,

September 30, 2017

Alarming headlines warn readers of an overvalued stock market, saying stock prices rose too much, too fast. For 2017 through the end of September, the S&P 500 index appreciated 14.2%. Although stock prices have climbed swiftly, S&P 500 earnings have also climbed. While the “Trump Bump” is often credited for the post-election market expansion, earnings growth is the unsung hero behind the rally.

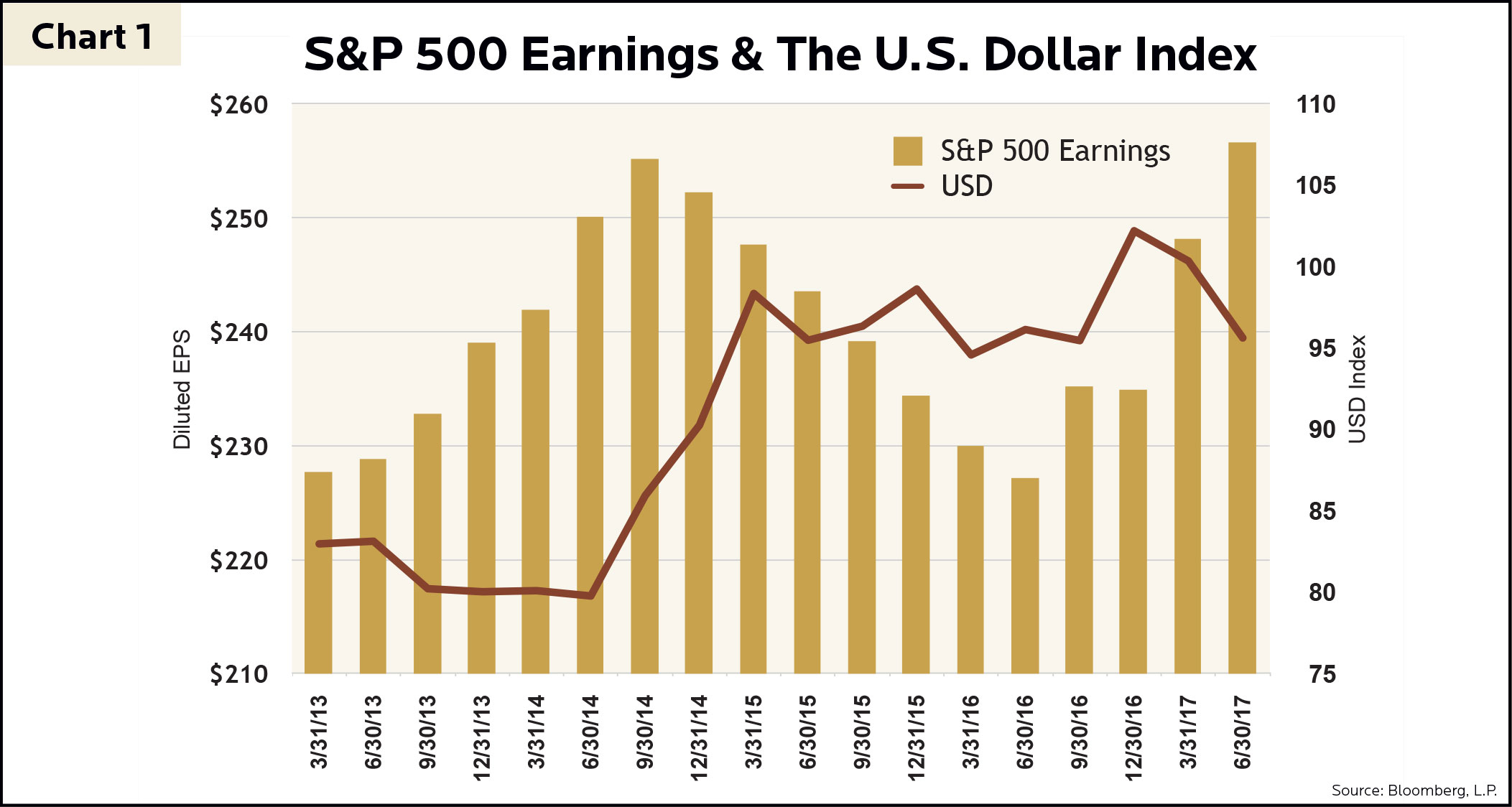

In mid-2014, the U.S. dollar (“USD”) strengthened against major currencies, such as the euro, Japanese Yen, and Canadian dollar. While the dollar’s appreciation made traveling abroad and gas station fill-ups less expensive for Americans, the largest U.S. companies were not as fortunate. Most companies in the S&P 500 index have some, if not sizable, revenue streams from outside the U.S. In 2014, foreign revenue was 48% of these companies’ total revenue. Companies like Google and Microsoft receive half of their revenue in foreign currencies, which lose value when converted to an appreciated USD. Although many of these large, multinational companies were still conducting the same, if not more, volume of business year-over-year, earnings suffered from the strong dollar. Earnings previously peaked in September 2014, just after the USD began its upward trend (Chart 1). The dollar strengthened an enormous 23% in the first nine months of its expansion. The headwind multinational companies navigated through was huge. Take Google for example – 57%, or $38 billion, of its 2014 revenue was from foreign sources. Without accounting for any increases or changes in business, a 23% increase in the USD translated to a 13%, or $8.7 billion, decrease in annual revenue.

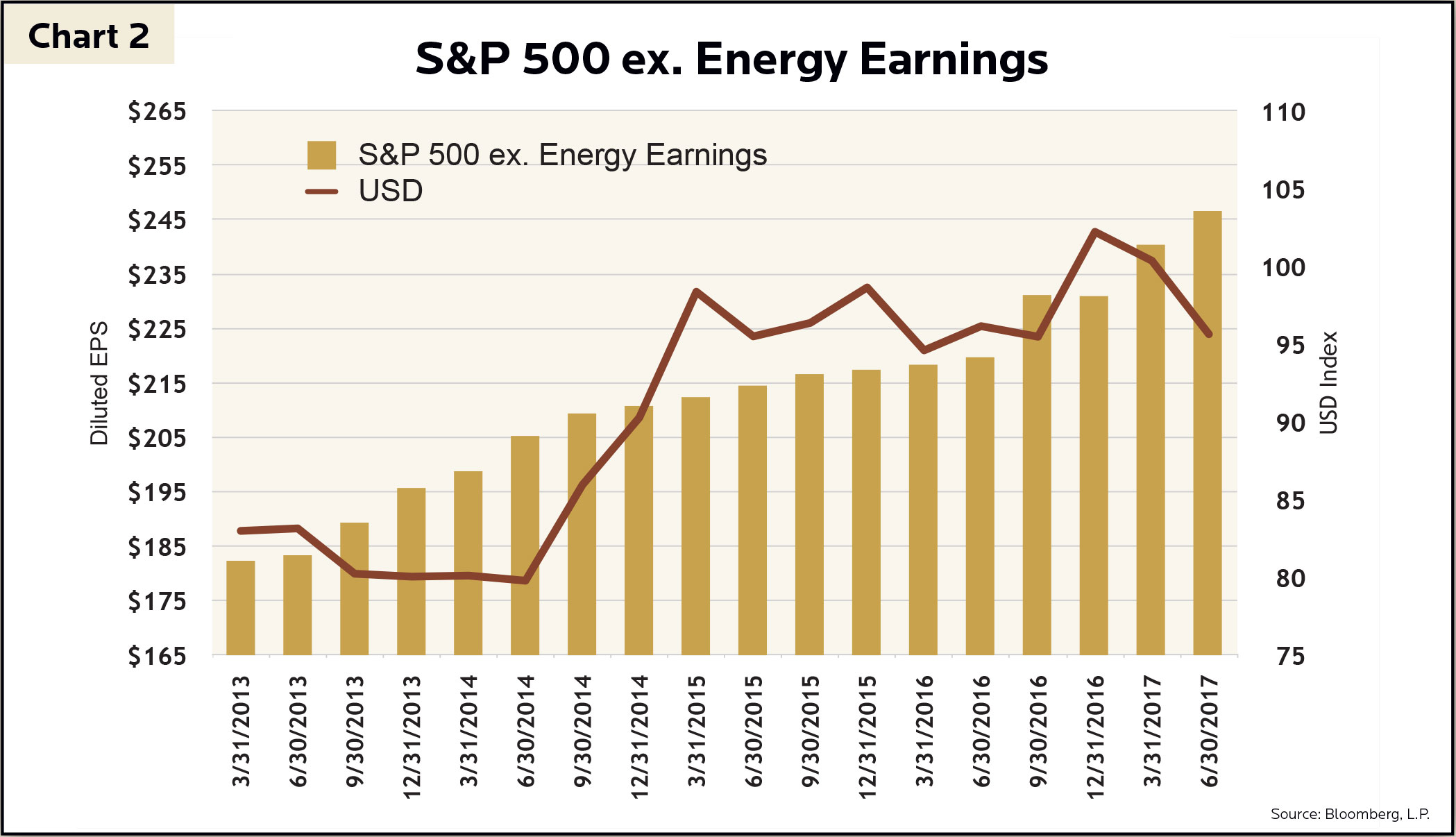

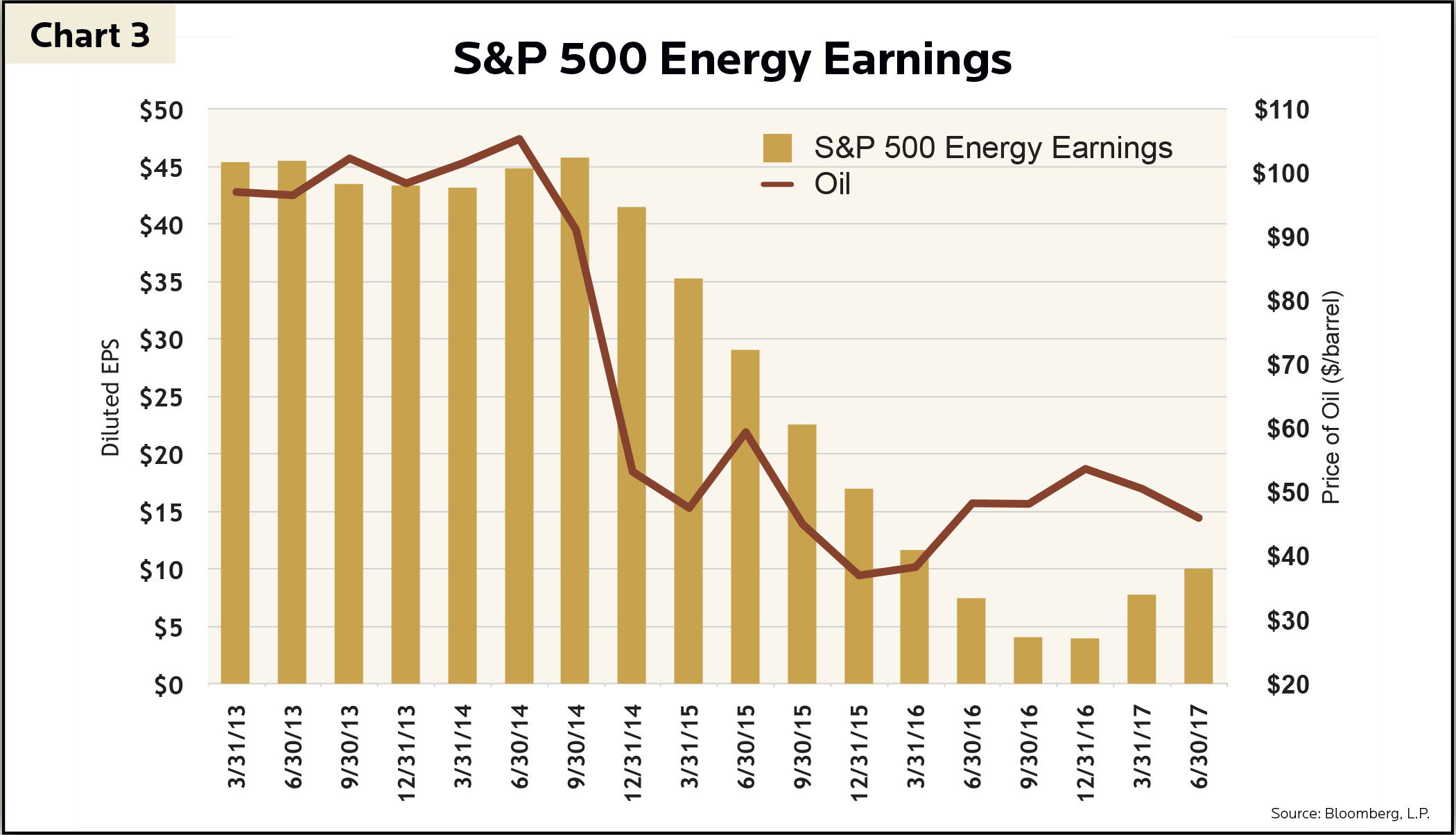

Multinational companies were hit hard by a strong USD, but the energy sector was completely pummeled. The energy sector revolves around the price of oil – when the price of oil goes down, so do earnings. As oil is priced in USD, when the dollar strengthens, this puts downward pressure on oil prices. In addition, large energy companies receive significant revenue from foreign sources, which exacerbated the declining earnings trend for the energy sector in 2014. However, when energy sector earnings are stripped from the S&P 500 (Chart 2), earnings stalled but never fell into a recession. Energy company earnings have yet to recover to the extent large multinationals have (Chart 3). Due to sustained low oil prices, earnings remain depressed. Companies were forced into survival mode and took undesirable actions, including cutting production, cutting spending, consolidating, or in the worst case scenario, filing for bankruptcy. However, the companies that endured made their businesses more efficient and will likely see higher profits with any future increase in oil prices. We do not expect oil prices to skyrocket soon, but if there is a continued recovery for energy companies, the S&P 500 index could benefit greatly.

The Russell 3000 index includes companies of all sizes and is commonly used as a gauge for the entire U.S. stock market. The Russell 2000 index is a subset containing the 2,000 smallest companies. Some of the stock market excitement around President Trump’s election came from the anticipation of corporate tax cuts. The Russell 2000 returned 8.8% from the beginning of October 2016 through the end of 2016, while the S&P 500 “only” returned 3.8% (by itself, the latter is an impressive figure). Not coincidentally, the median effective tax rate for the Russell 2000 is currently 33.2%, whereas the S&P 500’s median is 27.7%. Small companies have more to gain than large companies if any corporate tax cuts occur. For 2017 through the end of September, the S&P 500 outperformed the Russell 2000 by more than 3% as larger company earnings outgrew smaller company earnings, and corporate tax policies remain unchanged.

The Russell 2000 and S&P 500 have many other differences, such as what type of companies comprise the index. The Russell 2000 has a 26% allocation to financial companies, while the S&P 500 only has a 14% allocation to financials. As interest rates rise, financial company earnings also rise. Even if interest rates in the United States increase gradually, the Russell 2000 could benefit more than the S&P 500, given its higher allocation to financial companies.

While GHPIA incorporates the U.S. economic environment into our investment philosophy, we do not believe in investing based on risky speculations. By diversifying investments across various company sizes and sectors, we are positioned for both expected and unexpected events in the market. Unforeseen scenarios could be destructive to an undiversified portfolio. Large company earnings are the unsung hero of this year’s stock market rally, but we cannot predict the hero behind future rallies. When investing to accomplish long-term financial goals, diversification is essential.

Investment Insight is published as a service to our clients and other interested parties. This material is not intended to be relied upon as a forecast, research, investment, accounting, legal or tax advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only. Past performance is no guarantee of future results.