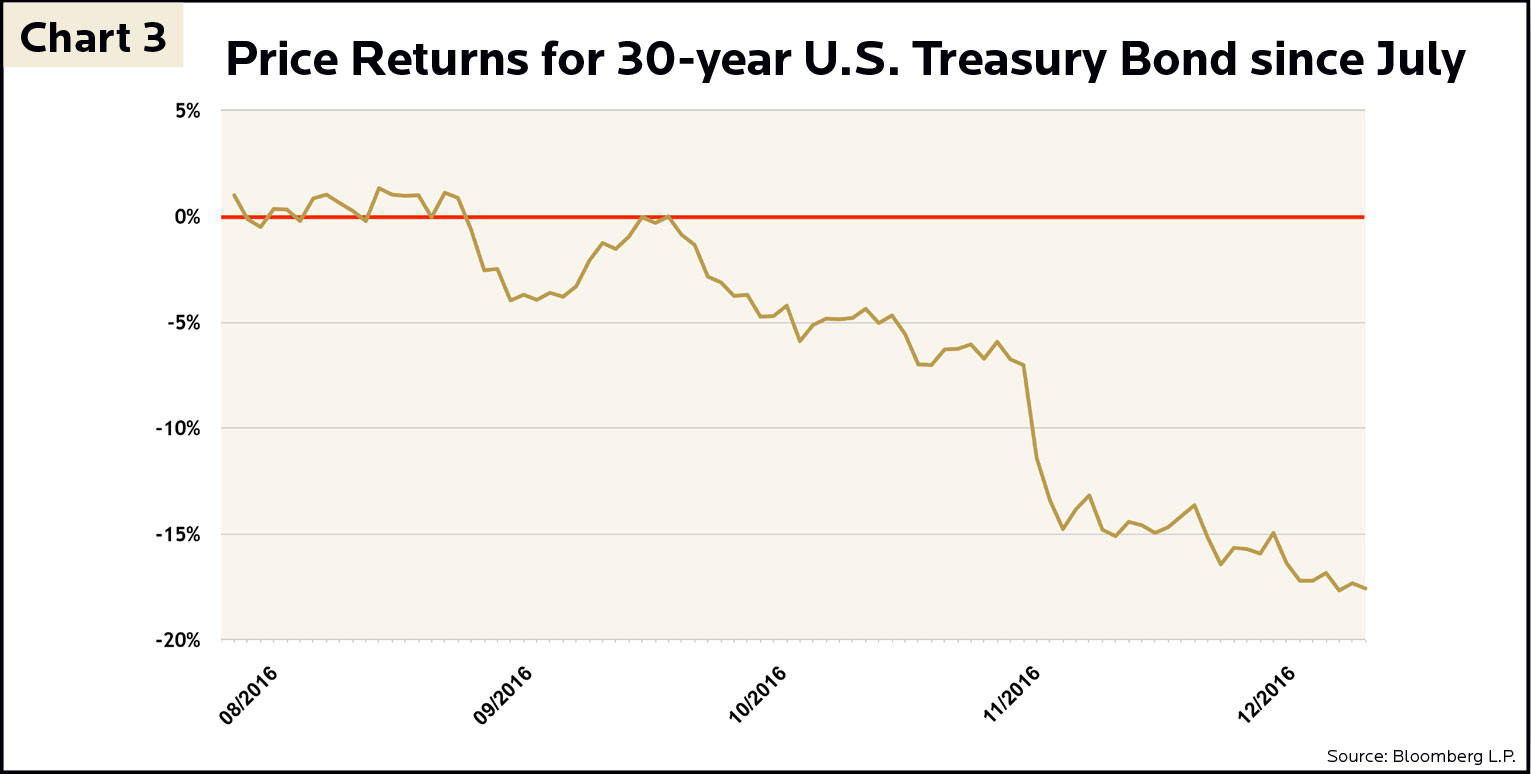

Since early July, 30-year U.S. Treasury bond yields climbed over 1% which led to a price drop of 18% (see Chart 3). Remember, these are bonds issued with the full backing and taxing power of the U.S. government to ensure payment, so they are considered virtually risk-free investments.

Let’s unpack this recent example of interest rate risk a bit further to illustrate why a virtually risk-free investment plummeted 18% in just a few months:

In summary, when interest rates are exceptionally low and begin to climb upwards, it only takes a slight increase in those rates for bond prices to plunge dangerously. This is an unprecedented era of interest rate risk demanding considerable circumspection for intermediate and long-term bond investments.

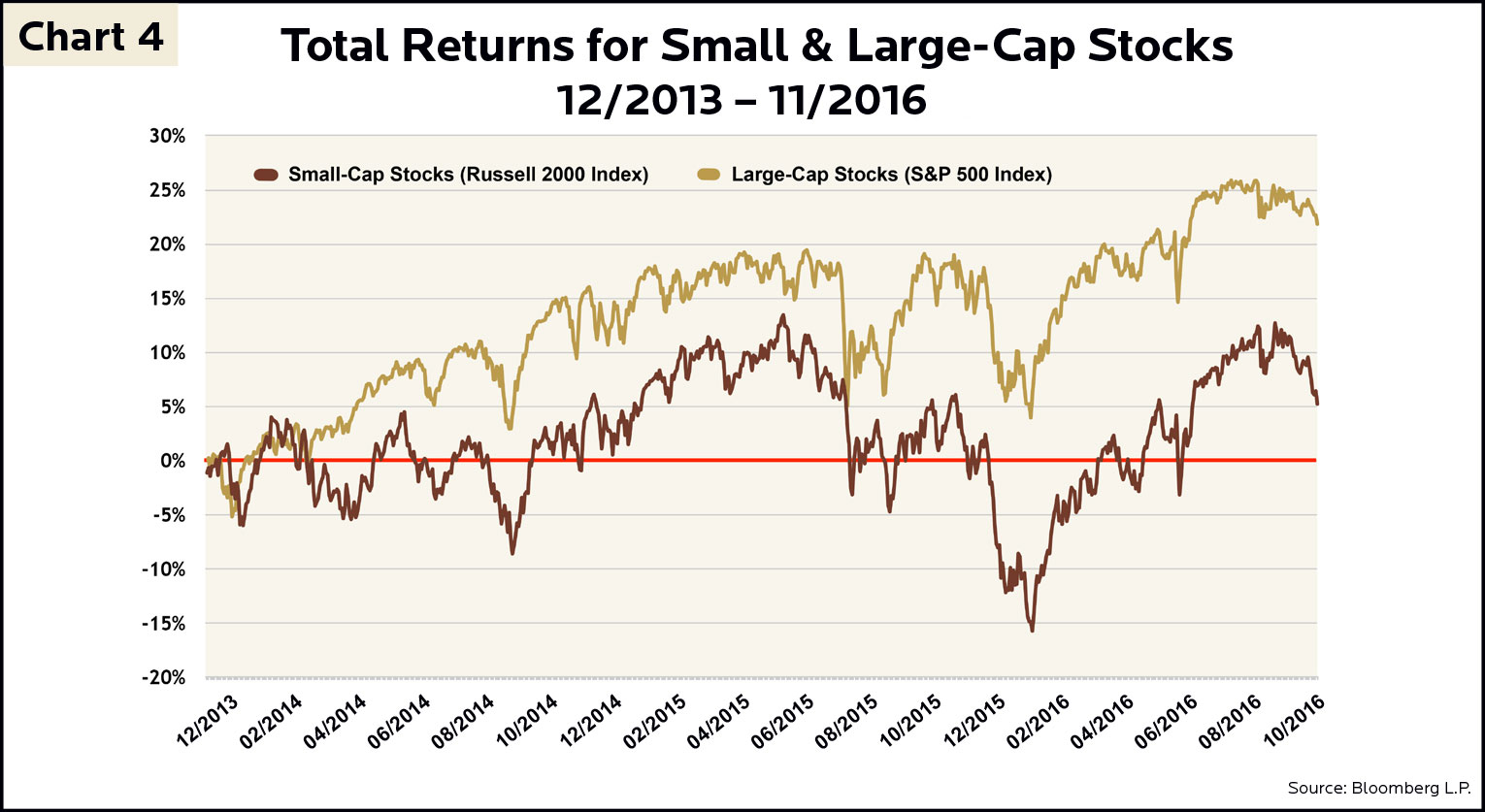

“What good is warmth without cold to give it sweetness.” – John Steinbeck

For a three-year time frame beginning in late 2013 and ending in early November of 2016, U.S. small-cap stock returns had gone cold. Small-caps, which represent less than 20% of the total value in the U.S. stock market, delivered investors growth of a mere 5.2% during this stretch. Meanwhile, large-cap stocks (think S&P 500 Index), which make up the vast majority of total stock market value (roughly 75%), returned over 21% in cumulative investor profits for this same period (see Chart 4). In other words, the large-cap hare was leaving the small-cap tortoise well behind in the dust.

Steady and resolute goes the wise tortoise, even when returns are slow. On the other hand, the capricious market often has short-term fixations on the hot trends of the day. These fixations frequently lend to temporarily mispriced stocks well-over or under their intrinsic long-term values. We see these mispricing episodes as potential threats or opportunities. For example, in early 2016 (see our 2nd Quarter 2016 GHPIA Newsletter, A Balanced Diet) our analysis conveyed over-pricing threats with regards to large-cap technology stocks within the S&P 500 Index. Conversely, small-cap stocks have been priced opportunistically for several years now both in absolute terms and relative to large-cap stocks.

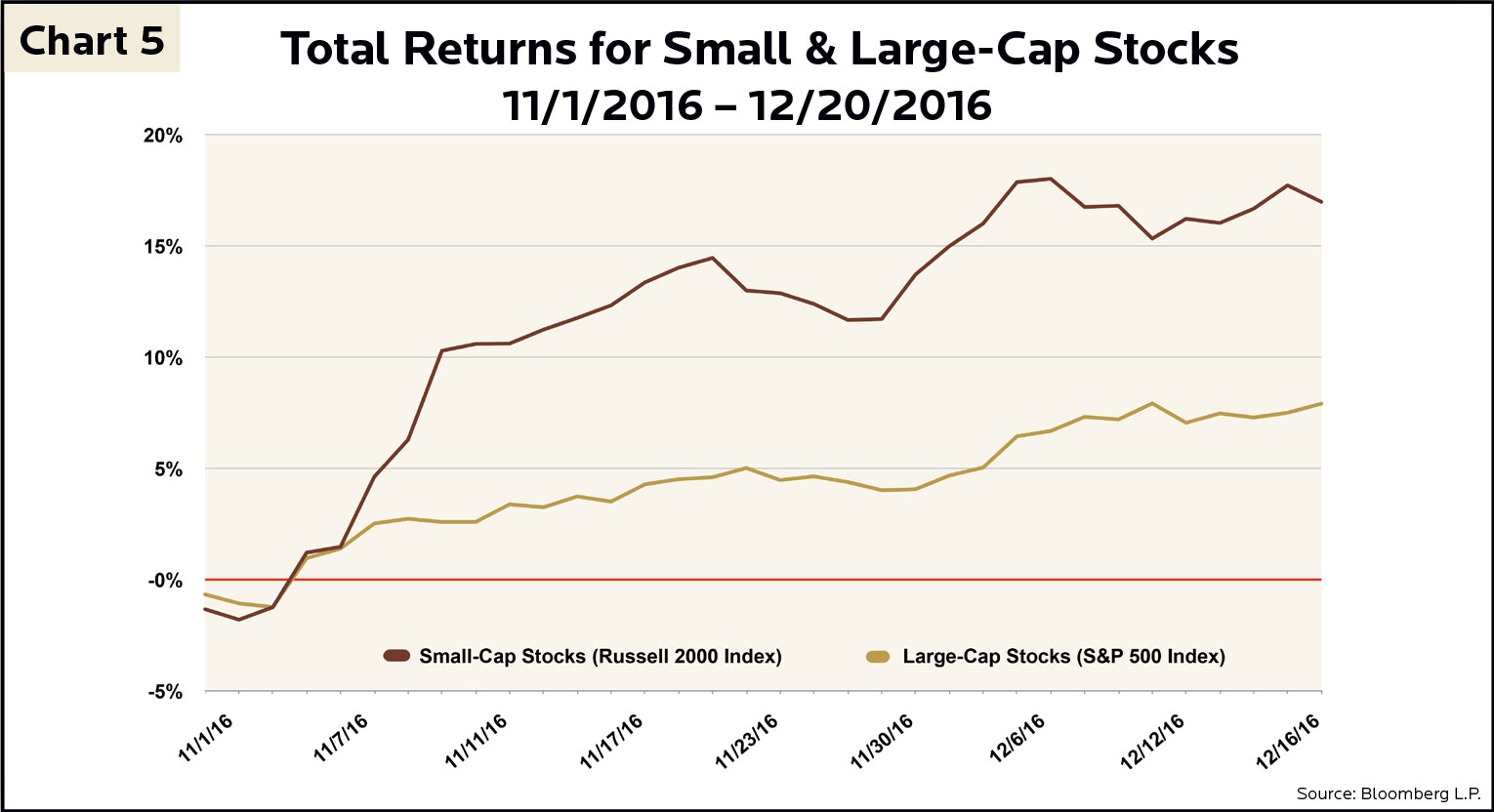

Ultimately, it is of no consequence to the long-term investor if short-term performance is sluggish, as long as fundamental valuations remain intact. Eventually the market comes to its senses and will recognize the true value of a particular stock or asset class. In this case, good things came for our strategy of steadily diversifying a portion of our equity portfolios into small-cap stocks. After several years of languishing, small-cap stocks rocketed up over 17% since early November and nearly doubled the performance of the S&P 500 Index for 2016 (see Chart 5). Sweetness well worth the wait.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

Clearly Aesop’s ill-fated hare became his own worst enemy, with his overconfidence brimming so much so that he decided to shift his focus from the race and enjoy a nap while the victorious tortoise ambled across the finish line. Long-term wealth management has no finish line, and 2016 provided yet another compelling set of examples reinforcing the advantages of steady focus and fortitude.

Whether we are advising “Moms and Millennials” or “Grandpas and Gen-Xers”, we will not guide you towards heavily leveraged, get-rich-quick investments. Likewise, our long-term analysis of the ever-evolving financial markets and shifting political landscape indicates formerly conventional safe-haven bond investments may be anything but safe. Finally, Aesop’s stalwart tortoise serves as a continual reminder that opportunities are so often concealed when measured only in short, impetuous cycles, while those same opportunities are regularly actualized by patient investors willing to see a strategy through, and stay the course. We are here to steadily see you through and we wish you further prosperity for 2017.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.